USD/JPY Forecast: Holding on to gains but lacking momentum

USD/JPY Current Price: 109.16

- Japanese yen weakened on the back of the better market mood.

- Easing dollar’s demand capped the upside for the pair.

- USD/JPY could gather upward momentum on a break above 109.40.

The USD/JPY pair traded as high as 109.38 this Monday, underpinned by the positive momentum of global equities and recovering in government bond yields. The market’s mood improved amid signs of a flattening contagion curve in Europe and New York. The figures, however, are still outrageous and the crisis is far from over. Nevertheless, global equities surged, with US indexes adding over 5.0% each. US Treasury yields also recovered, with the yield on the benchmark 10-year note surging to 0.68% and settling not far below this last.

In the data front, Japan released at the beginning of the day, March Consumer Confidence, which resulted at 30.9 from 38.4 in February. The US won’t release relevant data today. The country will publish this Tuesday earnings and spending figures, and the preliminary estimate of the February Leading Economic Index, foreseen at 90.4 from 90.5 in the previous month.

USD/JPY short-term technical outlook

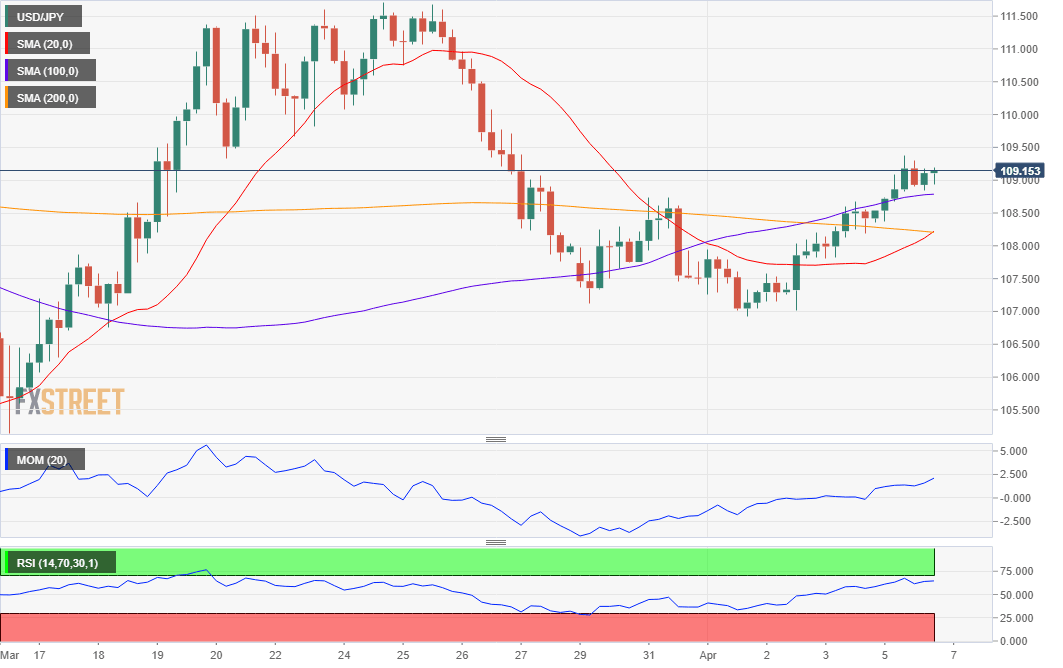

The USD/JPY pair has briefly surpassed the 23.6% retracement of its latest daily advance, having spent most of the American session just below the level. The short-term picture skews the risk to the upside, as, in the 4-hour chart, the pair is above all of its moving averages, while technical indicators hold within positive levels, although lacking directional strength. The pair would be better poised to extend its advance on a break above 109.40, the immediate resistance.

Support levels: 108.70 108.25 107.90

Resistance levels: 109.40 109.80 110.15

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.