- US dollar surrenders the week’s gains after NFP.

- WTI rises 1.2% to near three-year high.

- US Treasury rates drop after Friday payrolls.

- FXStreet Forecast Poll sees long-term consolidation below 1.2400.

The USD/CAD lost most of its weekly gain on Friday after opening at 1.2294 on Monday and reaching 1.2437 on Thursday.

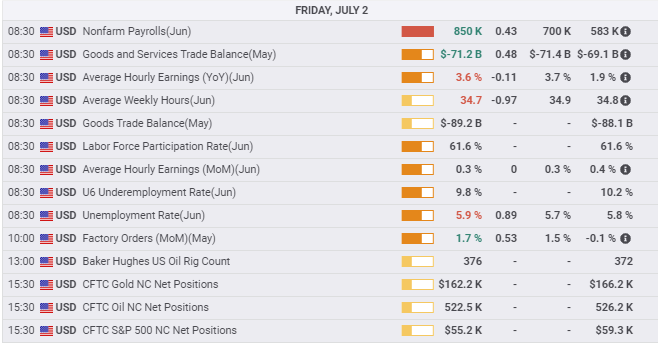

The main economic event, US Nonfarm Payrolls, managed a strong enough expansion to ease economic worries but not dramatic enough to excite rate hike fears. Treasury rates fell across the board. Without the prospect, or at least hope, of higher US returns, the dollar fell to 1.2331 against the Canadian and lost ground in all major pairs.

Crude oil prices provided additional support for the Canadian dollar. West Texas Intermediate (WTI) ended the week at $74.67, its highest close since October 3, 2018.

Nonfarm Payrolls’ 850,000 addition in June confirmed the Purchasing Managers’ Index (PMI) picture of a robust expansion oddly joined to a somewhat reluctant workforce.

The discrepancy between the record number of jobs on offer, 9.3 million in April, and the large pool of unemployed, also 9 million by some counts, is a policy conundrum for the Fed. Initial Jobless Claims fell to a pandemic low, further evidence that the US unemployment rate is not a purely economic function. In contrast, the Manufacturing Employment Index from the Institute for Supply Management (ISM) dropped into contraction, albeit barely. The ISM Prices Paid Index registered a record high in June, suggesting that inflation pressures are more than temporary and rooted in economy-wide changes.

Economic projections from the Federal Reserve meeting on June 16 continue to be the fundamental US rate background for the currency markets. June payrolls did not alter the Fed’s economic calculus.

The Fed and Chair Jerome Powell have repeatedly asserted that the surge in first quarter consumer inflation is a temporary base effect from last year’s lockdown. That is correct but incomplete. It does not account for the impact of product scarcity on prices and, more importantly, the wage inflation produced by extensive labor shortages. It is the latter and its potential to change inflation expectations that has moved the Fed to a slightly surreptitious tightening stance.

Fed rhetoric has stayed focused on the labor market, but its rate projections, with two possible hikes in 2023 and a taper this year, sing a different tune.

The Fed is attempting to use its rate projections to quell fears that it is not doing enough to contain inflation, while its rhetoric continues to deny that a bond program taper is at hand. The Fed fears a repeat of 2013’s famous taper tantrum when an unguarded comment from Chairman Ben Bernanke sent US interest rates flying higher.

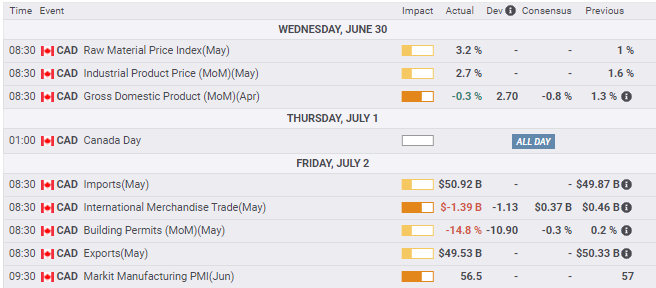

Canadian data had no impact on trading this week. April’s GDP at -0.3% was less than half the expected 0.8% drop and the International Merchandise deficit in May at -1.3% instead of -0.37 billion can probably be attributed to the partial lockdowns in some provinces.

USD/CAD outlook

The failure of the USD/CAD to sustain its mid-June channel break is threatening to reassert Canadian dollar dominance.

Several factors are at play.

First, the loonie has its own source of strength in the oil market. For more than a year, during whatever period is chosen, WTI has moved steadily higher.

In the last six weeks, WTI has gained 20% from $69.25 on May 20. In the last month it has added 7.8% from $69.25 on June 4. The past week WTI rose 1.2% to $74.67 on Friday, the highest finish since October 3, 2018. With the crude complex contributing 11% to the Canadian economy, rising energy prices are a straight addition to corporate profitability and loonie strength.

Second, the Federal Reserve has been extremely reluctant to release the credit market rate genie despite robust economic growth and sharply rising inflation. The prospect of higher US rates has been the main support for the dollar this year. It is still the long-term scenario, but the lack of a conclusive break higher in Treasury returns restricts the greenback’s ability to rise.

Clarification on the bond buying program and a tapering schedule is expected at late August's annual Fed Jackson Hole Economic Policy symposium, but two months is a long time in the currency markets.

Crude oil is near the top of its seven-year range, and it is unclear if possible OPEC production cuts or more demonstrable global economic growth will push prices higher.

For the USD/CAD, the prospect of higher US rates sometime in the fourth quarter or next year is a poor substitute for rising yields today. When stable or lower US returns are combined with strengthening crude prices, it is difficult for the US dollar to compete with the Canadian.

The USD/CAD arrested at 1.2320 on Friday, just above support at 1.2315. There is another line immediately beneath at 1.2280 and then nothing until 1.2180.

Repositioning the descending channel to account for the late April rise puts the upper border at the 1.2180 support.

A re-entry to the pandemic channel will not be a major technical development, it may, however, have an important psychological impact as a failure of the most determined rally attempt in more than a year.

Canada statistics June 28–July 2

US statistics June 28–July 2

FXStreet

Canada statistics July 5–July 9

Canada's June Net Change in Employment is the main event. Even if payrolls fall 20,000 as expected, for the third loss in a row, its negative impact on the Canadian dollar will be negligible.

FXStreet

US statistics July 5–July 9

Services PMI should confirm the overall manufacturing outlook with particular interest in the employment and prices indexes. The JOLTS report for May is expected to drop the million gained in April. This is not normally a market moving statistic, largely because it is relatively old data, but it will certainly be noted.

USD/CAD technical outlook

With fundamentals beginning to again tilt against the USD/CAD, technical support will be the main bulwark this week, but it should be sufficient to prevent a serious fall in the USD/CAD. Consolidation between1.2200 and 1.2350 is the likely option.

Momentum indicators have an interesting split opinion. The MACD remains a weaker but still an evident buy, while the True Range is strongly positive and the Relative Strength Index (RSI) peaked on Thursday and turned lower with Nonfarm Payrolls. The 21-day moving average (MA) at 1.2265 is a backer of support at 1.2280. The 100-day MA had a dual role this week, resistance on Tuesday and Wednesday, support on Thursday and broken support on Friday. At 1.2388 it is now part of resistance at 1.2400.

Resistance: 1.2360, 1.2400, 1.2465, 1.2510

Support: 1.2315, 1.2280, 1.2180, 1.2150, 1.2100

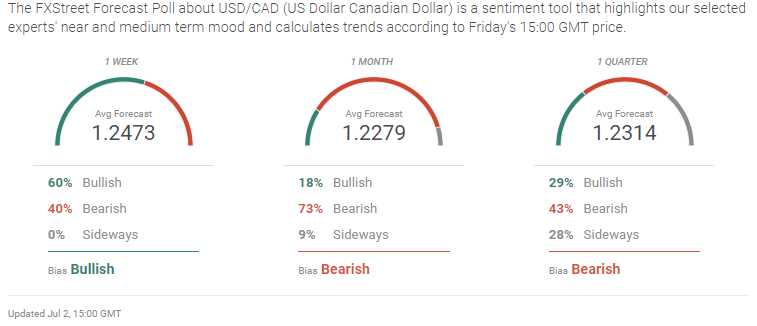

FXStreet Forecast Poll

The one-week range is too optimistic given the result on Friday. The one-month and one-quarter predictions are realistic given the weakening fundamental props for the USD/CAD.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.

-637610111331046808.png)

-637610114420808946.png)