US Michigan Consumer Sentiment October Preview: It's really an employment survey

- Consumer Sentiment expected to be little changed in October.

- Payrolls slowed substantially in September though unemployment fell.

- Retail sales moderated in August with more of the same forecast for September.

- Sentiment is background economic data and not actively traded.

American consumers are a long way from recovering their optimism of the beginning of the year and the lull of the last two months will continue until the election sorts out economic policy for next year.

The Michigan Consumer Sentiment Index is forecast to edge up to 80.5 in October from 80.4 in September. Optimism had plunged from 101 in February to 71.8 in April as the pandemic lockdowns devastated the economy and threw 22 million people out of work. Prior to last month the post-closure high had been 78.1 in June.

Payrolls and Initial Jobless Claims

Jobs and the labor market are the most important factors for consumer attitudes. In 2019 when unemployment and initial jobless claims were at two-decade lows, consumer optimism consistently registered it best levels in twenty years.

The rapid gain in rehires of May and June helped consumer sentiment recover from the April low. As payroll additions have subsided with just 661,000 to Nonfarm Payrolls in September, sentiment is expected to stall in October. Total labor rehires are at 51.4% 11.4 million of the 22.16 million who were laid off in March and April.

At the same time that job creation has diminished initial jobless claims have continued at more than 800,00 a month. Filings jumped to 898,000 in the latest week. They had been forecast to drop to 825,000 from 845,000. This is not the first or even the largest reversal in the last five months. A surprise increase of 133,000 to 1.104 million in the second week of August prompted much speculation that the US recovery was stalling, until claims fell, again unexpectedly, 127,000 to 884,000 two weeks later.

The labor market recovery is ebbing and with it consumer sentiment.

Retail Sales

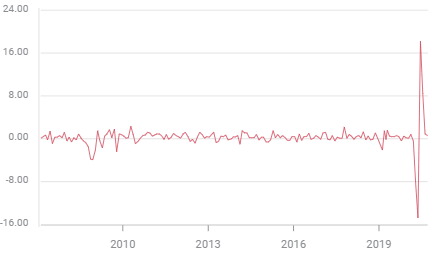

Given that at least 11 million people remain out of work and many others are working part-time by necessity, it is a testimony to the resilience of the US consumer that retail sales have recovered as quickly as they have. Retail Sales plunged 22.9% in March and April and rebounded 27.5% in May, July and July.

The bulk of that return was probably due to the near total deferral of all but essential items in March and April. August's 0.6% increase and September's forecast of 0.7% are a return to a normal consumption patterns.

Retail Sales

Conclusion and the dollar

Currency markets will continue to trade the vagaries of the stimulus negotiations, at least for the next three weeks.

With only half the people laid-off during the shutdowns returned to work and a 12.8% underemployment rate consumer sentiment has plateaued. As jobless benefits begin to expire for many of those workers and with Congress, in the throes of a nasty election campaign, unable to agree on a new stimulus and spending package, the risk to consumer outlook is negative. American are a practical people, life depends on a job.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.