USD/CAD resistance in view

Headline and core inflation jumps

Underpinned on higher gasoline prices, headline inflation jumped to 4.0% in the twelve months to August, up from 3.3% in July and a touch north of economists estimates at 3.8%. From July to August, inflation climbed 0.4%, versus 0.3% expected but lower than July’s 0.6% print. Core inflation rose 3.3% in the twelve months to August, up from 3.2% in July, but lower than the 3.5% expected, while on a month-on-month basis, core inflation eased to 0.1%, down from 0.5%.

Rates markets are still leaning towards a no-change at the next meeting for the Bank of Canada (BoC), though the odds for a rate hike certainly increased and now stand at around a 43% chance of a 25bp push. Nevertheless, with the unemployment rate increasing since May and economic growth showing signs of slowing, a rate hike is still unlikely.

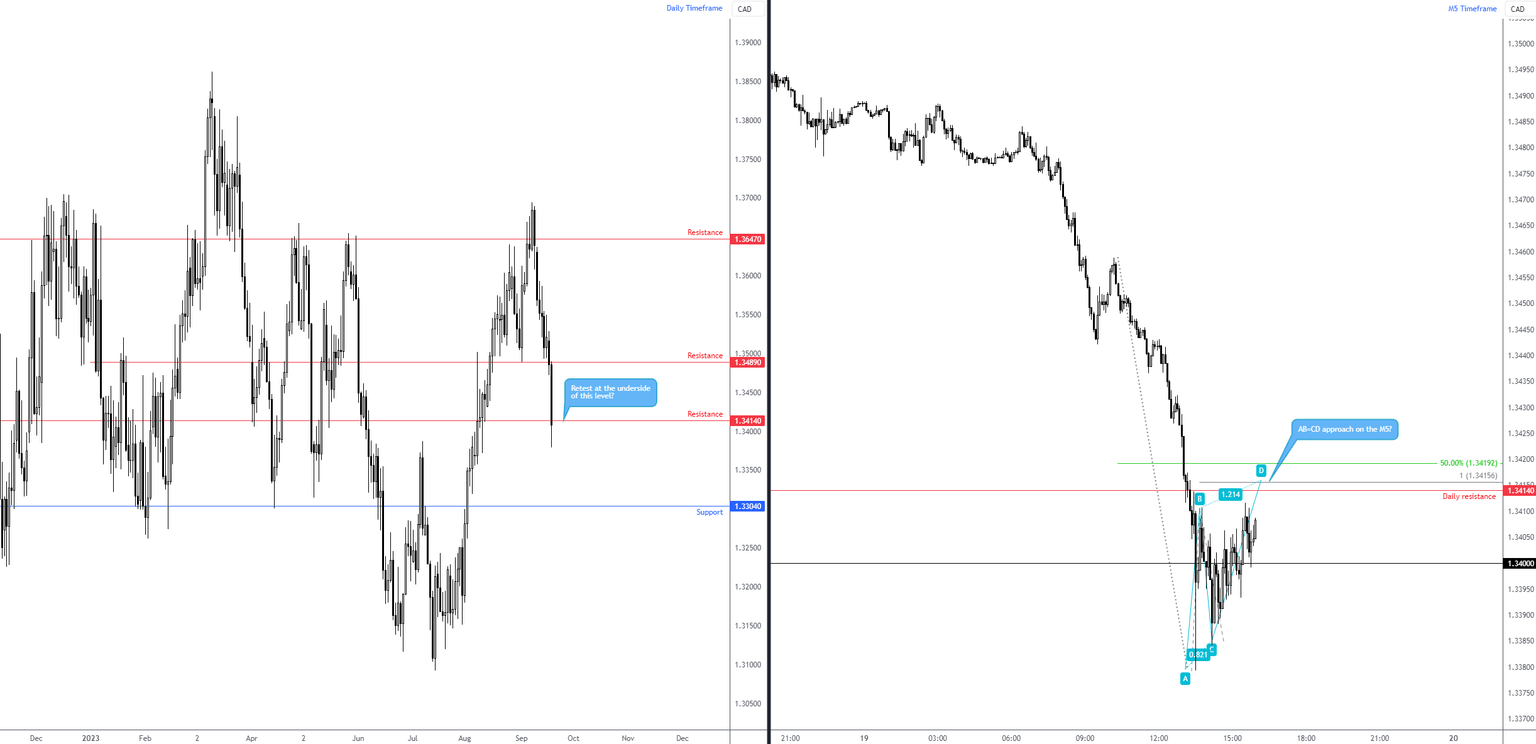

Daily resistance at CAD1.3414, anyone?

Following today’s inflation numbers out of Canada, the USD/CAD currency pair spiked to a session low of CAD1.3379 and technically opened the door to daily resistance at CAD1.3414. What’s technically interesting is that beneath the aforementioned resistance, the unit has room to aim as far south as daily support at CAD1.3304.

With this in mind, on the M5 timeframe, short-term analysis shines a light on a possible AB=CD resistance approach to the underside of the current daily resistance at CAD1.3416 (depicted by way of a 100% projection ratio). Complementing the aforesaid AB=CD pattern is a 50.0% retracement ratio at CAD1.3419. Another key technical observation is the currency pair is testing space just above the big figure CAD1.34, thus echoing a stop-run vibe, which could see sellers make a show from the daily resistance to take advantage of any buy stops above CAD1.34.

Author

Aaron Hill

FP Markets

After completing his Bachelor’s degree in English and Creative Writing in the UK, and subsequently spending a handful of years teaching English as a foreign language teacher around Asia, Aaron was introduced to financial trading,