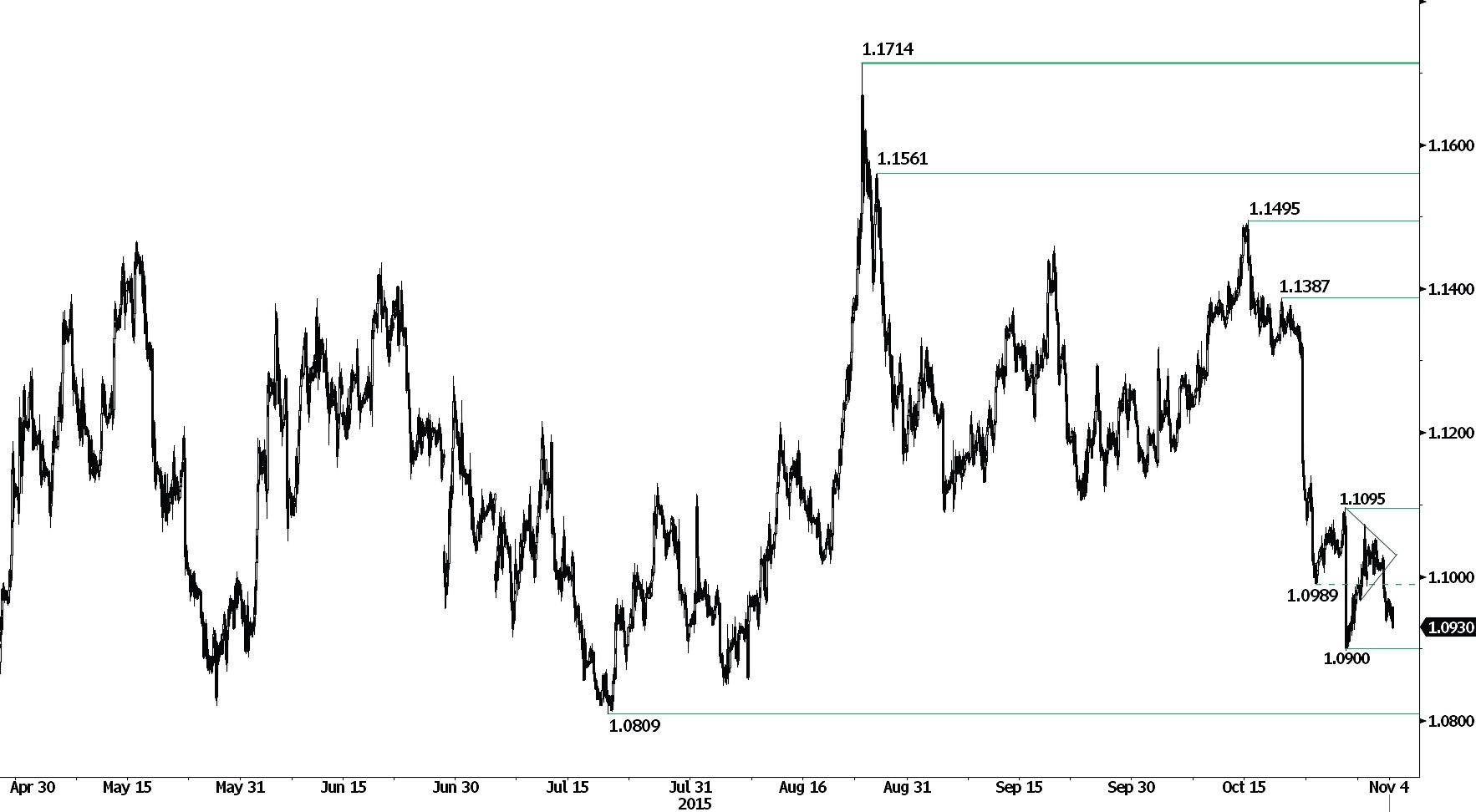

EUR/USD

Challenging the key support at 1.0900.

EUR/USD continues to decline, as can be seen by the break of the support at 1.0936 (03/11/2015 low) and 1.1006 (uptrend rising channel). Prices are now challenging the key support at 1.0900 . Hourly resistance for a short term bounce is given at 1.1095 (28/10/2015 reaction high). Stronger resistance can be found at 1.1387 (20/10/2015 low).

Since March 2015, the pair is improving. Key supports can be found at 1.0458 (16/03/2015 low) and 1.0000 (psychological support). The technical structure favours an eventual break higher. Strong resistance is given at 1.1871(12/01/2015).

GBP/USD

Trying to form a short-term base?

GBP/USD bullish rally has paused but watch initial resistance found at 1.5529 (18/09/2015 high). The short-term technical structure suggests continued bullish momentum should a base around 1.5410 develop. An initial support lies at 1.5404 (02/11/2015) then 1.5202 (06/06/2014 high).

In the longer term, the technical structure looks like a recovery as long as support given at 1.5089 stands. A full retracement of the 2013-2014 rise is expected.

USD/JPY

Pushing higher.

USD/JPY continues to rise within its range after failing to challenging its recent lows at 120.80 (28/10/2015 low). Lack of technical drivers indicate that range trading should continue. Strong resistance is given at 121.75 (28/08/2015 high). Expected to show continued increase before targeting again resistance at 121.75.

A long-term bullish bias is favored as long as the strong support at 115.57 (16/12/2014 low) holds. A gradual rise towards the major resistance at 135.15 (01/02/2002 high) is favored. A key support can be found at 116.18 (24/08/2015 low).

USD/CHF

Approaching the key resistance at 0.9957.

USD/CHF has broken the resistance at 0.9880 (declining channel), confirming an increasing buying interest. As long as the support at 0.9808 (27/10/2015 low) holds, the technical structure looks to further bullish momentum. Additional hourly support is given at 0.9476 (15/10/2015 low).

In the long-term, the pair has broken resistance at 0.9448 suggesting the end of the downtrend. This reinstates the bullish trend. Key support can be found 0.8986 (30/01/2015 low).

USD/CAD

Weakening.

USD/CAD remains weak as can be seen by the breach of the hourly support lies at 1.3056 (30/10/2015 low). More significant supports stand at 1.2949 (Fibo 38% retracement level). Hourly resistances can be found at 1.3069 (intraday high). Expected continued bullish momentum of the pair.

In the longer term, the break of the key resistance at 1.3065 (13/03/2009 high) has indicated increasing buying pressures, which favours further medium-term strengthening. Support can be found at 1.1731 (06/01/2015 low).

AUD/USD

Challenging its key resistance around 0.7220.

AUD/USD continues to move within its short term uptrend and is now challenging its recent high at 0.7220 (declining downtrend channel). As the pair has broken hourly support at 0.7165 (08/10/2015 low) underlying downside trend is dominate. Key support lies at 0.6893 (04/09/2015 low).

In the long-term, there is no sign to suggest the end of the current downtrend. Key supports stand at 0.6009 (31/10/2008 low) . A break of the key resistance at 0.8295 (15/01/2015 high) is needed to invalidate our long-term bearish view. In addition, we still note that the pair remains well below the 200-dma which confirms selling pressures.

GBP/JPY

Bullish recovery in the uptrend channel.

GBP/JPY rebound nearing the key support area at 184.30 (see also the rising channel) is thus far impressive. A break of the resistance at 187.33 (21/09/2015 high) is needed to suggest further short-term strength. Expected to start a downside momentum by breaking support of this uptrend channel.

In the long-term, the lack of any medium-term bearish reversal pattern favours a bullish bias. The successful test of the strong support at 175.51 (03/02/2015 low) signals persistent buying interest. Key resistances stand at 197.45 (26/09/2008 high). A major support area can be found between 169.51 (11/04/2014 low) and 167.78 (18/03/2014 low).

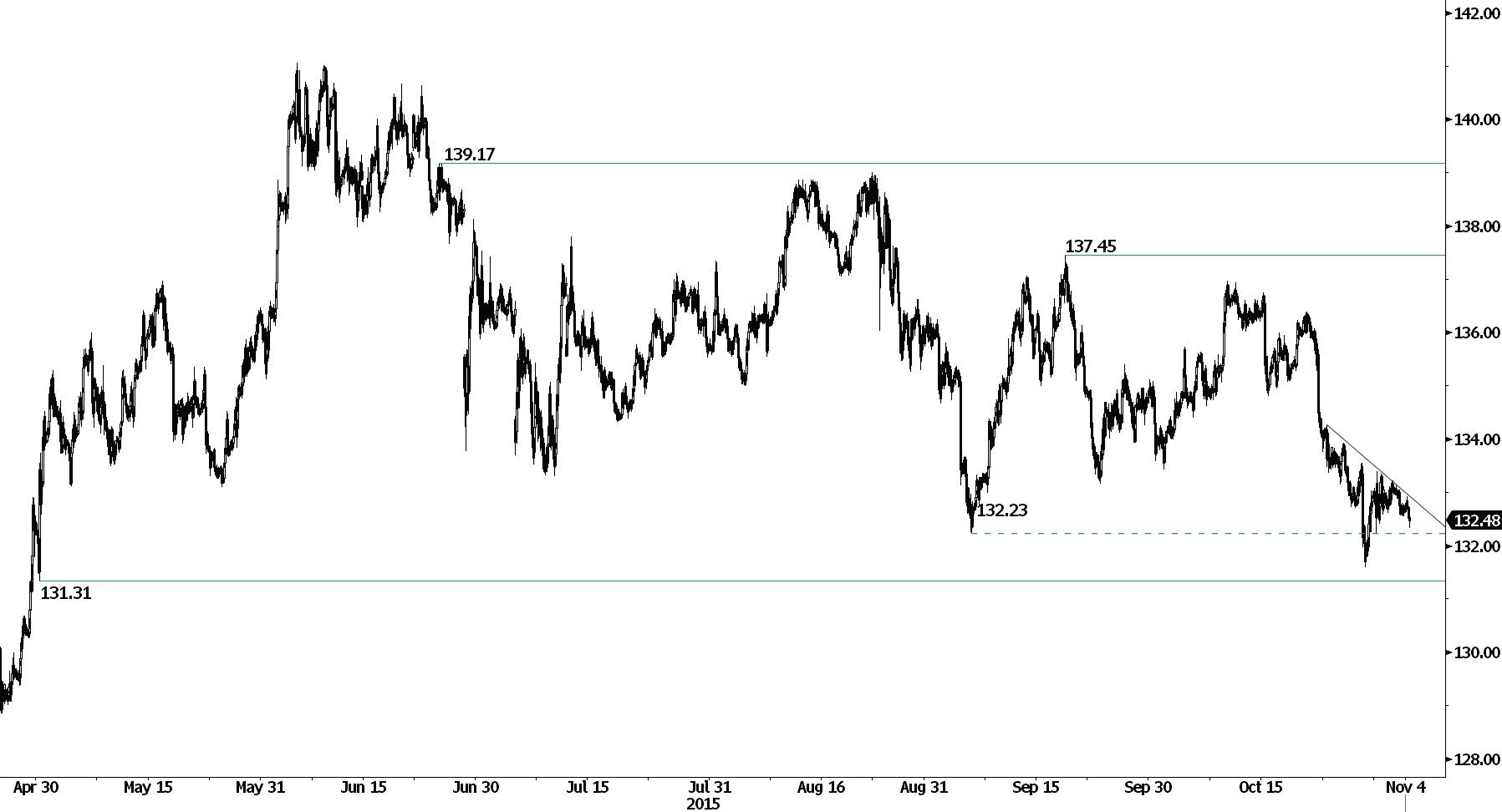

EUR/JPY

Remains weak.

EUR/JPY is bouncing after breaking support at 132.23 (04/09/2015 low). Hourly resistance is located at 132.88 (declining downtrend channel) and hourly support lies at 132.24 /09/04/2015 low). Expected to show continued weakness.

In the longer term, the break of the support at 130.15 validates a medium-term succession of lower highs and lower lows. As a result, the resistance at 149.78 (08/12/2014 high) has likely marked the end of the rise that started in July 2012. Key supports stand at 124.97 (13/06/2013 low) and 118.73 (25/02/2013 low). A key resistance can be found at 141.06 (04/06/2015 high).

EUR/GBP

Making new lows.

EUR/GBP short-term succession of lower lows indicates the technical structure is negative. Monitor the support at 0.7026 (18/08/2015 low). Hourly resistance can be found at 0.7108 (02/11/2015 low). Structural pattern indicates continued weakness.

In the long-term, prices are in an underlying declining trend. The general oversold conditions suggest a limited medium-term downside potential. A key resistance lies at 0.7592 (03/02/2015 high).

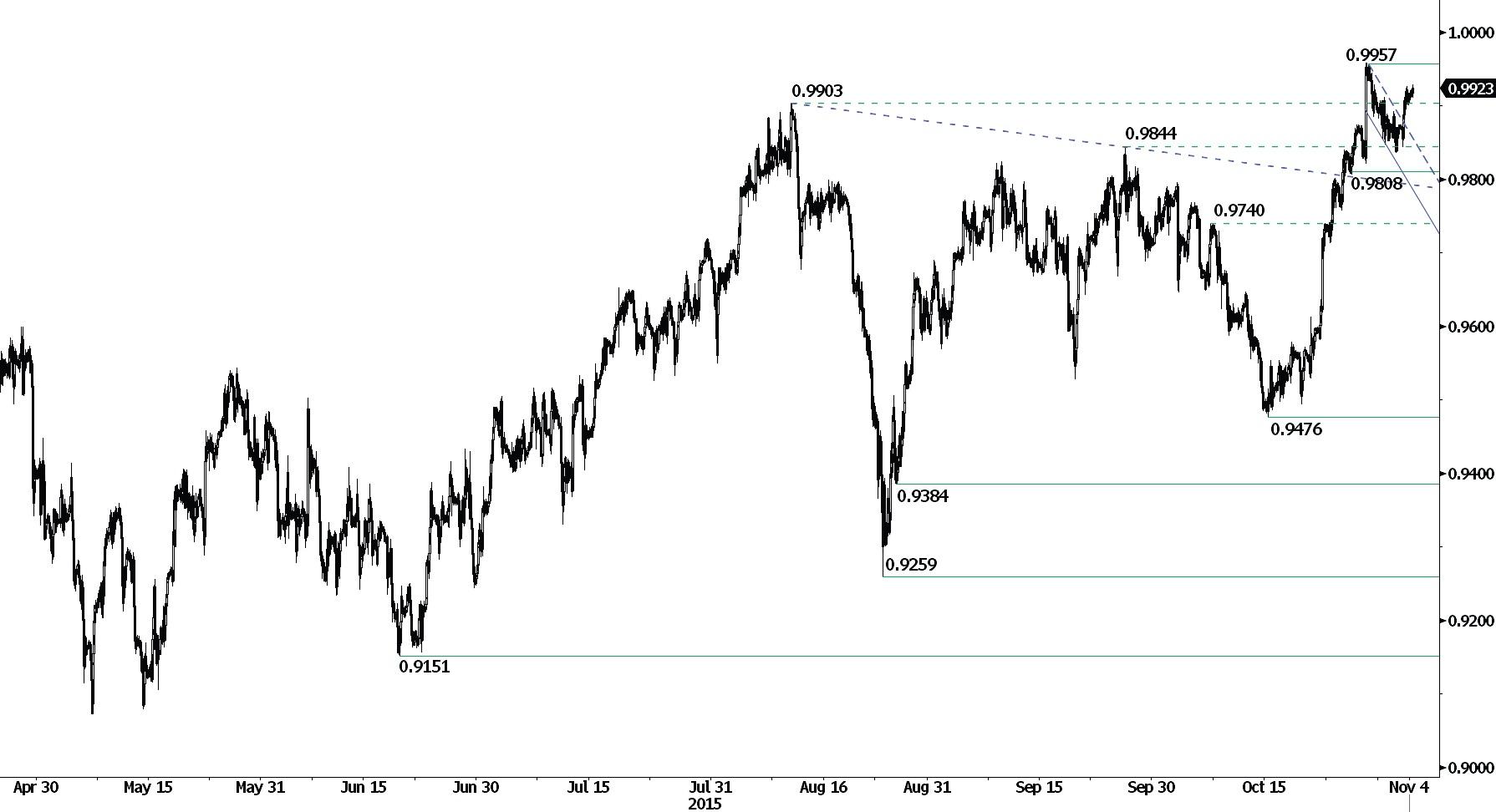

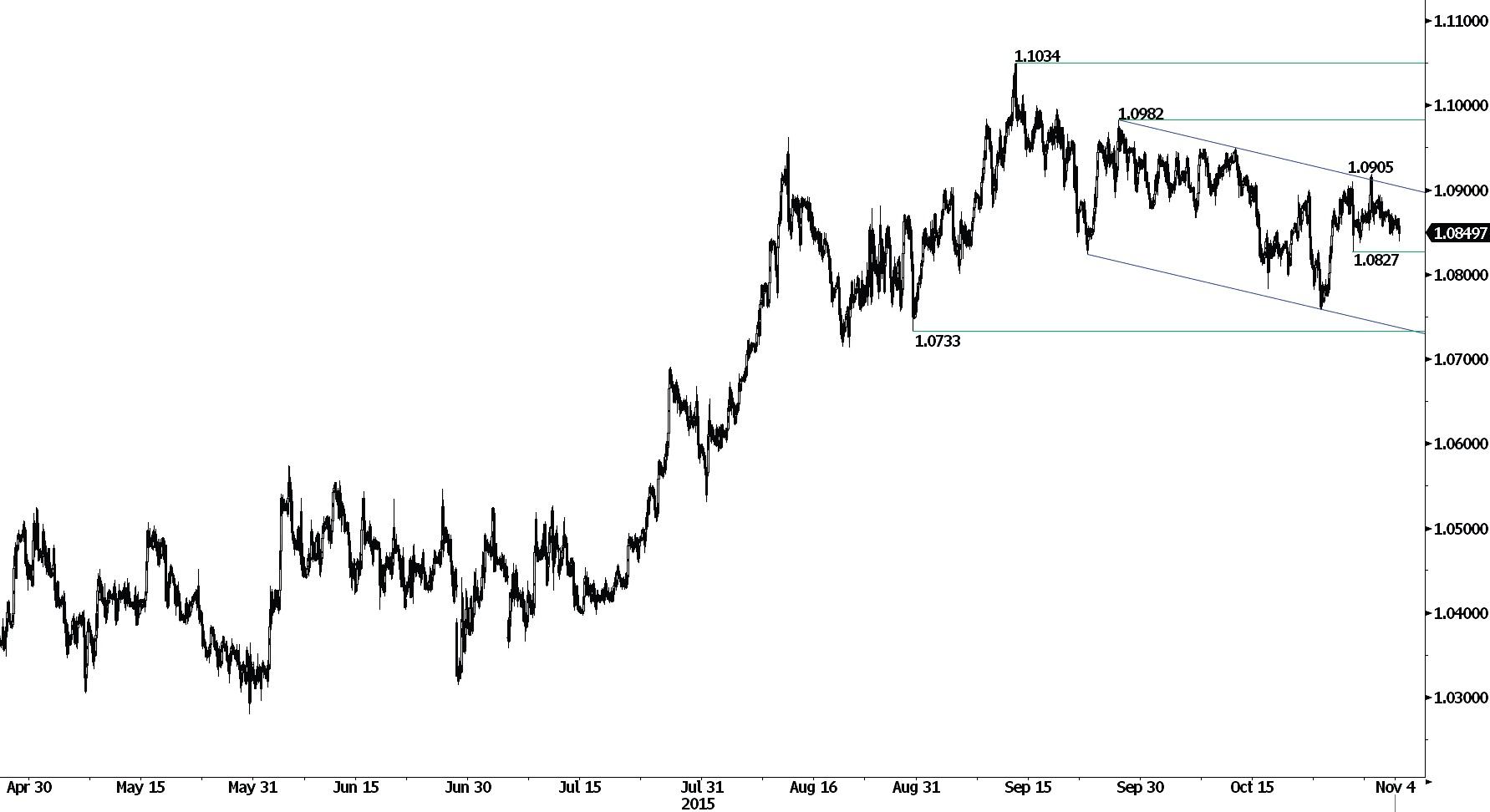

EUR/CHF

Slight bearish pressure within range.

EUR/CHF is riding the downtrend channel. The short-term technical structure remain negative. Hourly support lies at 1.0733 (16/10/2015 low). Hourly resistance can be found at 1.0908 (declining channel resistance). Expected to fall below 1.0800.

The EUR/CHF is digesting its 15 January sharp decline. A key resistance stands at 1.1002 (02/09/2011 low). The ECB's QE programme is likely to cause persistent selling pressures on the euro, which should weigh on EUR/CHF. Supports can be found at 1.0184 (28/01/2015 low) and 1.0082 (27/01/2015 low).

GOLD

Weak bounce off support.

Gold is moving lower and the short-term technical structure is negative. Short-term supports region can be found at 1115. Another support can be located at and 1093 (12/08/2015 low). Hourly resistance is given at 1205 (18/06/2015 high). Expected to show continued weakness.

In the long-term, the underlying downtrend (see declining channel) continues to favour a bearish bias. Although the key support at 1132 (07/11/2014 low) has been broken, a break of the resistance at 1223 is needed to suggest something more than a temporary rebound. A major support can be found at 1045 (05/02/2010 low).

SILVER (in USD)

Breaks support at 15.30

Silver is weakening. The potential mediumterm base formation and the short-term challenge to range support favours a bearish bias. Hourly support is given at 15.16 (10/05/2015 low). The resistance at 15.45 (declining channel) has thus far held.

- In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. The strong support at 14.66 (05/02/2010 low) has been broken and prices have then consolidated. A key resistance stands at 18.89 (16/09/2014 high).

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD tests lows near 0.6550 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is testing lows near 0.6550 after Australian Retail Sales dropped by 0.4% in March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data fails to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY rebounds to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.