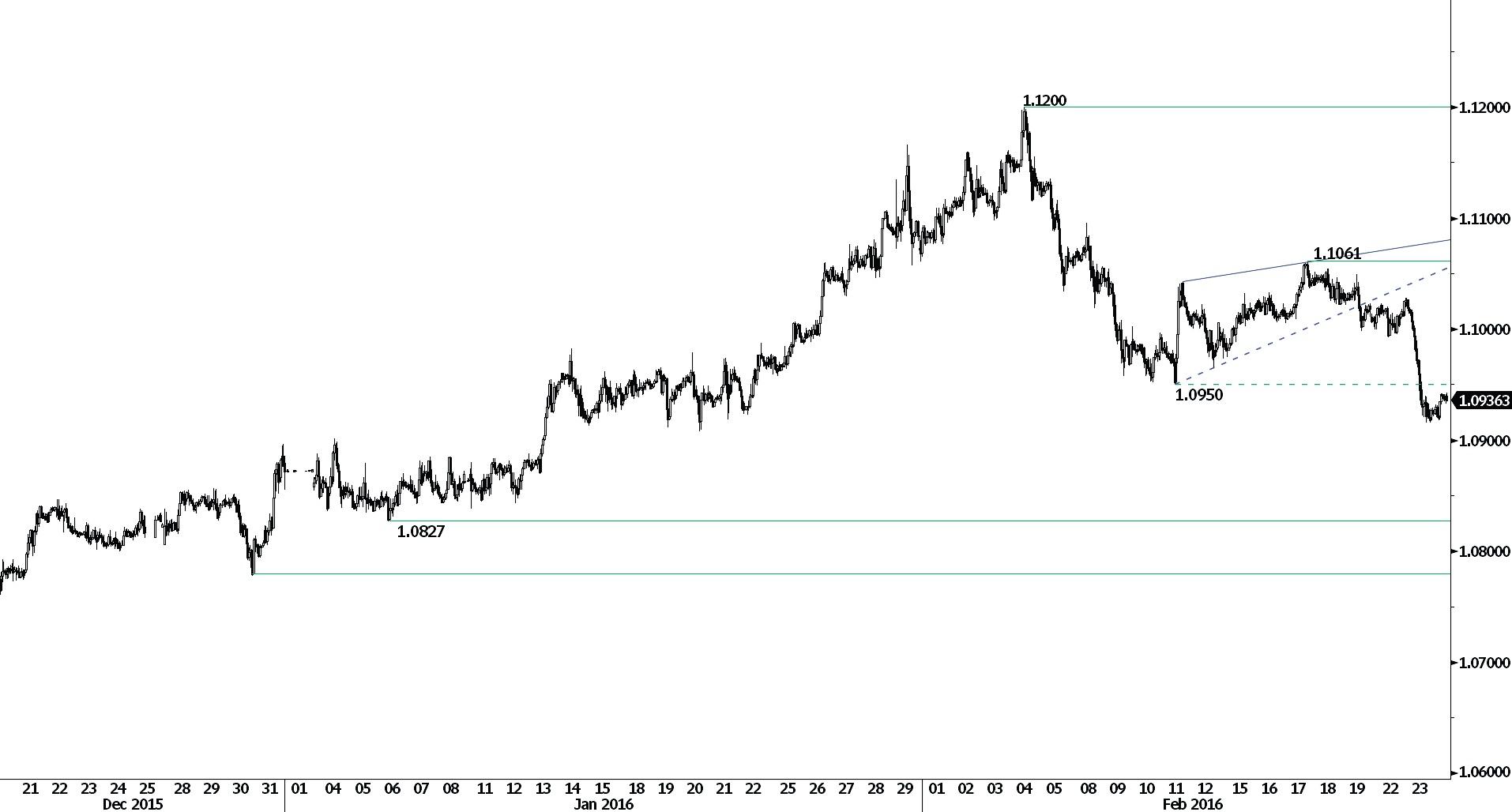

EUR/USD

Pausing around 1.1000.

EUR/USD is now pausing around 1.1000. The short-term technical structure still suggests a further bearish move. Hourly resistance lies at 1.1139 (19/02/2016 high) and hourly support is given at 1.0905 (03/02/2016 low). Expected to keep on declining.

In the longer term, the technical structure favours a bearish bias as long as resistance holds. Key resistance is located region at 1.1453 (range high) and 1.1640 (11/11/2005 low) is likely to cap any price appreciation. The current technical deteriorations favours a gradual decline towards the support at 1.0504 (21/03/2003 low).

GBP/USD

Stronger bearish momentum.

GBP/USD has broken hourly support at 1.4150 (29/01/2015 low) and 1.4081 (21/01/2015 low). The road is wide open to stronger support at 1.3657 (11/03/20009 low). Hourly resistance is given at 1.4168 (22/02/2016 high). The technical structure suggests further decline.

The long-term technical pattern is negative and favours a further decline towards the key support at 1.3503 (23/01/2009 low), as long as prices remain below the resistance at 1.5340/64 (04/11/2015 low see also the 200 day moving average). However, the general oversold conditions and the recent pick-up in buying interest pave the way for a rebound.

USD/JPY

Slowly declining.

USD/JPY is pushing lower. The medium-term technical structure is clearly negative. Hourly support can be found at 111.64 (intraday low). Hourly resistance lies can be found at 113.39 (22/02/2016 high). Expected to further decline towards hourly support at 110.99 (11/02/2016 low).

We favour a long-term bearish bias. Support at 105.23 (15/10/2014 low) is on target. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) seems now less likely. Another key support can be found at 105.23 (15/10/2014 low).

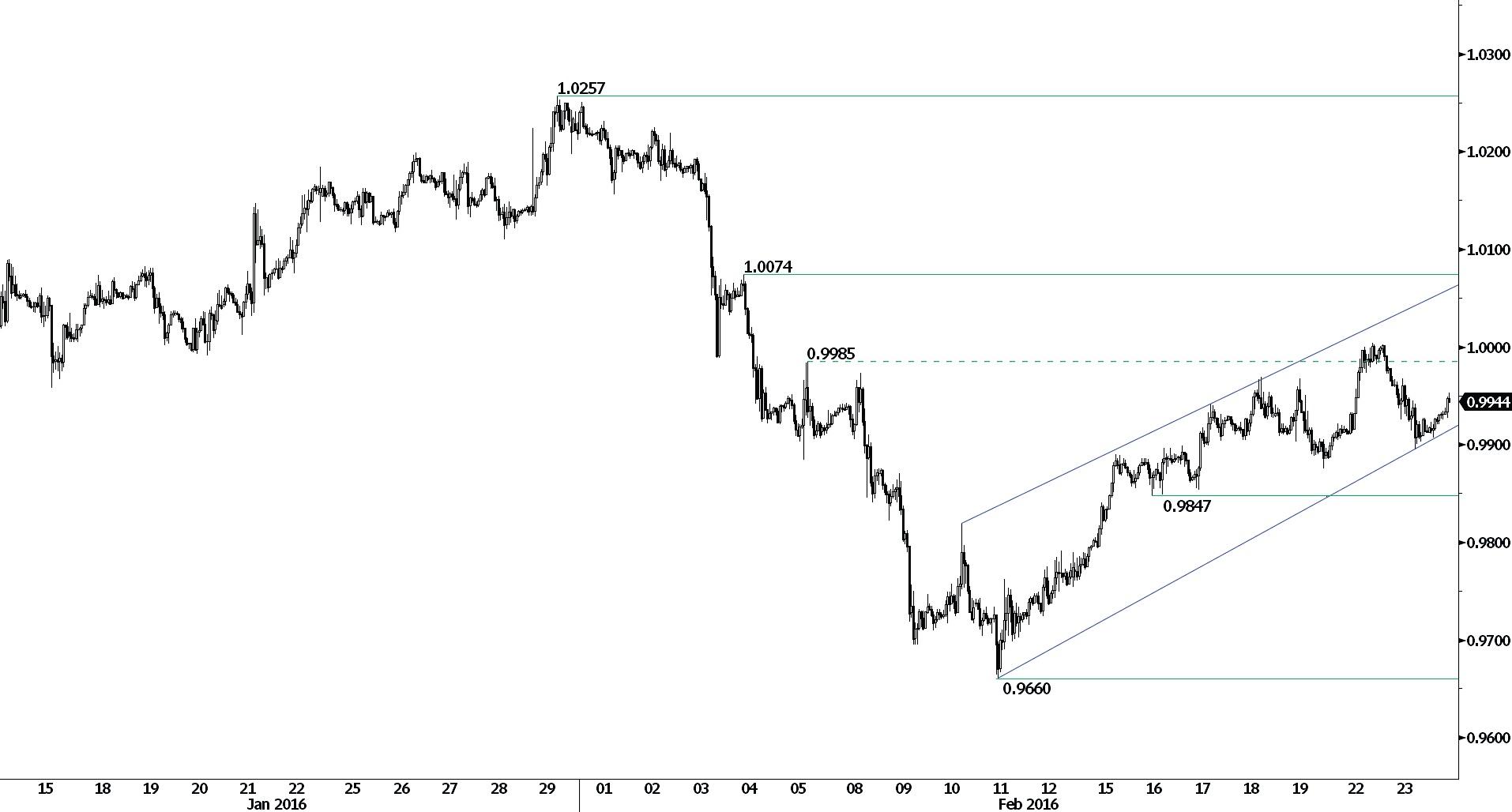

USD/CHF

Riding short-term uptrend channel.

USD/CHF is riding the uptrend channel. Hourly resistance is given at 1.0003 (22/02/2016 high). Stronger resistance is given at 1.0074 (04/02/2016 high). Hourly support can be found at 0.9896 (23/02/2016 low). Stronger support is given at 0.9847 (16/02/2016 low). Expected to see further strengthening.

In the long-term, the pair is setting highs since mid-2015. Key support can be found 0.8986 (30/01/2015 low). The technical structure favours a long term bullish bias.

USD/CAD

Failed to test support at 1.3640.

USD/CAD is bouncing back. Yet, we favour a bearish bias. Current price action is following a downtrend channel. Hourly support is located at 1.3640 (04/02/2016 low) and hourly resistance can be found at 1.3847 (19/02/2016 high). Expected to see further weakening.

In the longer term, the break of the key resistance at 1.3065 (13/03/2009 high) has indicated increasing buying pressures, which favours further medium-term strengthening. Strong resistance is given at 1.4948 (21/03/2003 high). Support can be found at 1.2832 (15/10/2015 low) then 1.1731 (06/01/2015 low).

AUD/USD

Increasing volatility.

AUD/USD's short-term momentum is bullish despite stronger volatility. Hourly resistance at 0.7243 (23/02/2015 high). Support lies at 0.7167 (24/02/2016 low). Expected to keep on pushing higher.

In the long-term, we are waiting for further signs that the current downtrend is ending. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair is approaching the 200-dma which confirms fading selling pressures.

EUR/CHF

Strong bearish momentum.

EUR/CHF's selling pressures continues. Hourly support can be found at 1.0827 (06/01/2016 low) is on target. Hourly resistance lies at 1.0942 (intraday high). The technical structure suggests further weakening.

In the longer term, the technical structure remains positive. Resistance can be found at 1.1200 (04/02/2015 high). Yet,the ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

EUR/JPY

Collapsing.

EUR/JPY's breakout of support implied by the lower bound of the downtrend channel has paved the way for further decline. Hourly resistance can be found at 124.20 (intraday high). Expected to decrease.

In the longer term, the technical structure validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Key support at 124.97 (13/06/2013 low) has been broken. Stronger support is given at 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Pushing higher.

EUR/GBP is trading in range between hourly resistance at 0.7897 (11/02/2016 high) and hourly support at 0.7695 (16/02/2016 low). Expected to show further consolidation. Yet, the very shortterm technical structure suggests a bullish growing momentum toward hourly resistance at 0.7897.

In the long-term, the technical structure suggests a growing upside momentum. The pair is trading well above its 200 DMA. Strong resistance can be found at 0.8066 (10/09/2014 high).

GOLD (in USD)

Bullish momentum is rebirthing.

Gold's bullish momentum is increasing. The metal has exited a symmetrical triangle. Hourly supports lies at 1201(18/02/2016 low) and 1191 (16/02/2016 low). Daily resistance can be found at 1263 (11/02/2016 high).

In the long-term, the technical structure suggests that there is a growing upside momentum. A break of 1392 (17/03/2014) is necessary ton confirm it, A major support can be found at 1045 (05/02/2010 low).

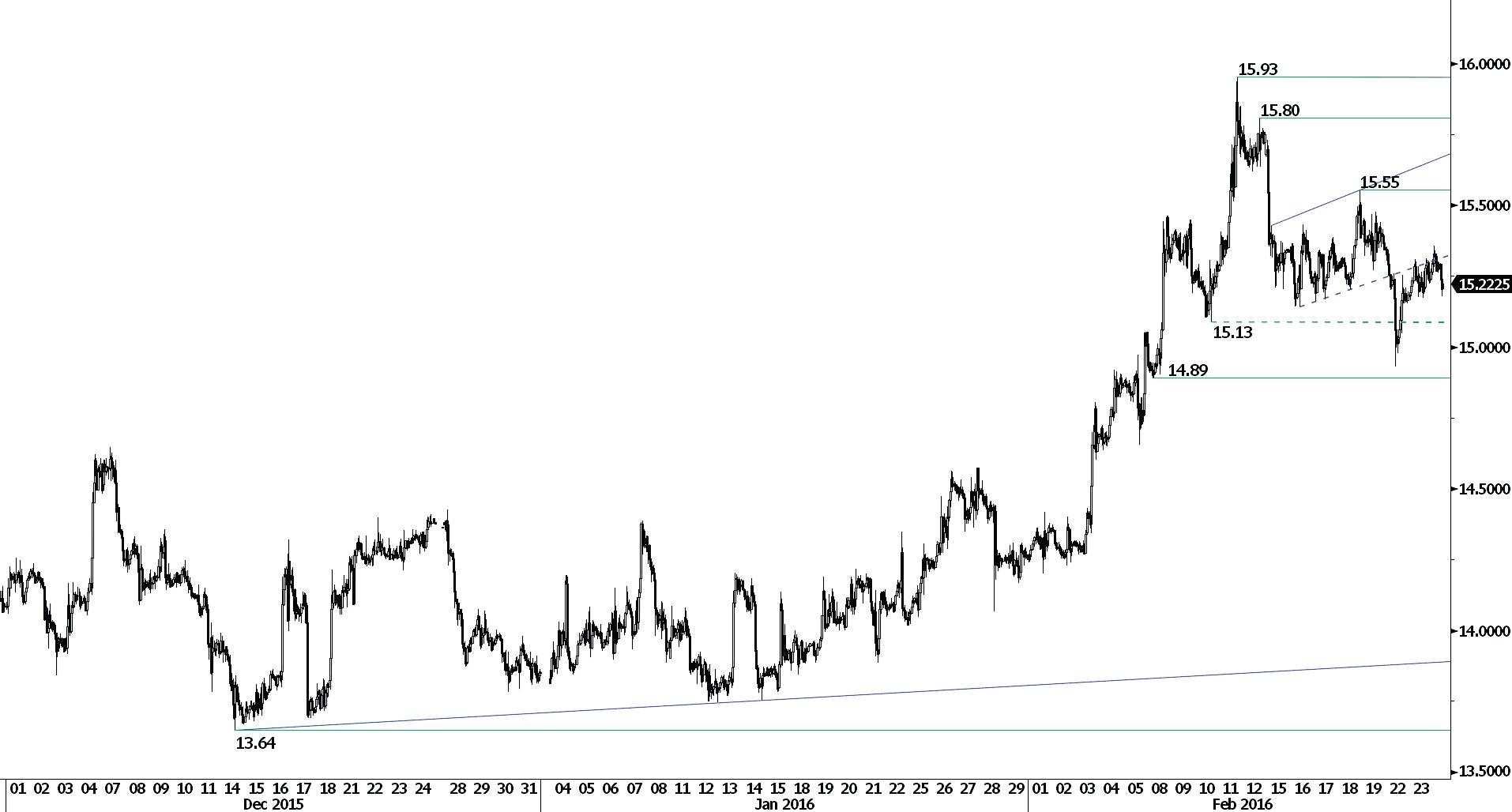

SILVER (in USD)

Sideways price action.

Silver is trading mixed around 15.22. The metal has failed to test hourly support at 14.89 (10/02/2016 low). Hourly resistance can be found at 15.55 (18/02/2016 high).

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Strong support can be found at 11.75 (20/04/2009). A key resistance stands at 18.89 (16/09/2014 high).

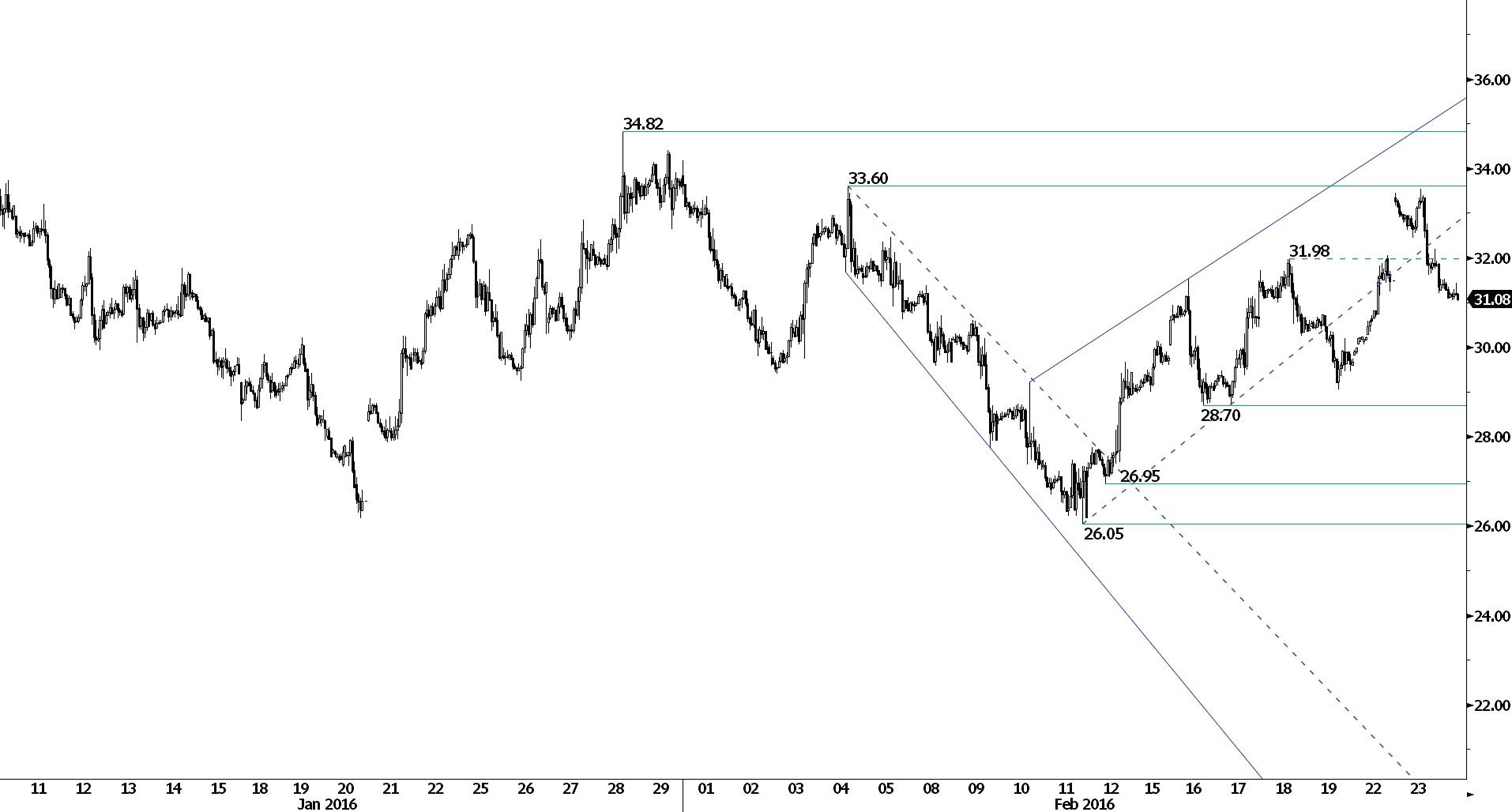

Crude Oil (in USD)

Short-term bullish.

Crude oil's volatility is still strong for the time being. In the context of oil oversupply, we consider that there is still room for further downside moves. The higher highs suggest that oil is in a short-term bullish momentum. Hourly support stand at 28.70 (16/02/2016 low) and hourly resistance can be found at 33.60 (04/02/2016 high).

In the long-term, crude oil is on a sharp decline and is of course no showing any signs of recovery. Strong support at 24.82 (13/11/2002) is now on target. Crude oil is holding way below its 200-Day Moving Average (setting up at around 47). There are currently no signs that a reverse trend may happen.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD stays slightly above 1.0700 after mixed US data

EUR/USD lost its traction and turned negative on the day but managed to hold above 1.0700. Although the upbeat Employment Cost Index data boosted the USD earlier in the day, the weak consumer sentiment reading limits the currency's gains.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold extends daily slide toward $2,300 as US yields edge higher

Gold stays under bearish pressure and declines toward $2,300 on Tuesday. The benchmark 10-year US Treasury bond yield stays in positive territory above 4.6% after US Employment Cost Index data, weighing on XAU/USD.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.