With risk assets surging higher for the second straight day, two of the safe haven currencies are getting left in the dust. FX traders piled in to buy the US dollar and Japanese yen aggressively in recent weeks as they unwound carry trades and sought a safe place to store capital, but now that tide is going out (or at least the latest “wave” of the flow is receding). While the market’s broader risk appetite has interesting implications for various pairs, we wanted to focus in on a key level that may determine which safe haven currency is king in the days to come.

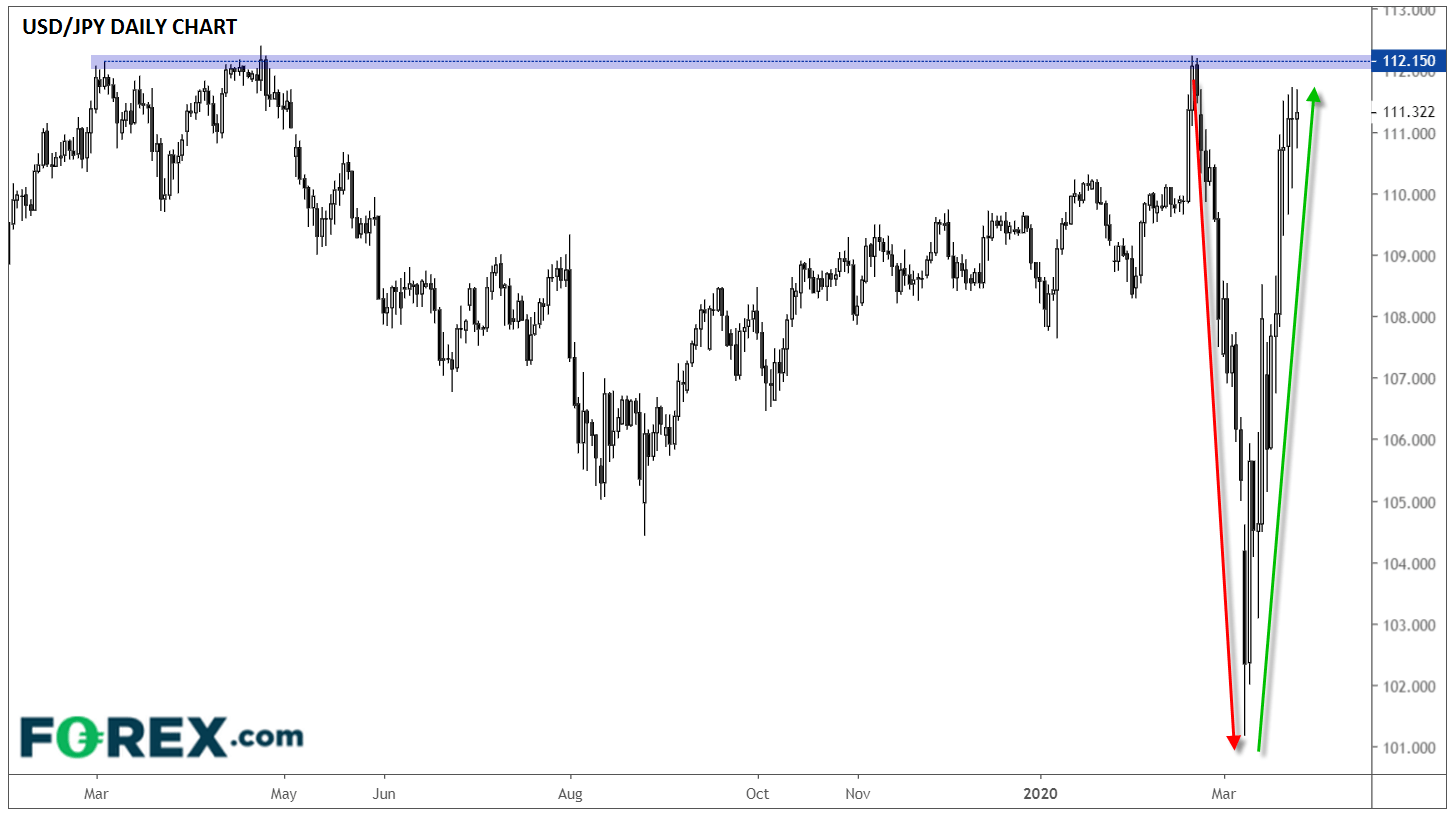

Looking at USD/JPY, rates have seen a violent round trip after peaking near 112.00 in late February, collapsing all the way to near 101.00 by early March, and then rising from the ashes to tack on over 1,000 pips to trade back in the mid-111.00s as of writing:

Source: TradingView, GAIN Capital

Generally speaking, ascending triangle patterns indicate growing buying pressure that most often leads to a bullish breakout and continuation higher, though as we approach month- and quarter-end rebalancing after one of the most volatile months in recent memory, all FX pairs may see less predictable moves. Nonetheless, a break above 111.60 (ideally confirmed by a daily close above that area) would be a bullish sign that could reaffirm the US dollar as the “Safe Haven King” of the FX market. Meanwhile, a break lower from the current ascending triangle pattern could be the first step toward a swing back toward the yen being the most in-demand currency on the market’s next bout of risk aversion.

This research is for informational purposes and should not be construed as personal advice. Trading any financial market involves risk. Trading on leverage involves risk of losses greater than deposits.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.