Are you trading today? Read the Forex Trading Strategies for the Day.

EUR/USD

Trading within downtrend channel.

-

EUR/USD is moving sideways within downtrend channel. The pair still seems far from hourly support at 1.1144 (24/03/2016 low). Stronger support is located a 1.1058 (16/03/2016 low). Resistance can be found at 1.1465 (12/04/2016 high). Expected to show further bouncing back within the downtrend channel.

-

In the longer term, the technical structure favours a bearish bias as long as resistance at 1.1746 ( holds. Key resistance is located at 1.1640 (11/11/2005 low). The current technical appreciation implies a gradual increase.

GBP/USD

Monitoring resistance at 1.4668.

-

GBP/USD is heading towards 1.4668 (04/02/2016 high). The pair is gaining momentum to break this level. Hourly support is given at 1.4320 (04/04/2016 high). Expected to show further consolidation below resistance at 1.4668 (04/02/2016 high).

-

The long-term technical pattern is negative and favours a further decline towards key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY

Sideways price action.

-

USD/JPY is consolidating around 111. The pair still lies within the uptrend channel. Hourly resistance can be found at 111.91 (25/04/2015 high) while hourly support can be found at 107.68 (07/04/2016 low). Short-term momentum is clearly bullish. Expected to show further increase.

-

We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

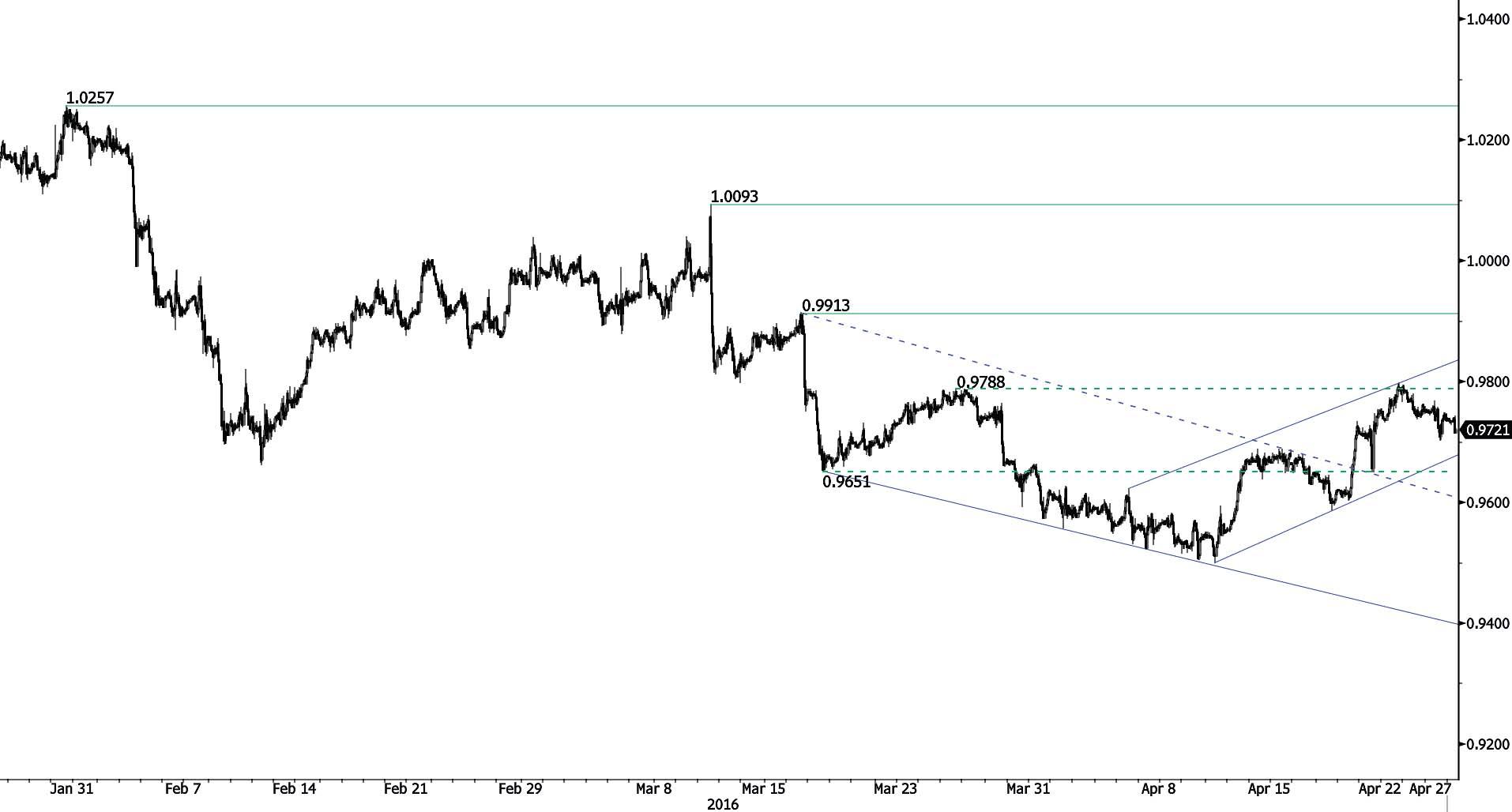

USD/CHF

Bearish consolidation.

-

USD/CHF is lying within a short-term uptrend channel but the pair fails to hold above former resistance at 0.9788 (25/03/2016 high). Hourly support can be found at 0.9499 (12/04/2016 low). Expected to show further increase.

-

In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.

USD/CAD

Bearish move continues.

-

USD/CAD's bearish momentum is still on. Yet, selling pressures are diminishing. The volatility is now very low. Hourly support is located at 1.2593 (20/04/2016 low). Hourly resistance is given at 1.2897 (14/04/2016 high). Expected to show continued decline.

-

In the longer term, the pair is now trading well below the 200-day moving average. Strong resistance is given at 1.4948 (21/03/2003 high). Stronger support can be found at 1.1731 (06/01/2015 low).

AUD/USD

Sharply declining.

-

AUD/USD has sharply declined. Strong resistance area can be found at 0.7835 (24/04/2016 high). Hourly support is given at 0.7555 (rising trendline) then 0.7415 (16/03/2016 low). Buying pressures remains important as long as the pair remains above support implied by the uptrend channel and 0.7415.

-

In the long-term, we are waiting for further signs that the current downtrend is ending. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair is now above the 200-dma which confirms our view that buying pressures are increasing.

EUR/CHF

Monitoring strong resistance area.

-

EUR/CHF is trading around 1.1000 which is a strong resistance area. Selling pressures seem important at this level. Hourly support can be found at 1.0863 (23/03/2016 low) while hourly resistance is given at 1.1061 (17/02/2016 high). Expected to show continued monitoring of strong resistance area at 1.1000.

-

In the longer term, the technical structure remains positive. Resistance can be found at 1.1200 (04/02/2015 high). Yet,the ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

EUR/JPY

Short-term bullish.

-

EUR/JPY is riding the short-term uptrend channel. Hourly resistance at 125.53 (26/04/2016 high) has been broken. Hourly support is given at 124.70 (26/04/2016 low). Stronger support can be found at 121.72 (18/04/2016 low). Expected to show continued increase in the short-term.

-

In the longer term, the technical structure validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Strong support is given at 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Ready to go higher.

-

EUR/GBP has declined but remains in a medium-term upside momentum which should prevail against short-term bearish momentum. Hourly resistance can be found at 0.7811 (25/04/2016 high). Expected to reverse around 0.7800 in the short-term and to monitor again resistance area at 0.8000 in the medium-term

-

In the long-term, the pair is currently recovering from recent lows in 2015. The technical structure suggests a growing upside momentum. The pair is trading well above its 200 DMA. Strong resistance can be found at 0.8815 (25/02/2013 high).

GOLD (in USD)

Bullish momentum is growing.

-

Gold is lying in a short-term uptrend channel. The metal is currently edging slightly higher. Support is given at 1208 (28/03/2016). Resistance can be found at 1284 (11/03/2016 high). A break of support at 1182 (08/02/2016 low) is necessary to confirm deeper selling pressures.

-

In the long-term, the technical structure suggests that there is a growing upside momentum. A break of 1392 (17/03/2014) is necessary ton confirm it, A major support can be found at 1045 (05/02/2010 low).

SILVER (in USD)

Increasing again.

-

Silver is back to bullish after its recent consolidation. Hourly resistance can be found at 17.78 (18/05/2015) while support can be found at 14.79 (01/04/2016 low). Expected to see further consolidation before entering into another upside move.

-

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Strong support can be found at 11.75 (20/04/2009). A key resistance stands at 18.89 (16/09/2014 high).

Crude Oil (in USD)

Pushing higher.

-

Crude is back to bullish which confirms strong medium-term momentum. Hourly support can be found at 37.61 (18/04/2016 low) while strong resistance lies at 48.36 (03/11/2016 low). Expected to show deep increase towards 48.36.

-

In the long-term, crude oil is on a sharp decline but is now showing some signs of recovery. Strong support lies at 24.82 (13/11/2002). Crude oil is holding above its 200-Day Moving Average. Crude oil should recover during this year.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.