USD/JPY Weekly Forecast: Liquidity and spending have not worked, but what else do we have?

- Widening Treasury-JGB yield spread has boosted USD/JPY.

- The 10-year differential has increased 20 basis points since the last FOMC.

- Japanese election on October 31 will ensure more easing and a large stimulus package.

- FXStreet Forecast Poll is bullish in the short term, but negative out to one quarter

The widening spread between US and Japanese sovereign yields over the past three weeks has kept the USD/JPY moving sharply higher despite the more diffident general market view on the dollar. Friday’s surge to 114.42, up 1.96% from Monday’s open, was the highest trade for the pair since October 4, 2018.

The yen was hampered by the prospect of another huge stimulus package from Tokyo when the national elections on October 31 are completed.

Current Prime Minister and Liberal Democratic Party (LDP) candidate, Fumio Kishida is expected to easily defeat the leader of the Diet’s second ranking Constitutional Democratic Party of Japan, Yukio Edano. The LDP holds more than twice as many seats in the current Diet, 282 to 113. It has controlled the Japanese government continuously since 1955 with the exception of two short periods in 1993 and 1994 and from 2009 to 2012.

Mr. Kishida defeated Taro Kono, Minister for Vaccinations and former holder of the Defense and Foreign Affairs portfolios, in a run-off for the LDP leadership on September 29.

In Japan's parliamentary system the leader of the majority party in the legislature is automatically the Prime Minister until a new election is held. The previous Prime Minister, Yoshihide Suga, had assumed the post when Shinzo Abe resigned in September 2020 for health reasons but withdrew from the LDP leadership contest.

Mr. Kinishida is expected to propose more monetary easing and spending in an effort to prevent deflation which, since the pandemic, has again become a major problem for the Japanese economy.

Since the Federal Reserve meeting on September 22, the yield spread between the 10-year Japanese Government Bond (JGB) and its US equivalent has grown from 4.5 basis points to 20 points. Yields on both securities dropped slightly this week, leaving the advantage to the US bond and the dollar.

Markets are positioning for an announcement from the Federal Reserve on the start date and amount of its bond purchase program reduction at its November 3 meeting.

Inflation in Japan and the United States continued to dominate economic news.

In Japan, the Producer Price Index (PPI) for September rose 6.3% (YoY), its greatest increase since September 2008. With the National Consumer Price Index (CPI) at -0.4% annually in September and negative for 11 straight months, however, there will be no change in Prime Minister Kishida’s expected liquidity and spending plans. Industrial Production rose less than forecast in August , and the annual loss was greater.

Across the Pacific, annual US CPI rose to 5.4% in September, the highest it has been in 13 years, and core inflation stayed at 4%. Producer Prices in September climbed as well, promising further consumer price hikes in the months ahead. The PPI (YoY) rose to 8.6% from 8.3% in August, and core climbed to 6.8% from 6.7%. That both indexes missed their forecasts, 8.7% for headline and 7.1% for core, was not an indication that price increases may be waning.

Retail Sales for September at 0.7% were much stronger than the -0.2% prediction. August sales rose 0.9%, also surpassing the -0.8% forecast. Michigan Consumer Sentiment registered two of its lowest scores for the past decade in both months. Perhaps Americans are unhappy about something other than the economy.

West Texas Intermediate, the US crude pricing standard, reached $81.97 on Thursday, its highest finish in seven years, ensuring that inflation pressures will continue to surge through the industrial and consumer sectors.

USD/JPY Outlook

As long as sovereign spreads continue to widen, the USD/JPY will rise.

Even if the rate differential stabilizes, government monetary and fiscal policies in Japan and the US are headed in opposite directions. The Federal Reserve is about to start its withdrawal from the emergency policies of the pandemic, and the Bank of Japan (BOJ) is set to reinforce their liquidity and spending provisions.

The first economic order of business for the new Japanese Prime Minister will be to revive the Japanese economy.

Historically, a weaker yen is one of the methods the Japanese government has used to assist Japan’s export industries. The area from 115.00 to 120.00 is a likely goal for the new Tokyo administration.

Japanese import and export data for September will be released on Wednesday. Annual rates are still referencing the pandemic collapse and are unaturally strong. National CPI for September should remain deflationary and suggest further fiscal stimulus from the government and easing from the BOJ.

American data on Industrial Production and the housing market for September will not change views on the dollar. The Fed's Beige Book collection of anecdotal economic information prepared for the November 3 FOMC meeting will gather much attention, even though it is rarely predictive of bank policy.

Japan statistics October 11–October 15

US statistics October 11–October 15

FXStreet

Japan statistics October 18–October 22

FXStreet

US statistics October 18–October 22

FXStreet

USD/JPY technical outlook

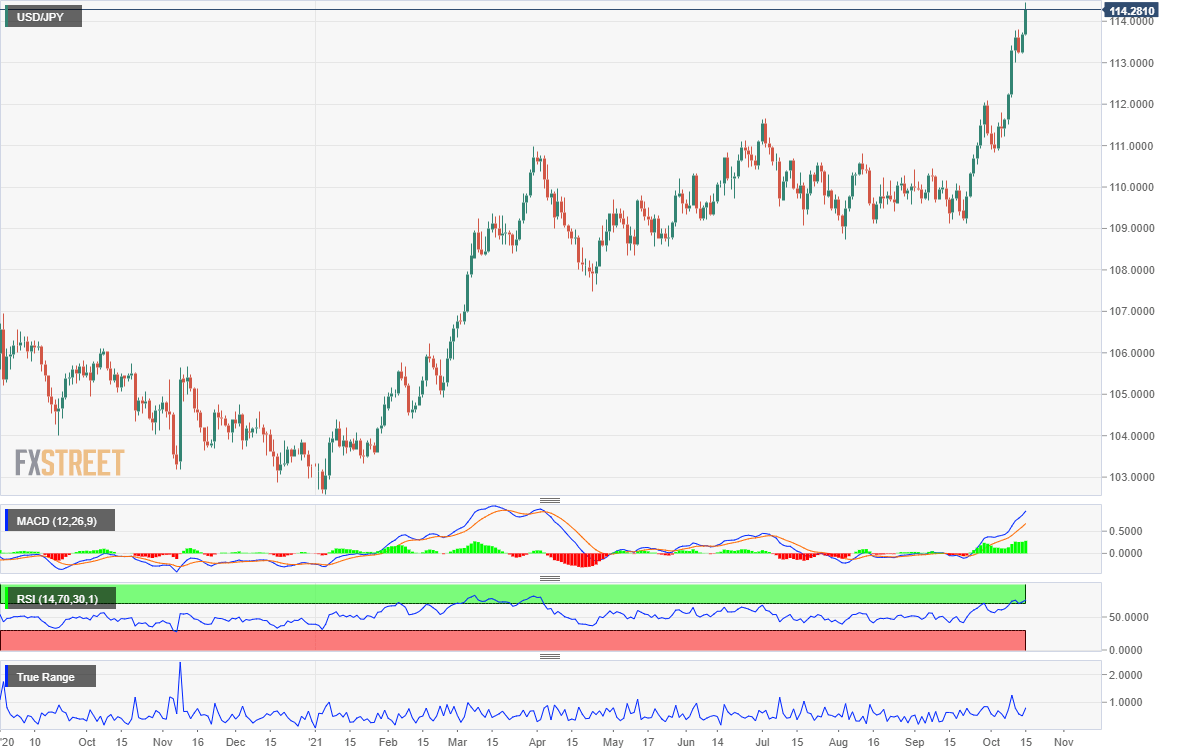

Since opening at 109.23 on September 22, the day of the last Fed meeting, the USD/JPY has climbed 4.68%. This week the pair has gained 1.8%. With such figures momentum indicators are soaring. The MACD (Momentum Average Convergence Divergence) is at its highest level since early April. The Relative Strength Index (RSI) moved into overbought status on Monday and remained there all week. True Range peaked at 1.255 on Monday's more than one figure rise, its highest level since November 9, 2020. These indicators reflect the fundamental yield based evolution in USD/JPY.

Given the rapid acceleration of the USD/JPY in the last three weeks, moving averages (MA) have lagged market movement. Even the 21-day MA at 111.51 is almost three big figures below current levels. The 50-day and 100-day averages are well below 111.00 and the 200-day MA is beneath 109.00. Profit-taking sales are the normal sequel to such vertical movement but that should not be mistaken for a change in attitude or altitude.

The USD/JPY has outstripped all support references more recent than November 2018 except those of the current run. Resistance levels are even more distant. Fundamental factors, primarily yields, combined with the limited but active support should restrain any substantial profit-taking.

Resistance: 114.50, 114.75, 115.30

Support: 113.70, 113.30, 112.22, 112.00, 111.55

FXStreet Forecast Poll

The FXStreet Forecast Poll is unduly pessimistic for the long term, USD/JPY levels reflect the underlying yield basics.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.