The US Dollar reversed sharply yesterday as US rates shot higher. Recent US data has persistently come in above expectations. Consumer confidence and business sentiment have improved markedly. The Virus has relented. However, the Fed has been downplaying the recovery citing downside risks and has not been acknowledging the improvement in economic conditions. Persistently solid US data is now causing markets to believe that the recovery is now too strong for the Fed to not acknowledge it.

The strongest evidence of this is the yield on the 2y US treasuries which spiked 6 bps in a couple of sessions. Thus far, though the longer end had been rising, the shorter end had remained well anchored due to ultra dovish Fed communication. US 2y yield had barely budged and had been confined in a 0.10-0.12% range. Rising short-term US yields are a definite sign of caution for short Dollar positions.

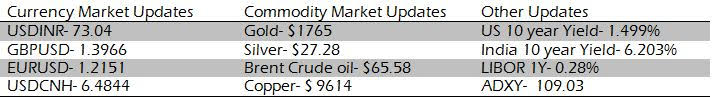

Yesterday US jobless claims were lower than expected and January Durable goods data beat estimates. The US yields which were already climbing higher, shot up after 7y auction received a tepid response. This triggered a massive unwinding of Dollar shorts. US 5y yield has risen to the highest since March 2020. US 10y yield had crossed the 1.50% mark at one point. The 10y break-evens on the other hand are at 2.16% only. This implies a 10y US real rate of -0.65% which was about -1% not too long ago. Higher US real rates make it more expensive to hold riskier assets.

The rupee was the worst-performing currency in trade yesterday on account of the LEF relaxation granted by RBI. 1y forwards fell by 20p (The 1y forward yield fell 25bps to 5.05%). Cash-tom points also normalized to 0.85p from 1.20p the previous day. Ld-Fd points cooled off to 16p from 22p.

Post the onshore close, the Dollar reversed across the board. USD/INR too saw massive short covering in NDF, spiking to above 73.

Domestic Q3 FY21 GDP print is due today post-market hours, alongside Jan core sector data.

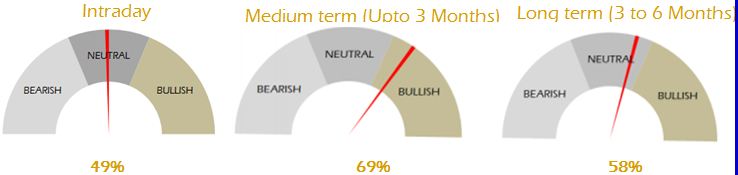

Strategy: Exporters are advised to cover a part of their exposure on upticks to 73.40-73.50. Importers are advised to cover through options. The 3M range for USDINR is 72.50 – 74.40 and the 6M range is 73.00 – 76.00.

This report has been prepared by IFA Global. IFA Global shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. IFA Global nor any of directors, employees, agents or representatives shall be held liable for any damages whether direct, indirect, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. No liability whatsoever is accepted for any loss arising (whether direct or consequential) from any use of the information contained in this report. This statement, prepared specifically at the addressee(s) request is for information contained in this statement. All market prices, service taxes and other levies are subject to change without notice. Also the value, income, appreciation, returns, yield of any of the securities or any other financial instruments mentioned in this statement are based on current market conditions and as per the last details available with us and subject to change. The levels and bases of, and reliefs from, taxation can change. The securities / units / other instruments mentioned in this report may or may not be live at the time of statement generation. Please note, however, that some data has been derived from sources that we believe to be reliable but is not guaranteed. Please review this information for accuracy as IFA Global cannot be responsible for omitted or misstated data. IFA Global is not liable for any delay in the receipt of this statement. This information is strictly confidential and is being furnished to you solely for your information. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject IFA Global to any registration or licensing requirements within such jurisdiction. The information given in this report is as of the date of this report and there can be no assurance that future results or events will be consistent with this information. IFA Global reserves the right to make modifications and alterations to this statement as may be required from time to time. However, IFA Global is under no obligation to update or keep the information current. Nevertheless, IFA Global is committed to providing independent and transparent information to its client and would be happy to provide any information in response to specific client queries. Neither IFA Global nor any of its directors, employees, agents or representatives shall be liable for any damages whether direct, indirect, special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information. The information provided in these report remains, unless otherwise stated, the copyright of IFA Global. All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and copyright IFA Global and may not be used in any form or for any purpose whatsoever by any party without the express written permission of the copyright holders.

Recommended Content

Editors’ Picks

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

AUD/USD consolidates gains above 0.6500 after Australian PPI data

AUD/USD is consolidating gains above 0.6500 in Asian trading on Friday. The pair capitalizes on an annual increase in Australian PPI data. Meanwhile, a softer US Dollar and improving market mood also underpin the Aussie ahead of the US PCE inflation data.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Stripe looks to bring back crypto payments as stablecoin market cap hits all-time high

Stripe announced on Thursday that it would add support for USDC stablecoin, as the stablecoin market exploded in March, according to reports by Cryptocompare.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.