USD/CAD Weekly Forecast: When technical and fundamental analysis agree

- USD/CAD settles at three year low and support on Friday

- Weak Canadian Retail Sales mattered less than a 14-month high in WTI

- Commodity prices and vanishing technical support undermines USD/CAD

- FXStreet Forecast Poll expects resistance to hold at 1.2550.

Poor December Retail Sales did no harm to the Canadian dollar while the retention of West Texas Intermediate above the $58.70 support and the failure of USD/CAD to finish beyond 1.2700 resistance any day this week, pointed the pair to its lowest close in almost three years on Friday.

Except for 1.2620 where the USD/CAD finished the week, and two brief lows below 1.2600, one in January and one this month, there is no more recent support level than April 2018.

The technical pressure on the USD/CAD after the failed breakout attempt in the first week of February, the lack of support references and the continuing achievements of WTI and commodities have overwhelmed any positive impact from the rise in US Treasury rates.

Markets are also ignoring the lockdowns in Ontario and Quebec, the low vaccination numbers compared to those of the US and the UK, and the 2.8% drop in WTI from Wednesday.

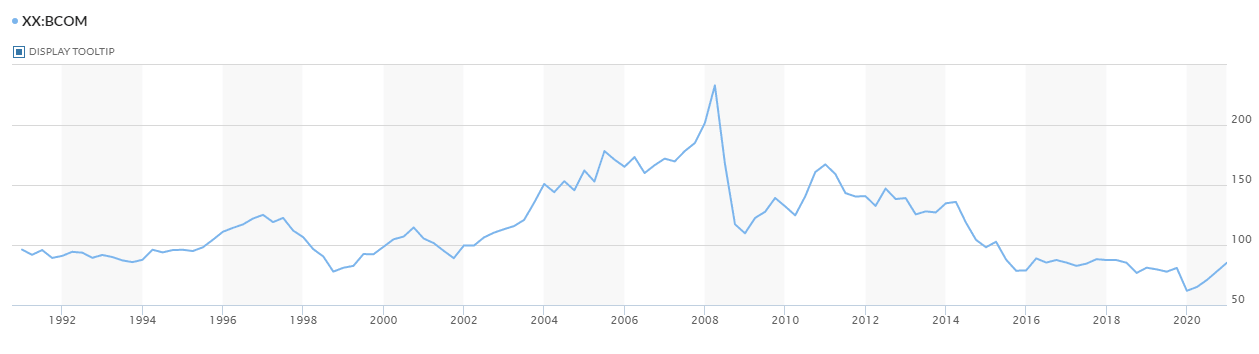

The steady rise of commodity prices to levels not seen since the fall of 2018 has provided hefty support and continuing sustenance to the resource heavy Canadian GDP and the loonie. With the global economy expected to accelerate in the second and third quarters there may be more room for commodity prices to rise despite the 43% gain in the Bloomberg Commodity Index (BCOM) since the pandemic bottom in April.

Bloomberg Commodity Index (BCOM)

Canadian statistics were mixed with December Retail Sales and January ADP payrolls ignored as old information and Housing Starts and stronger inflation mooted by the already improved Canadian dollar.

American economic statistics were mostly positive, particularly January Retail Sales which suggests heavy consumer spending when the new stimulus package is finally passed. Inflation received a boost in January with the annual Producer Price Index (PPI) quadrupling to 1.3% from 0.3%, bringing it to the highest rate since August 2009. Industrial Production rose 0.9% in January and has averaged 1.05% for the last four months.

Initial Jobless Claims rose unexpectedly in the latest week, underlining the rising number of business failures after almost a year of economic and business restrictions. Strong Existing Home Sales in January and Building Permits at the highest level since the housing bubble more than a decade ago, promise construction jobs once the winter weather that covers three-quarters of the country relents.

USD/CAD outlook

The USD/CAD is primed for a move lower as the Canadian dollar anticipates the global recovery.

Even a healthy resumption of US growth, by no means assured, would have limited positive impact on the USD/CAD. As the largest trading partner of the US and a resource supplier to the world's largest economy, Canada and its currency actively participate in American success.

There is weak support at 1.2590, the January low, but nothing of consequence beneath. The combination of technical weakness for the USD/CAD and fundamental strength for the Canadian dollar likely spells further for the US dollar losses against its northern cousin.

Canada statistics February 15-February 19

The housing market retained its strong aspect in January with Starts rising 282,400 (annualized) higher even than the September 2007 bubble peak of 278,200. January core and headline inflation were stronger than projected which will provide some optimism for January Retail Sales when they are released in March. December Retail Sales fell as expected as the provincial lockdowns exacted their toll on consumption.

Monday

Manufacturing Sales rose 0.9% in December on a 0.6% forecast and November's revised 0.4% decline, initially -0.6%. Housing Starts in January were 282,400 (YoY), after December's 229,300.

Wednesday

The Consumer Price Index for January rose 0.6% (MoM) and 1% (YoY) with 0.4% and 0.9% expected and -0.2% and 0.7% in December. The Bank of Canada Core CPI was 0.5% (MoM) and 1.6% (YoY), with 0.0% and 1.4% forecast and -0.4% (MoM) and 1.5% (YoY) in December.

Thursday

ADP Employment Change dropped 231,200 positions in January on a -14,100 prediction. After the loss of 212,800 in the national rolls that was foregone.

Friday

Retail Sales in December fell 3.4% and the November result was revised to 1.8% from 1.3%; -2.5% had been forecast. Sales ex-Autos dropped 4.1%, more than double the 2% forecast, and November was revised to 2.9% from 2.1%.

US statistics February 15-February 19

Retail Sales proved US consumers can be counted on to perform their usual prodigies of spending as long as there is cash available. The rise in Initial Jobless Claims indicates that the aftermath of the lockdowns will be longer and more painful than anticipated. Producer Prices hinted that inflation might not be as quiescent as thought. The Atlanta Fed GDPNow estimate for the first quarter was unchanged at 9.5% on Thursday.

Wednesday

Retail Sales soared 5.3% in January as consumers took all of their pandemic relief payments to market, far surpassing the 1.1% forecast. The result was more than sufficient to bring the three month holiday season total into the black at a very respectable 2.9% (November -1.4%, December -1%). Sales ex-Autos soared 5.9% on a 1% estimate and the revised 1.8% loss in December. The Retail Sales Control Group led all categories at 6% in January, bringing the total for the season to 2.5% (November -1.1%, December -2.4%). Industrial Production climbed 0.9% in January, almost twice the 0.5% estimate though December was revised to 1.3% from 1.6%. Capacity Utilization rose to 75.6% in January, the best of the pandemic, from 74.9%. The Producer Price Index rose 1.3% on the month and 1.7% on the year in January far outstripping the 0.4% and 0.9% forecasts. Core PPI rose 1.2% on the month and 2% on the year, a sharp acceleration from December's 0.1% and 1.2%. The minutes of the January FOMC meeting stressed the hesitant nature of the recovery and the long-term need for economic support.

Thursday

Housing Starts slid 6% in January to 1.58 million (annualized) from 1.68 million in December as much of the country lingered under snow cover. Building Permits jumped 10.4% to 1.881 million, the highest since the housing bubble, indicating a construction boom as soon as the weather permits. The Philadelphia Fed Manufacturing Survey dropped to 23.1 in February, better than the 20 prediction but down from 26.5 in January. Initial Jobless Claims rose to 861,000 in the February 12 week from 848,000 prior, 765,000 had been forecast. Continuing Claims were 4.494 million on February 5, down from 4.558 the week before.

Friday

Markit Manufacturing PMI slipped to 58.5 in February from 59.2. Services PMI rose to 58.9 from 58.3 and the Composite PMI rose to 58.8 from 58.7. Existing Home Sales, 90% of the US market, increased 0.6% in January to 6.69 million (annualized) from 0.9% and 6.65 million in December. The forecasts had been -1.5% and 6.61 million. Except for the sales rate in October, 6.86 million, and November, 6.71 million, it was the strongest annual sales since the housing bubble of 2006-2008.

FXStreet

Canada statistics February 22-February 26

Nothing of market note this week.

Tuesday

Bank of Canada Governor Tiff Macklem's video speech to the Edmonton and Calgary Chambers of Commerce.

Friday

Raw Material Price Index for January: December 3.5%. Industrial Product Price for January (MoM): December 1.5%. Building Permits for January (MoM): December -4.1%.

FXStreet

US statistics February 22-February 26

Tuesday

Dallas Fed Manufacturing Business Index for February: January was 7. Case-Schiller Home Price Index (YoY) is forecast to gain 8.6% in December after 9.1% in November.

Wednesday

Richmond Fed Manufacturing Index for February: January 14. Conference Board Consumer Confidence for February: January 89.3

Thursday

Durable Goods Orders for January should rise 1.3% following December's revised 0.5% gain, initially 0.2%. Durable Goods Orders ex Transportation are forecast to increase 0.6% from December's adjusted 1.1% gain, originally 0.7%. Nondefense Capital Goods ex Aircraft for January: December 0.7%, revised from 0.6%. Initial Jobless Claims for February 19 week: prior 861,000. Continuing Claims for February 12 week: prior 4.494 million. Gross Domestic Product for the fourth quarter will receive its first revision, called by the Bureau of Economic Analysis 'preliminary', the first iteration is called 'advanced'. It is expected to be 4.2% after the initial 4%. New Home Sales in January are expected to rise 1.5% to 856,000 annualized from 1.6% and 842,000 in December.

Friday

Kansas Fed Manufacturing Activity Index for February: January 22. The Personal Consumption Expenditure Price Index for January: December 0.4% (MoM), 1.3% (YoY); core 0.3% (MoM), 1.5% (YoY). Personal Income in January is forecast to rise 9.4% after December's 0.6% increase. Personal Spending is expected to increase 0.5% in January after falling 0.2% prior. Wholesale Inventories for January: December 0.3%.

USD/CAD technical outlook

The technical position of the USD/CAD is weak. Resistance levels are more numerous and recent, the eleven-month descending channel is intact and formidable and support depends on ranges traded more than three years ago. All three moving averages are resistance points above with the 21-day at 1.2736 in current play and the 100-day at 1.2912 and the 200-day at 1.3170 indicative of the long-runnning negative trend. The Relative Strength Index at 39.10 is not close to being oversold despite the decline of the past three weeks. The Friday USD/CAD finish at the last major support of 1.2620 invites a test lower in Monday's Asian markets.

Resistance: 1.2700; 1.2780; 1.2830; 1.2865; 1.2920

Support: 1.2620; 1.2590; 1.2550; 1.2500

USD/CAD Forecast Poll

The FXStreet Forecast Poll predicts a technical bounce from the 1.2550 support level followed by consolidation beneath 1.2700 resistance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.