USD/JPY Forecast: Heading higher on dollar’s comeback

USD/JPY Current price: 105.46

- US Congress revived discussions on a new stimulus package to aid the economy.

- The focus shifts now to US August Durable Goods Orders.

- USD/JPY pressuring weekly highs and poised to advance towards 106.25.

Dollar’s rally paused late on Thursday, amid hopes related to a US stimulus package. According to the latest headlines, Treasury Secretary Steven Mnuchin and House Speaker Nancy Pelosi have agreed to restart formal talks on a second round of stimulus. House Democrats are putting together another coronavirus relief package, which would cost about $2.4 trillion.

The positive sentiment, however, seems to be fading in the London session, as stocks plummet and the greenback gathers momentum against most major rivals. The USD/JPY pair, in the meantime, continues to trade around 105.40.

Japan published the August Corporate Service Price Index, which came in at 1% YoY, below the 1.4% expected. The focus now shifts to US Durable Goods Orders, foreseen at 1.5% in August, down from 11.4% in July.

USD/JPY short-term technical outlook

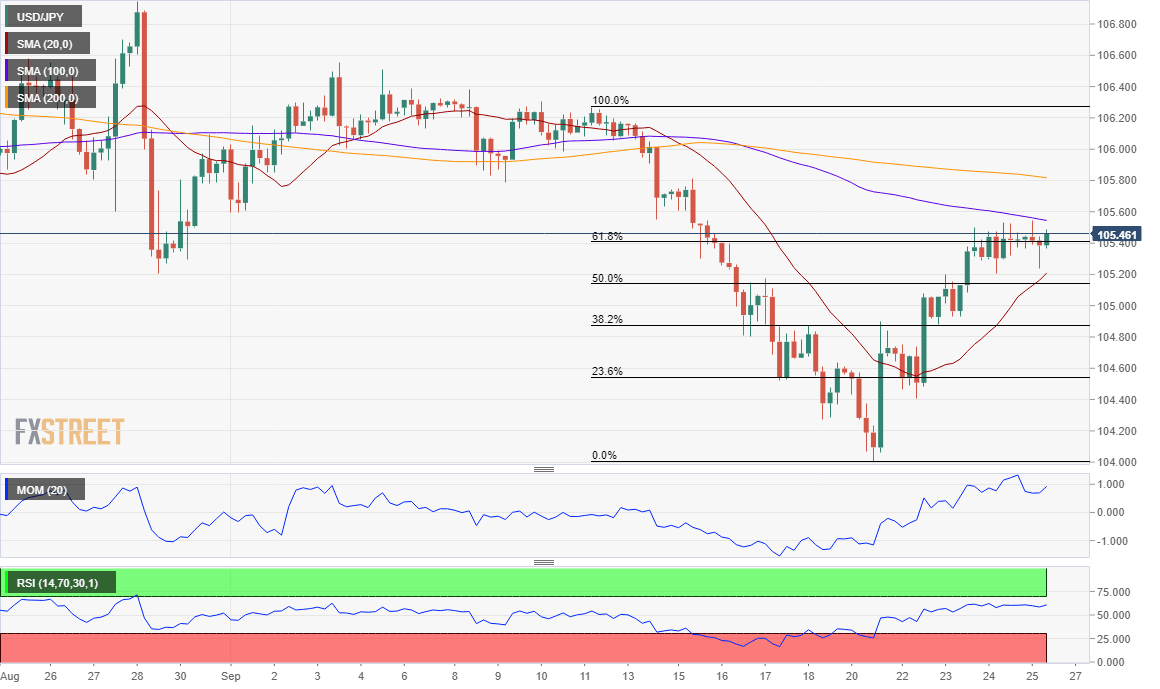

The USD/JPY pair is nearing its weekly high at 105.54, a handful of pips above the 61.8% retracement of its latest daily decline. The risk is skewed to the upside, according to the 4-hour chart, as the 20 SMA maintains its bullish slope, and surpassed the 50% retracement of the mentioned decline. The 100 SMA, however, maintains a modest bearish slope, providing a dynamic resistance around the mentioned high. Technical indicators, in the meantime, remain within positive levels, slowly grinding higher. A clear break of the mentioned high should favor an extension towards the 106.25, where the pair would complete a 100% retracement.

Support levels: 104.85 104.50 104.00

Resistance levels: 105.55 105.90 106.25

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.