USD/JPY Outlook: Eyeing a bullish break through 200-DMA/trend-line confluence hurdle

- A combination of factors assisted USD/JPY to gain traction for the fifth straight session on Tuesday.

- The risk-on mood continued undermining the safe-haven JPY and remained supportive of the move.

- Surging US bond yields helped offset USD selling bias and provided an additional boost to the pair.

The USD/JPY pair continued gaining positive traction for the fifth consecutive session on Tuesday and shot to over one-week tops during the Asian session. The progress in the rollout of vaccines for the highly contagious coronavirus disease, along with expectations for a massive US fiscal spending plan has been fueling hopes for a faster-than-anticipated global economic recovery. The optimism continued boosting investors' confidence, which was evident from the ongoing risk-on rally in the equity markets. This, in turn, undermined demand for the safe-haven Japanese yen and was seen as a key factor driving the pair higher.

The JPY was further pressured by dovish comments from the BoJ Governor Haruhiko Kuroda, saying that there is still very high uncertainty over the economic outlook. Kuroda further added that it was premature to debate an exit from the massive stimulus programme, including BoJ's ETF buying. Bullish traders further took cues from surging US Treasury bond yields. In fact, the yield on the benchmark 10-year US government bond jumped to the highest level since February 2020 amid worries that rising inflationary pressures would hurt the value of longer-dated debt.

The prospects for the passage of the US President Joe Biden's proposed $1.9 trillion COVID-19 relief package is expected to encourage faster economic recovery and lift consumer prices. Investors' expectations for inflation over the next decade jumped to 2.22% or the highest level since August 2014. The US bond market has been reacting strongly to the developments and remained supportive of the pair's move up. The momentum seemed unaffected by the prevalent selling bias surrounding the US dollar, which failed to gain any respite from rallying US bond yields.

There isn't any major market-moving economic data due for release from the US on Tuesday. This, in turn, leaves the pair at the mercy of the broader market risk sentiment. Apart from this, movement in the US bond yields and the USD price dynamics will also be looked upon for some meaningful trading opportunities.

Short-term technical outlook

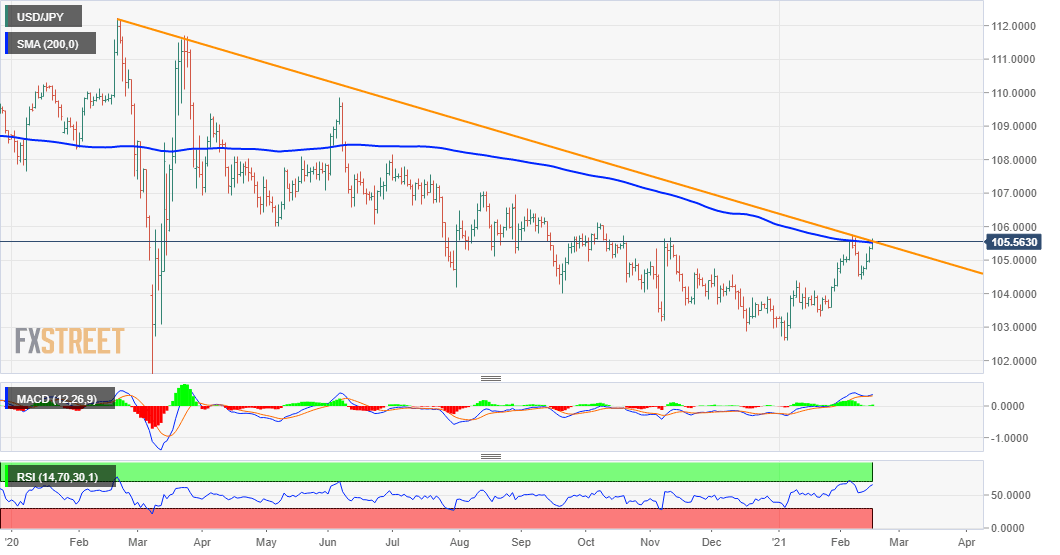

From a technical perspective, the pair might now be looking to build on the momentum beyond an important confluence hurdle comprising of the very important 200-day SMA and near one-year-old descending trend-line. A sustained move beyond YTD tops, around the 105.75 region, will confirm a near-term bullish breakout and set the stage for additional gains. The pair might then surpass the 106.00 mark and accelerate the positive move further towards the 106.50-55 supply zone.

On the flip side, the 105.25 level now seems to protect the immediate downside and is closely followed by the key 105.00 psychological mark. Failure to defend the mentioned support levels might prompt some technical selling and turn the pair vulnerable to slide back to last week’s swing lows support, around the 104.40 region. Some follow-through selling will negate any near-term positive bias and turn the pair vulnerable to slide further.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.