Main stock indices fall despite positive earnings

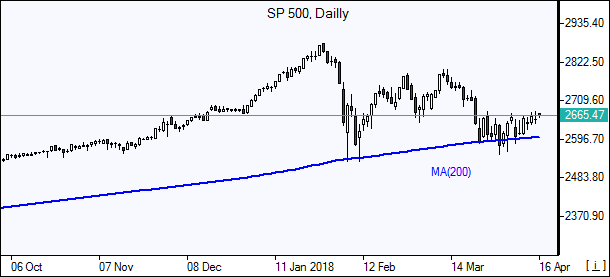

US stocks closed lower Friday despite better than expected first-quarter earnings. S&P 500 lost 0.3% to 2656.30 led by financial stocks. SP 500 gained 2% for the week. Dow Jones industrial average fell 0.5% to 24360.14. The Nasdaqcomposite dropped 0.5% to 7106.65. The dollar turned lower Friday: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched down less than 0.1% to 89.732. Stock indices futures indicate higher openings today.

European stocks log third straight weekly gain

European stocks extended gains on Friday. The Stoxx Europe 600 Index gained 0.1%, rising 1.2% for the week. Theeuro joined British Pound’s climb against the dollar. The DAX 30 rose 0.2% to 12442.40. France’s CAC 40 added 0.1% and UK’s FTSE 100 gained 0.1% to 7264.56. Indices opened flat to 0.3% higher today.

Asian indices mixed

Asian stock indices are mixed today with traders uncertain how events will develop in Middle East after Friday airstrikes against Syria by the US and allies. Nikkei rose 0.3% to 21836 despite yen reversal higher against the dollar. Chinese stocks are a lower: the Shanghai Composite Index is down 1.5% and Hong Kong’s Hang Seng Index is 2% lower. Australia’s All Ordinaries Index is up 0.2% as Australian dollar extends gains against the greenback.

Brent slides

Brent futures prices are retreating today following US and allies strikes on Syria and data showing rising US oil rig count last week. Prices rose Friday on geopolitical tensions as traders wondered when the US would launch Syria airstrikes ater President Trump’s warning. Brent for June settlement rose 0.8% to close at $72.58 a barrel Friday.

Want to get more free analytics? Open Demo Account now to get daily news and analytical materials.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.