USD/JPY Forecast: Modest bounce from 109.00 maintains the risk skewed to the downside

USD/JPY Current price: 109.27

- US Treasury yields remain at the lower end of their weekly range.

- Japanese Consumer Confidence improved in March to 36.1 from 33.8 previously.

- USD/JPY tested the 109.00 level and bounced modestly, in line with further slides.

The USD/JPY pair extended its slump to 108.99, its lowest in over two weeks, bouncing from the level ahead of the close but ending the day in the red. Softer US government bond yields and the poor performance of global equities helped the Japanese currency against its American rival. European and American stocks managed to post modest intraday advances but spent the day within familiar levels, while the yield on the 10-year Treasury note settled at 1.63%.

Japan published its February Current Account overnight, which posted a surplus of ¥2916.9 billion, largely surpassing the ¥1996 billion expected. The Trade Balance for the same month improved to ¥524.2 billion from ¥-130.1 billion in the previous month. Also, March Consumer Confidence printed at 36.1, better than the previous 33.8. The Eco Watchers Survey for the current situation came in at 49, while the Outlook resulted in 49.8. The country won’t publish relevant macroeconomic data this Friday.

USD/JPY short-term technical outlook

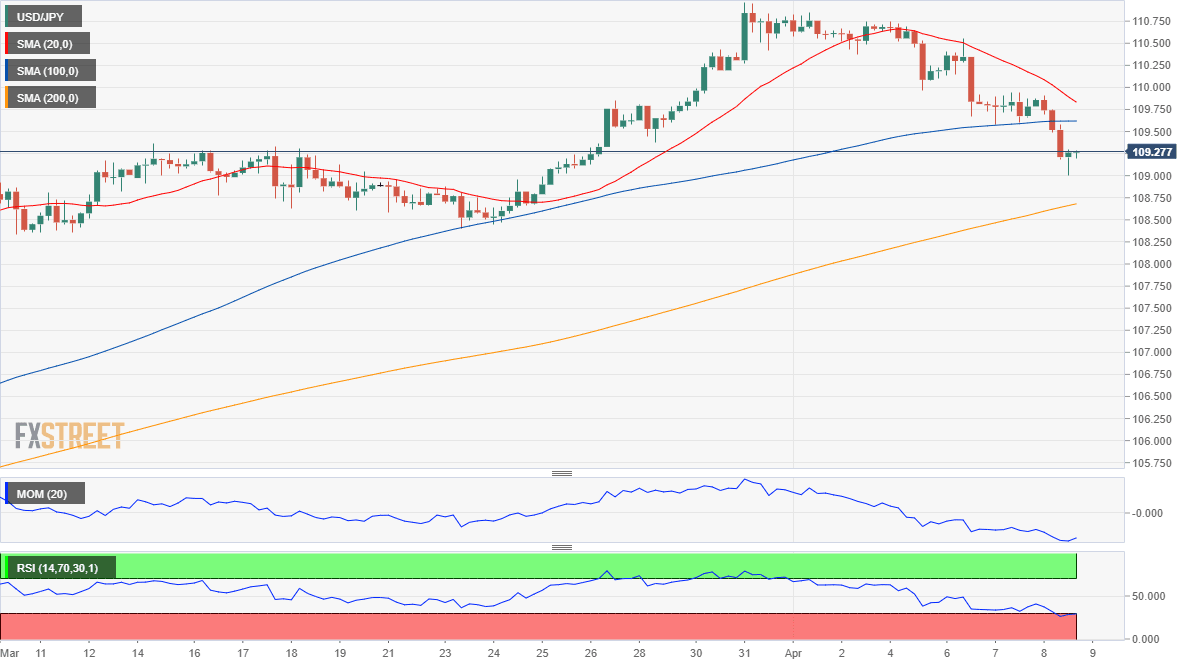

The USD/JPY pair trades in the 109.20 price zone ahead of the Asian opening, with the risk still skewed to the downside as the pair reached a lower low for a sixth consecutive day. In the 4-hour chart, the pair remains below its 20 and 100 SMAs, with the shorter accelerating lower above the longer one. The Momentum indicator recovered from intraday lows but remains within negative levels, while the RSI holds around 33, reflecting bears’ strength.

Support levels: 109.00 108.65 108.30

Resistance levels: 109.50 109.95 110.30

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.