USD/CAD posted sharp gains for a second straight week, gaining 220 points. The pair touched above the key 1.40 line and closed the week at 1.3955, its highest level since May 2004. This week’s key events are GDP and Core Retail Sales. Here is an outlook on the major market-movers and an updated technical analysis for USD/CAD.

After months of intense speculation, the Federal Reserve raised interest rates by 0.25 percent. The historic rate hike was not dovish as this small hike is just the start, with plans for additional hikes in 2016. Weak Canadian inflation numbers, and falling oil prices added to the woes of the Canadian dollar, as consumer inflation reports posted declines.

Updates:

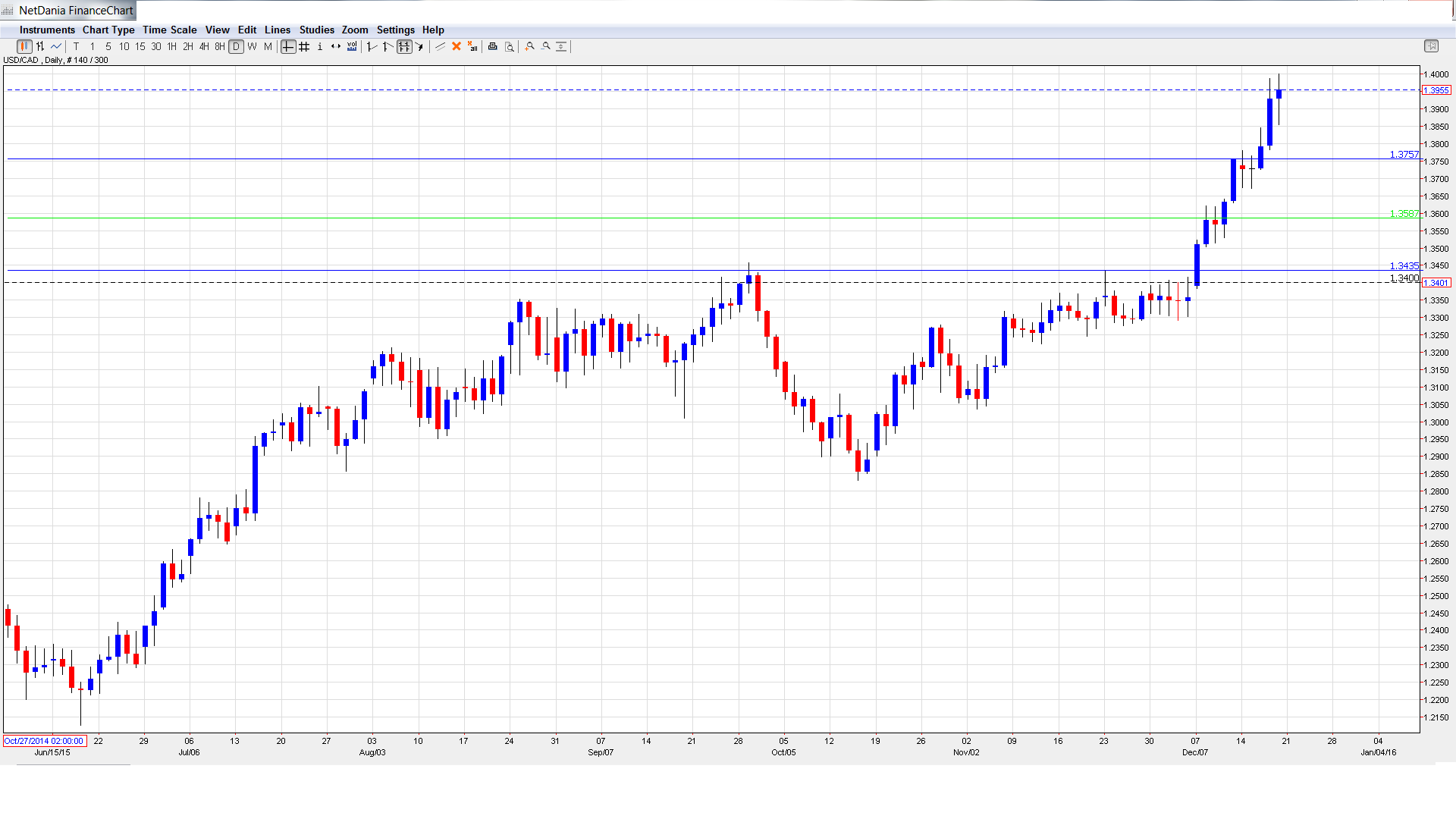

USD/CAD daily chart with support and resistance lines on it.

Core Retail Sales: Wednesday, 13:30. This indicator excludes automobile sales, which tend to be very volatile and distort the underlying trend. The indicator has not posted a gain since June, and came in at -0.5% in September, shy of the forecast of -0.3%.

GDP: Wednesday, 13:30. This key event is released monthly, and an unexpected reading could quickly affect the direction of USD/CAD. GDP looked dismal in September, contracting by 0.5%. The markets had expected a gain of 0.1%. Will we see an improvement in October?

Retail Sales: Wednesday, 13:30. This is the primary gauge of consumer spending. The indicator disappointed in October, with a reading of -0.5%, well off the forecast of +0.1%. It marked the indicator’s weakest reading in five months.

* All times are GMT

USD/CAD Technical Analysis

USD/CAD opened the week at 1.3737 and quickly touched a low of 1.3672. The pair then reversed directions, surging to a high of 1.4001, as resistance held firm at 1.4003 . USD/CAD closed the week at 1.3955.

Technical lines, from top to bottom

We start with resistance at 1.4310.

141.57 was an important cushion in April 2003.

1.4003 follows, just above the psychologically important 1.40 level. It was under strong pressure last week as USD/CAD posted sharp gains.

The round number of 1.39 has switched to a support line. It is a weak line.

1.3759 was easily breached last week and has reverted to a support role.

1.3587 was a cap in March 2004.

1.3435 has held firm since early December. It is the final support line for now.

I am bullish on USD/CAD

The Canadian dollar has plummeted in the past two weeks, losing some 550 points against its US counterpart. The Fed rate hike has sharpened monetary divergence and marks a vote of confidence in the US economy, which should further bolster the US dollar.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities.

Opinions are the authors — not necessarily OANDA’s, its officers or directors. OANDA’s Terms of Use and Privacy Policy apply. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The data from the US showed that weekly Jobless Claims held steady at 208,000, helping the USD hold its ground and limiting the pair's upside.

GBP/USD fluctuates above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside after Unit Labor Costs and weekly Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.