Yesterday’s ADP has shown us US employment growth of 237K vs 219K expected which led to another drop in EURUSD currency. Due to US Independence Day. NFP is scheduled for today at 12.30 PM (14.30). Good ADP numbers and Greece uncertainty led to USD strenght against its major counterpart EUR.

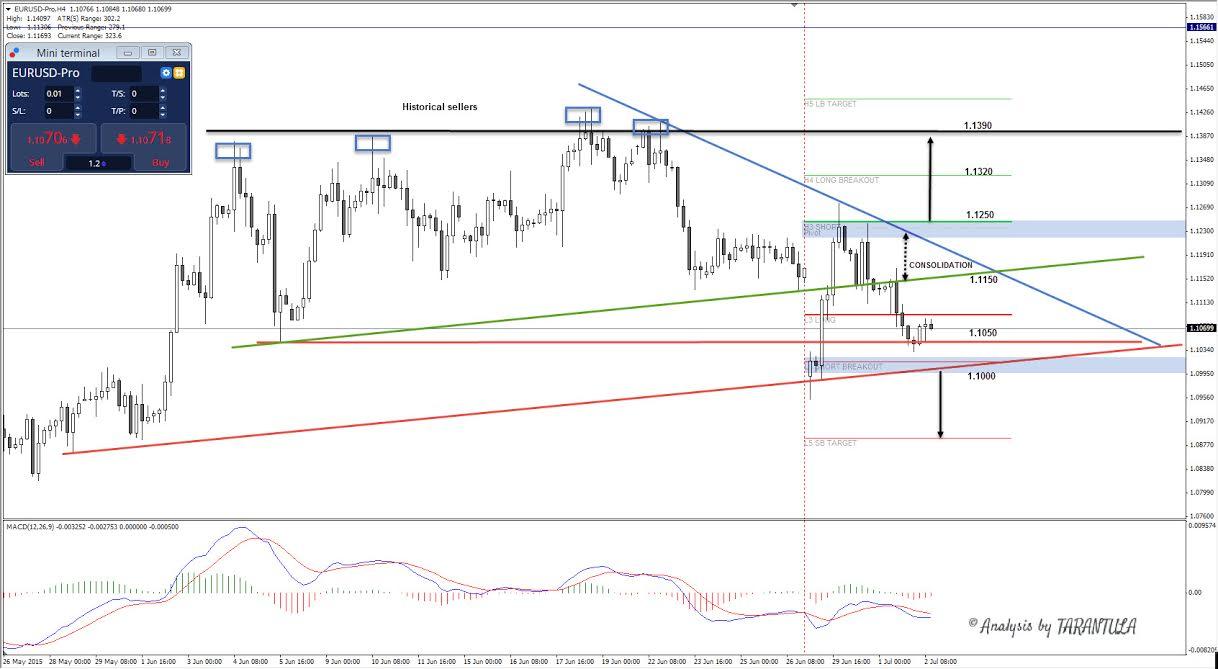

Technically we can see that EURUSD is consolidating above 1.1050 which serves as interim support. If there is any surprise with NFP results and Unemployment claims EURUSD could jump to 1.1150 and that will put the pair into NEUTRAL territory range 1.1150-1.1230. Only above 1.1250 we can have a trend again and EURUSD above 1.1250 should target 1.1320 and 1.1390 where we can see a CLUSTER of historical sellers.

On the contrary on good NFP results EURUSD might be pulled below 1.1050 targeting 1.1000. Below 1.1000 we can have a trend again targeting 1.0950 and 1.0880.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD looks depressed ahead of FOMC

EUR/USD followed the sour mood prevailing in the broader risk complex and plummeted to multi-session lows in the vicinity of 1.0670 in response to the data-driven rebound in the US Dollar prior to the Fed’s interest rate decision.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

Bitcoin price tests $60K range as Coinbase advances toward instant, low-cost BTC transfers

BTC bulls need to hold here on the daily time frame, lest we see $52K range tested. Bitcoin (BTC) price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.