USD/JPY Forecast: Waiting for the Fed around 109.00

USD/JPY Current price: 109.09

- The US Federal Reserve will announce its monetary policy decision this Wednesday.

- Japan’s February Merchandise Trade Balance Total posted a surplus of ¥217.4 billion.

- USD/JPY retains its monthly gains, the upcoming direction will depend on the Fed.

Markets are quieter this Wednesday as speculative interest waits for the US Federal Reserve. The central bank is having a monetary policy meeting and will unveil its decision in the American afternoon. The central bank is not expected to introduce changes to the current policy, as widely anticipated by Chief Jerome Powell, as the employment sector is way below its pre-pandemic levels. The Fed has long ago announced that it would tolerate inflation above the 2% target for some time.

In a speech not so long ago, head Powell suggested that bond yields volatility is not a concern for policymakers, neither a factor to decide a change in the monetary policy. Any change of view in this matter could spur wild volatility across the FX board.

Data wise, Japan published the February Merchandise Trade Balance Total, which posted a surplus of ¥217.4 billion, missing expectations, as imports were up by 11.8% while exports decreased by 4.5%. Ahead of the Fed, the US will publish February Building Permits and Housing Starts.

USD/JPY short-term technical outlook

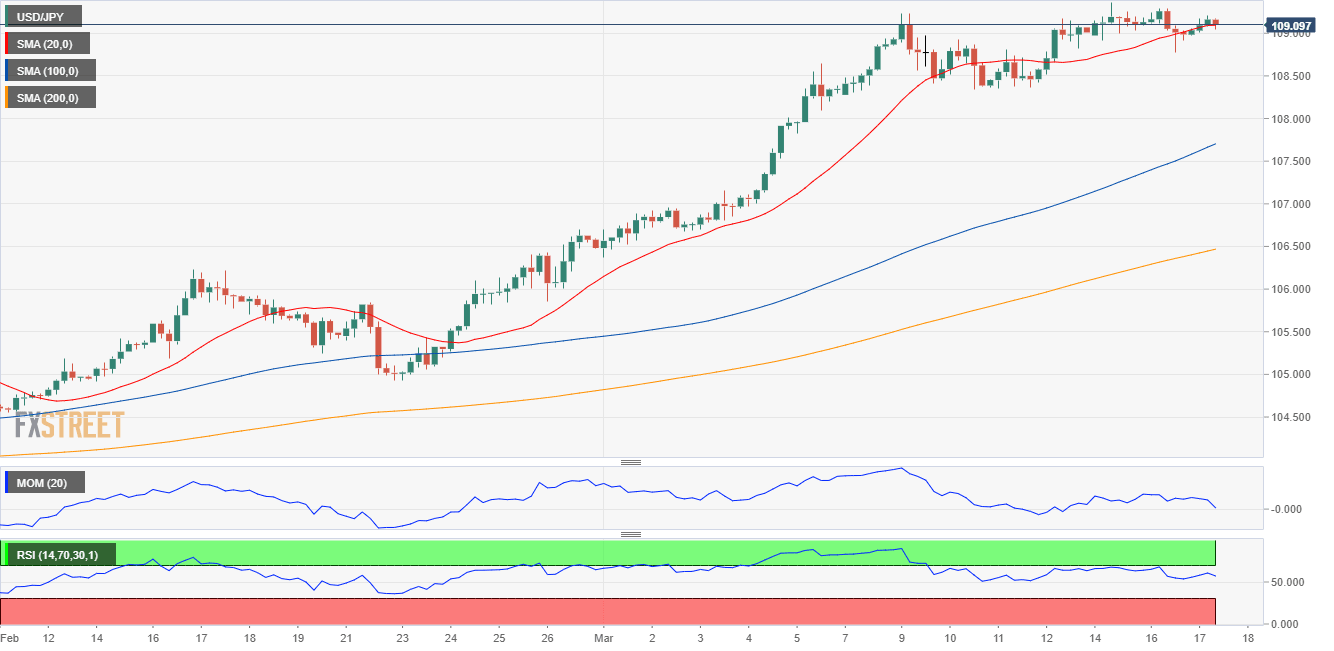

The USD/JPY pair trades just above the 109.00 figure, losing its bullish potential. In the 4-hour chart, the price is hovering around a mildly bullish 20 SMA, while technical indicators turned south, with the Momentum in neutral territory and the RSI around 55. A steeper decline could take place if the pair breaks below 108.80, although it all depends on the Fed and how government bond yields react afterwards.

Support levels: 108.80 108.40 108.05

Resistance levels: 109.30 109.65 110.00

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.