USD/JPY Forecast: Lower in range, critical support at 106.60

USD/JPY Current price: 106.94

- The Bank of Japan left its monetary policy unchanged, downgraded inflation and growth forecasts.

- Tokyo raised its alert to the highest levels this Wednesday, amid a spike in contagions.

- USD/JPY neutral-to-bearish on broad dollar’s weakness and heading towards 105.95.

The American dollar is in trouble against most major rivals, the Japanese yen included, as hopes for a coronavirus vaccine fuel optimism, sending global equities up ever since the day started in Asia. According to a press note from biotech Moderna, its vaccine has been found to induce immune responses in all of the volunteers who got it in a phase one study. On a down note, however, the number of new contagions continues to increase, and Tokyo raised its alert to the highest levels just this Wednesday.

The USD/JPY pair is down to the 106.90 region, not affected by the Bank of Japan monetary policy decision. As expected, the central bank kept rates unchanged at -0.1%, and its 10-year JGB target around 0%. Also, policymakers downgraded growth forecast, now seeing the economy shrinking between 4.5% and 5.7% in the current fiscal year. Core inflation is expected to stay between -0.5% and -0.7% in the same period. The US has a light macroeconomic calendar, with the focus on June Industrial Production, foreseen at 4.3% from 1.4% in the previous month.

USD/JPY short-term technical outlook

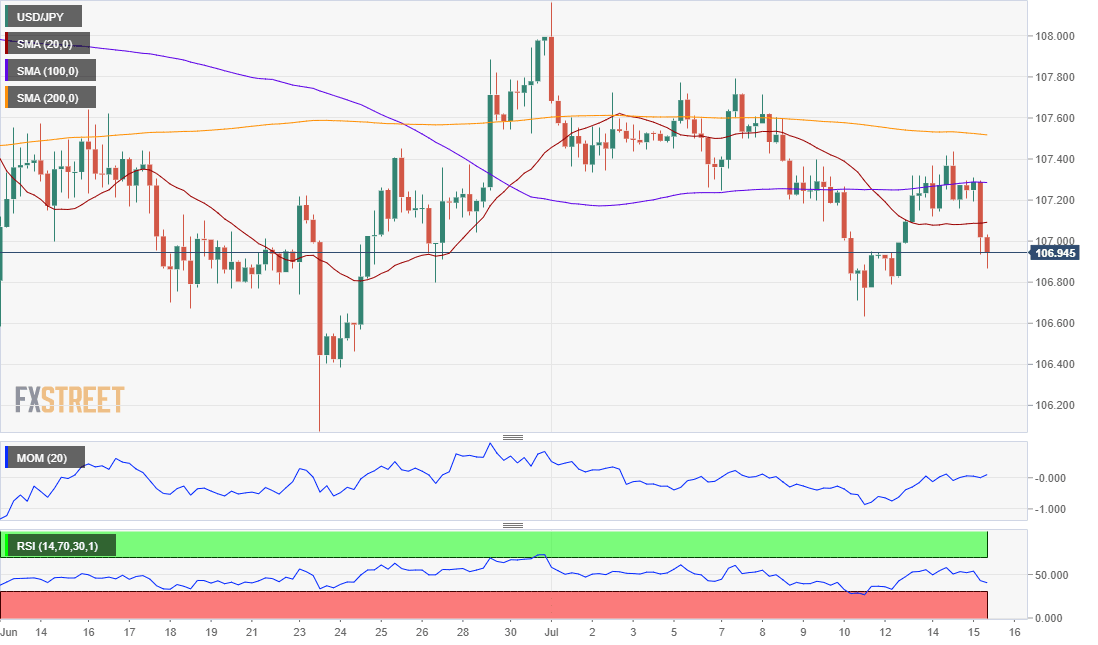

The USD/JPY pair is neutral-to-bearish in the short-term, still developing within familiar levels. To turn bearish, it would need to break below the 106.60 level, as it met buyers in the area several times throughout June and July. The 4-hour chart shows that the pair remains below all of its moving averages, which remain directionless, reflecting the lack of a clear trend. Technical indicators, in the meantime, have turned flat, although the RSI stands around 40, skewing the risk to the downside.

Support levels: 106.60 106.20 105.90

Resistance levels: 107.30 107.75 108.10

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.