US Michigan Consumer Sentiment June Preview: Inflation becomes a problem

- Job openings are plentiful, though hiring is lagging.

- JOLTS in April shows most offered positions on record.

- Rising inflation may be undermining consumer optimism.

The pandemic is over, jobs are plentiful, summer has arrived, yet Americans are afflicted with a case of the blues. Consumer attitudes are mired half-way between the pre-pandemic effervescence and the lockdown despair two-months later.

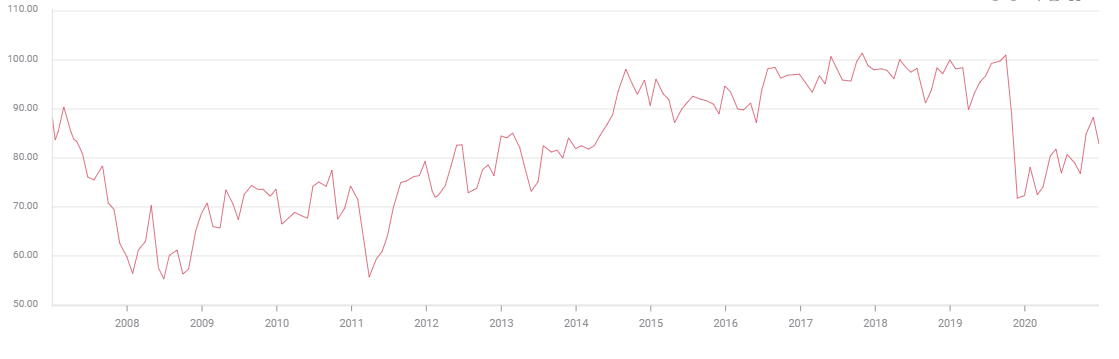

The Michigan Consumer Sentiment Index is expected to climb to 84 in May from 82.9 in April. If accurate, that would put it just shy of the midpoint of the last 16 months but below every reading of the five years prior to the March Covid-19 advent.

Michigan Consumer Sentiment

FXStreet

Payrolls and JOLTS

Employment is the most important ingredient in consumer satisfaction. A job or the prospect of one if wanted does not guarantee happiness, but the lack of one almost certainly prevents it.

Nonfarm Payroll hiring has dropped from 770,000 in March to 278,000 in April and 559,000 last month. The slowdown is not from a scarcity of work.

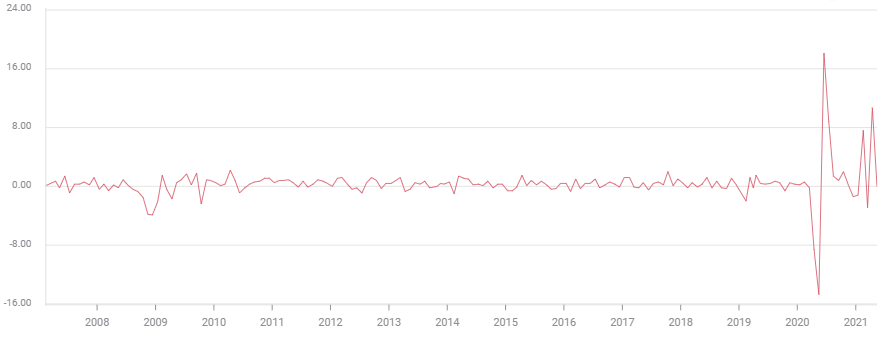

Open positions are at an all-time record. In April the Job Openings and Turnover Survey (JOLTS) recorded 9.3 million, up almost one million from March.

JOLTS

FXStreet

Anecdotal evidence from the Institute for Supply Management Purchasing Managers’ Surveys and the Federal Reserve Beige Book mentions the difficulties that businesses are having in finding employees.

One conjecture is that the $300 in additional Federal unemployment benefits and extension of payments from June to September has made it logical (and fun) for lower wage workers to put off returning until their benefits run out.

Retail Sales

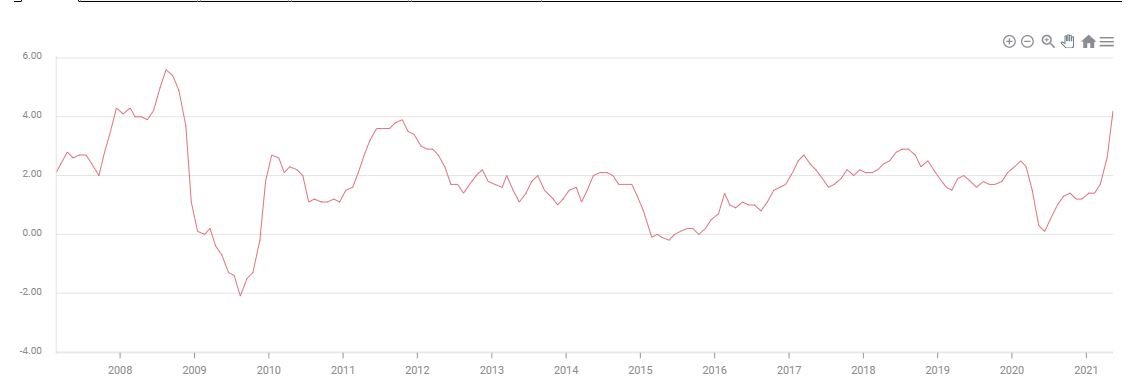

The lockdowns and government stimulus programs have played havoc with Retail Sales numbers.

Retail sales have increased 3.85% a month this year. While that is an exceptionally strong start, it is distorted by the federal pandemic grants in January and March that produced successive 7.6% and 10.7% gains. In February and March, months without government funding, sales registered -2.9% and flat.

Sales plunged 23.3% in March and April 2020, only to fly back 26.9% in May and June. The growth of 3.6% over the four months is a very respectable, indeed better than average, expansion of 0.9% each month.

Retail Sales

FXStreet

It is doubtful whether the monthly averages from March through June in 2020 or this year provide anything more than a chart of the practical, emotional and financial responses to the pandemic and lockdowns. Do the near record bursts of spending in January and March, which seem far greater than the relatively small stipend given most families, mean the consumer is ready to splurge after a 16 months of denial? If so, why was April flat?

Normally, Retail Sales are a reliable barometer of consumer attitudes. But for the past year it has been nearly impossible to disentangle pandemic reaction from the longer trend in consumer spending.

Consumer Price Index

Inflation has more than tripled in five months from 1.4% annually in January to 5% in May, its highest since August 2008.

CPI

US CPI May Preview: Inflation angst is coming

The Federal Reserve is correct to lay most of the blame for this spike on the reversal of the lockdown collapse in prices last year. The April to May increase of 0.6% is just over one-third of the 1.6% jump from March to April.

However, behind the dramatic base effect there are signs that higher consumer inflation is here to stay.

The most obvious example is gasoline prices. The nationwide average for a gallon of regular gasoline was $2.94 on June 6, 36.1% higher than its price on December 28 last year. Gasoline is a relatively fixed item for most American families, use does not vary very much with price. When fuel costs rise the extra comes directly from the household budget.

Crude oil is the world's most basic industrial commodity, its expense is part of almost every item manufactured or harvested anywhere in the world. The price of a barrel of West Texas Intermediate (WTI) has soared 44.3% since January 4 of this year and 93.9% since November 2 last year. With the global economy set for recovery and the change of administration in Washington, consumers can have little expectation that prices will reverse. Much higher gasoline and fuel costs are here to stay.

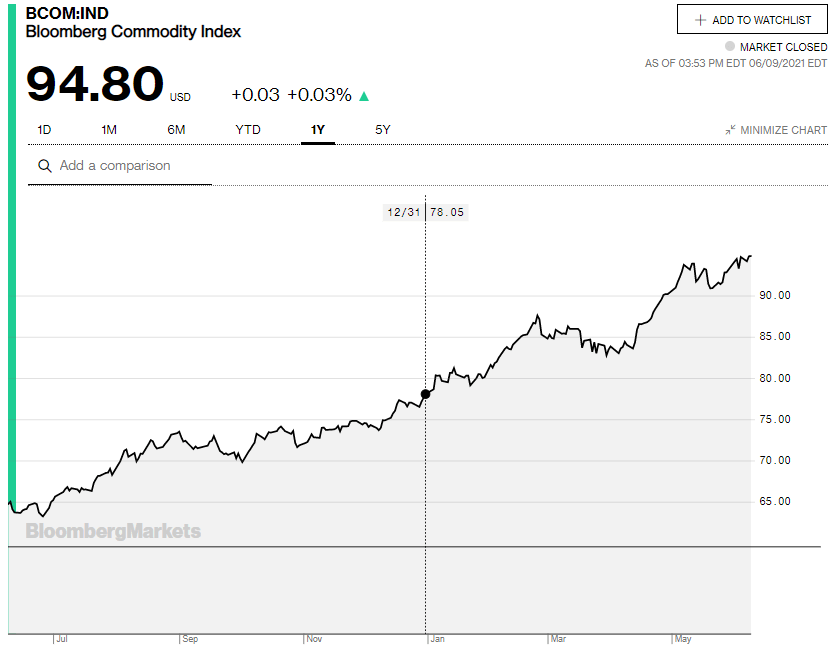

Commodities are another ingredient contributing to inflation. The Bloomberg Commodity Index (BCOM) is up 21.5% since the close on December 31 last year. It is 57.4% higher than the pandemic bottom on April 24, 2020.

Bloomberg Commodity Index

Production backlogs from the lockdowns combined with staffing issues have generated component and raw material shortages that have curtailed manufacturing for many consumer products and induced price increases..

Conclusion

Prices have already increased for a wide array of consumer goods and foodstuffs.

Not only are these higher costs likely to be permanent but there is every indication that they will continue to rise for many months.

The Fed is correct that the sharp gains in the Consumer Price Index through the first half of this year are due to the transfer of the lockdown collapse to the current index.

That does not change the fact that economic conditions are set for a steady increase in consumer prices as the impact of the lockdowns reverberate through the global economy.

The pandemic is rapidly ending in the United States. Just as consumers emerge from the financial and emotional trauma of the last 16 months, they are greeted by the highest and most pervasive inflation in a generation.

It is enough to sap anyone’s optimism.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Joseph Trevisani

FXStreet

Joseph Trevisani began his thirty-year career in the financial markets at Credit Suisse in New York and Singapore where he worked for 12 years as an interbank currency trader and trading desk manager.