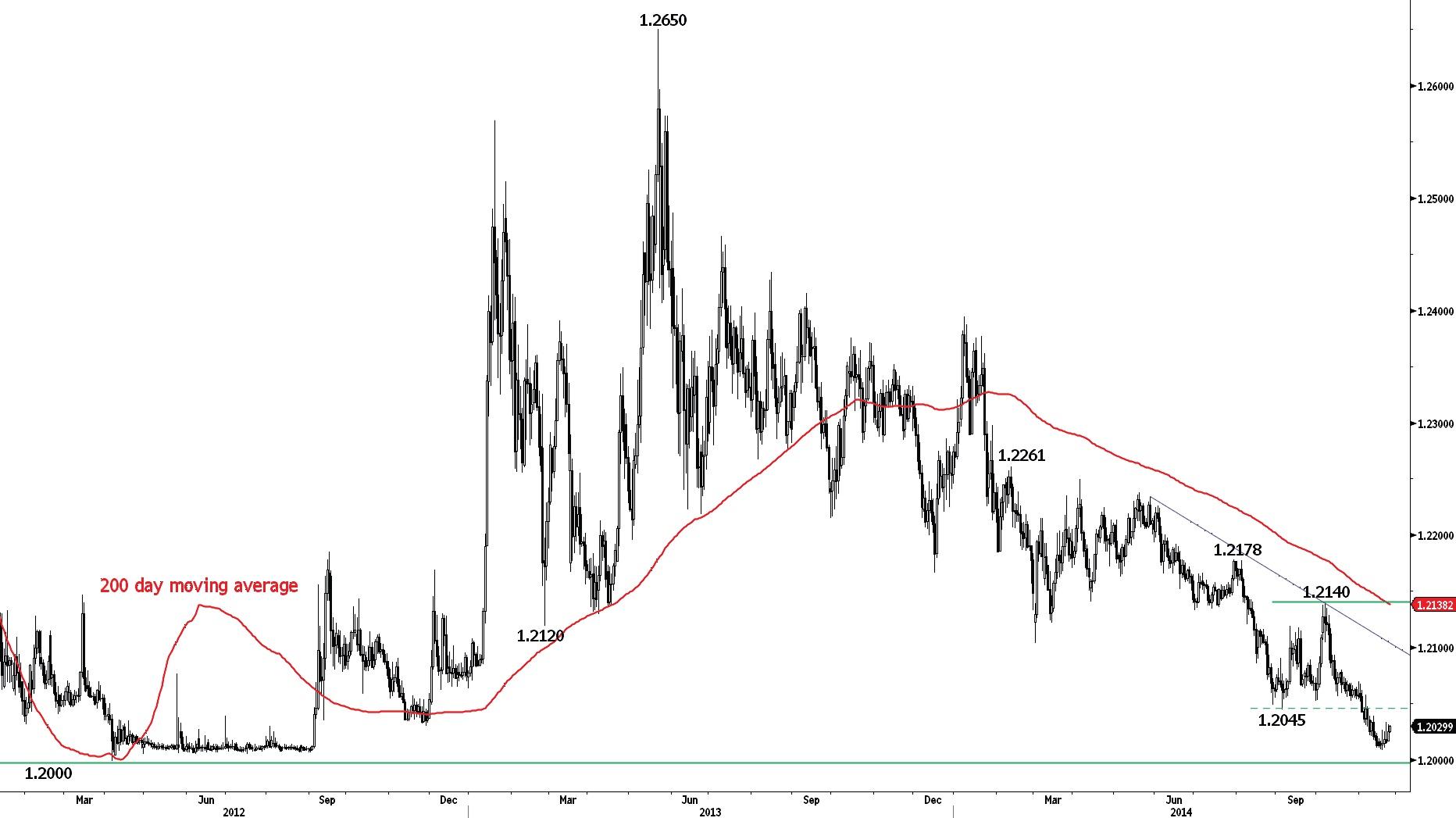

EUR/USD

The support at 1.2358 has held thus far.

EUR/USD has successfully tested the support at 1.2358. However, the subsequent bounce is thus far unimpressive. Hourly resistances can be found at 1.2460 (intraday high) and 1.2504 (20/11/2014 low).

In the longer term, EUR/USD is in a downtrend since May 2014. The break of the strong support area between 1.2755 (09/07/2013 low) and 1.2662 (13/11/2012 low) has opened the way for a decline towards the strong support at 1.2043 (24/07/2012 low). A key resistance stands at 1.2886 (15/10/2014 high).

Await fresh signal.

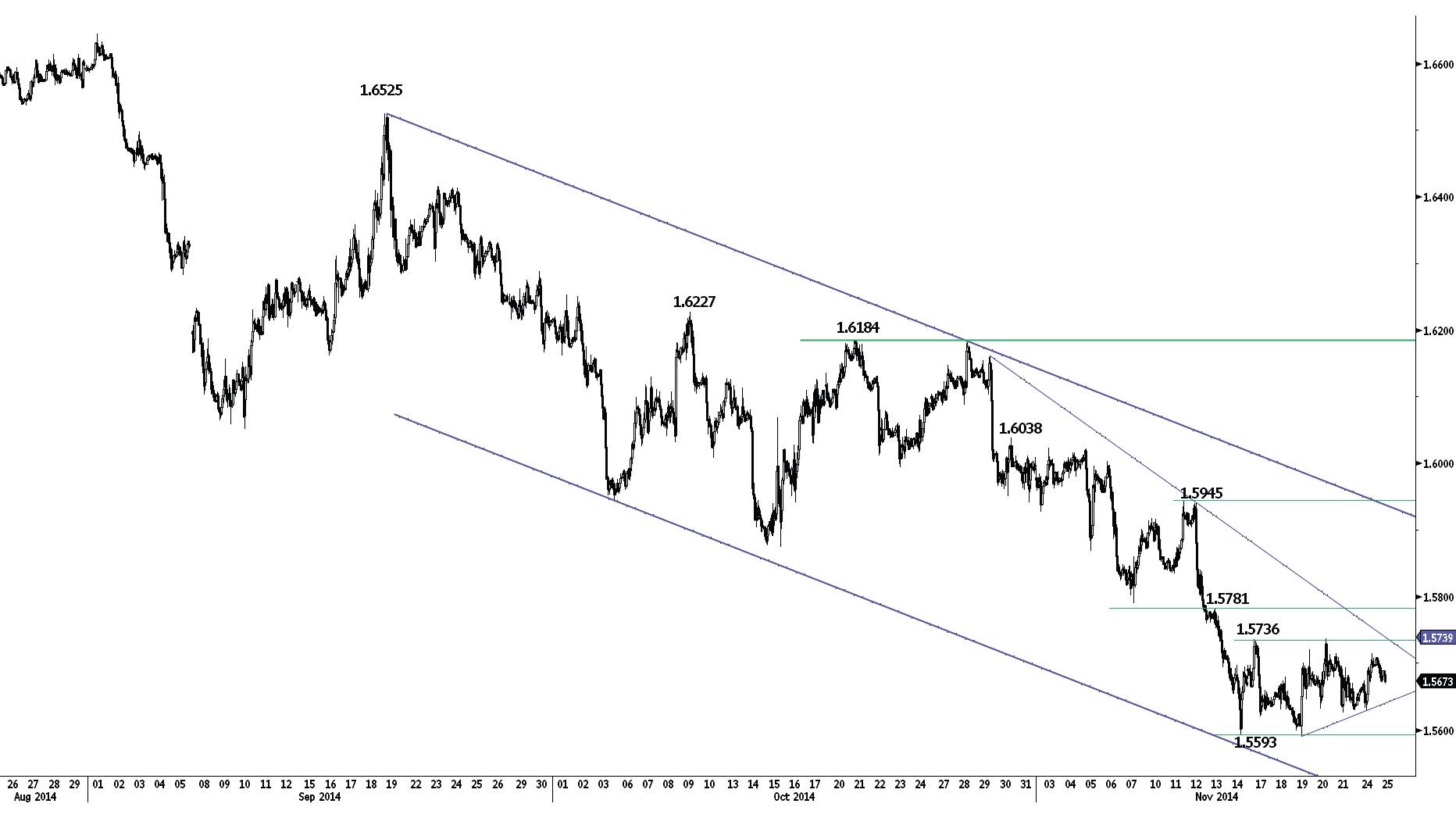

GBP/USD

Consolidating.

GBP/USD continues to consolidate within its horizontal range between the support at 1.5593 and the resistance at 1.5736 (see also the declining trendline). Another resistance can be found at 1.5781. An hourly support lies at 1.5626 (21/11/2014 low).

In the longer term, the break of the support at 1.5855 (12/11/2013 low) confirms an underlying bearish trend. A conservative downside risk is given by a test of the support at 1.5423 (14/08/2013 low). Another support can be found at 1.5102 (02/08/2013 low). A key resistance lies at 1.5945 (11/11/2014 high, see also the declining channel).

Await fresh signal.

USD/JPY

Short-term consolidation.

USD/JPY is consolidating after having posted a 7-year high at 118.98. The current mild prices decline suggests an underlying strong buying interest. Hourly supports can be found at 117.36 (21/11/2014 low, see also the rising trendline) and 116.34 (18/11/2014 low).

A long-term bullish bias is favoured as long as the key support 105.23 (15/10/2014 high) holds. The break of the major resistance at 110.66 (15/08/2008 high) opens the way for a further rise towards 120.00 (psychological threshold, see also the 61.8% retracement of the 1998-2011 decline). A major resistance stands at 124.14 (22/06/2007 high).

Await fresh signal.

USD/CHF

Fading near the resistance at 0.9742.

USD/CHF has thus far failed to break the resistance at 0.9742. Hourly supports can be found at 0.9655 (17/11/2014 high, see also the 38.2% retracement) and 0.9606 (20/11/2014 high, see also the 61.8% retracement).

From a longer term perspective, the technical structure favours a full retracement of the large corrective phase that started in July 2012. The recent new highs above the key resistance at 0.9691 confirm this outlook. A strong support stands at 0.9368 (15/10/2014 low). A key resistance can be found at 0.9839 (22/05/2013 high).

Long 1 unit at 0.9559, Obj: Close remaining at 0.9829, Stop: 0.9598 (Entered: 2014-11-20).

USD/CAD

Approaching the high of its declining channel.

USD/CAD is improving after the break of the key support at 1.1259. Monitor the resistance at 1.1326 (21/11/2014 high. see also the declining channel). Hourly supports stand at 1.1252 (intraday high) and 1.1192. Another hourly resistance can be found at 1.1369.

In the longer term, the technical structure looks like a rounding bottom whose minimum upside potential is at 1.1725. However, as highlighted by the recent prices behaviour, this expected rise is likely to be very gradual. A strong support stands at 1.1072 (02/10/2014 low).

Await fresh signal.

AUD/USD

Heading lower.

AUD/USD remains weak, confirming an underlying bearish trend. Monitor the supports at 0.8567 and 0.8541. Hourly resistances stand at 0.8620 (intraday high) and 0.8661 (intraday low).

In the long-term, the break of the strong support at 0.8660 (24/01/2014 low) confirms the underlying long-term bearish trend and opens the way for further weakness. Supports can be found at 0.8316 (01/07/2010 low) and 0.8067 (25/05/2010 low). A key resistance stands at 0.8911 (29/10/2014 high).

Await fresh signal.

GBP/JPY

Failing to make new highs.

GBP/JPY has failed to break the resistance at 186.13, despite the bullish setup implied by previous break to the upside out of the consolidation between 181.13 and 184.33. The support implied by the rising trendline (around 184.54) is challenged. Hourly horizontal supports can be found at 183.98 (21/11/2014 low) and 183.39 (17/11/2014 high).

In the long-term, the trend is positive as long as the strong support area between 169.51 (11/04/2014 low) and 167.78 (18/03/2014 low) holds. The break of the strong resistance at 180.72 (19/09/2014 high) opens the way for further strength. A key resistance stands at 197.45 (24/09/2008 high). A key support lies at 180.72 (previous resistance).

Await fresh signal.

EUR/JPY

Previous resistance at 145.69 is acting as support.

EUR/JPY has bounced near the previous support at 145.69. A break of the hourly resistance at 147.39 (intraday high) is needed to improve the short-term technical structure. Another resistance stands at 149.14 (20/11/2014 high), whereas another support lies a 144.79.

The long-term technical structure remains positive as long as the strong support at 134.11 (20/11/2013 low) holds. The break of the major resistance at 145.69 opens the way for a further rise towards the psychological resistance at 150.00. Another resistance stands at 157.00 (08/09/2008 high). A key support stands at 144.79.

Await fresh signal.

EUR/GBP

The key resistance area has successfully been tested.

EUR/GBP has failed to break the key resistance area between 0.8047 (15/10/2014 high, see also the declining channel) and 0.8066 (see also the 200-day moving average). Supports can be found at 0.7865 (intraday low) and 0.7800 (03/11/2014 low). An hourly resistance lies at 0.7955 (17/11/2014 low).

In the longer term, the major support area between 0.7755 (23/07/2012 low) and 0.7694 (20/10/2008 low) has held thus far. However, a decisive break of the resistance at 0.8034 (25/06/2014 high, see also the declining channel and the 200-day moving average) is needed to confirm an improving technical structure.

Await fresh signal.

EUR/CHF

Grinding higher.

EUR/CHF is showing signs of buying pressures near the SNB's threshold at 1.20. An hourly resistance can be found at 1.2039 (12/11/2014 high). Another resistance lies at 1.2069 (31/10/2014 high).

In September 2011, the SNB put a floor at 1.2000 in EUR/CHF, which will be enforced with the "utmost determination". For the time being, a break of this threshold is very unlikely.

Await fresh signal.

GOLD (in USD)

Consolidating near the resistance at 1208.

Gold is consolidating near the resistance at 1208 (61.8% retracement). Hourly supports can be found at 1187 (21/11/2014 low) and 1175. Another resistance stands at 1236.

In the long-term, the move below the strong support at 1181 (28/06/2013 low) confirms the underlying downtrend and opens the way for further declines towards the strong support at 1027 (28/10/2009 low). A strong resistance can be found at 1255 (21/10/2014 high).

Await fresh signal.

SILVER (in USD)

Challenging the resistance at 16.68.

Silver is grinding higher towards the resistance at 16.68. An hourly support lies at 16.13 (21/11/2014 low), while a more significant support stands at 15.91 (previous resistance). Another resistance can be found at 17.04 (see also the declining trendline).

In the long-term, the break of the major support area between 18.64 (30/05/2014 low) and 18.22 (28/06/2013 low) confirms an underlying downtrend. Although the strong support at 14.64 (05/02/2010 low) has held thus far, the lack of any base formation continues to favour a bearish bias. A resistance lies at 17.80 (15/10/2014 high). Another key support can be found at 11.77 (20/04/2009 low).

Await fresh signal.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.