- Initial Claims expected to climb to 750,000 from 730,000.

- Claims fell more than 100,000 for the second time this year last week.

- Continuing claims at 4.419 million were lowest of the pandemic.

- Texas and Mississippi announce full economic reopening.

- Markets and the dollar keying on US data.

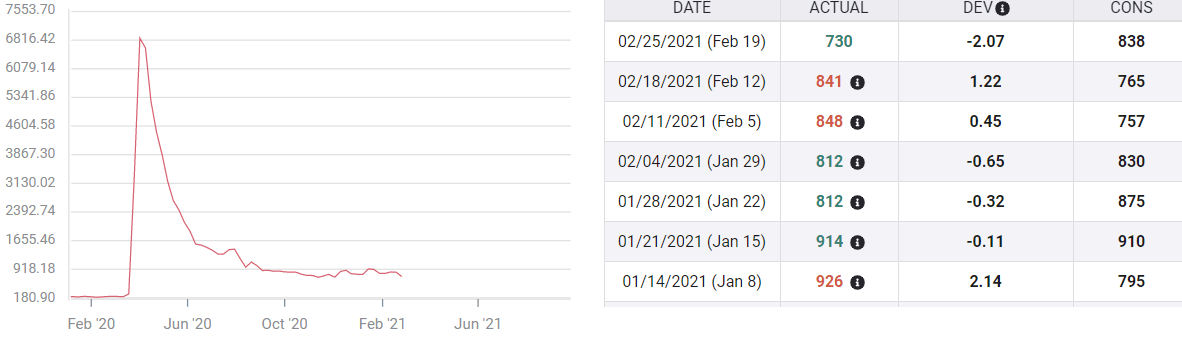

Initial claims for unemployment insurance have exhibited a notable increase in volatility since the beginning of December compared with the prior three months of steady decline.

Requests for jobless benefits are forecast to rise to 750,000 in the February 26 week from 730,000. Continuing claims were 4.419 million in the February 19 week.

Initial Jobless Claims

FXStreet

Initial Jobless Claims

From November 27 to February 19 claims rose or fell more than 100,000 four times, twice each way, in 12 weeks. The average weekly shift was 57,800. Claims started at 716,000 in the November 27 week and ended at 730,000 on February 19.

The previous 12 weeks had held a steady decline from 893,000 on September 4 to 716,000 by November 27. There was no rise or fall greater than 71,000 and the weekly shift was 28,600.

This three month interregnum was due to California's reapplied lockdown in December and lesser revived restrictions in a few other states. New York City again closed indoor dining in December. The job losses hit the areas that had been allowed partial reopening, restaurants and similar in-person retail venues.

Beginning of the end

Texas and Mississippi announced on Tuesday that all remaining restrictions on their economies, socialization and schooling will be removed.

It will shortly be difficult for other states to justify the rules that have limited business life and kept layoffs high, hiring low and children out of the classroom. The momentum toward reopening will build and with it the return to an active employment recovery.

Nonfarm Payrolls and Initial Claims

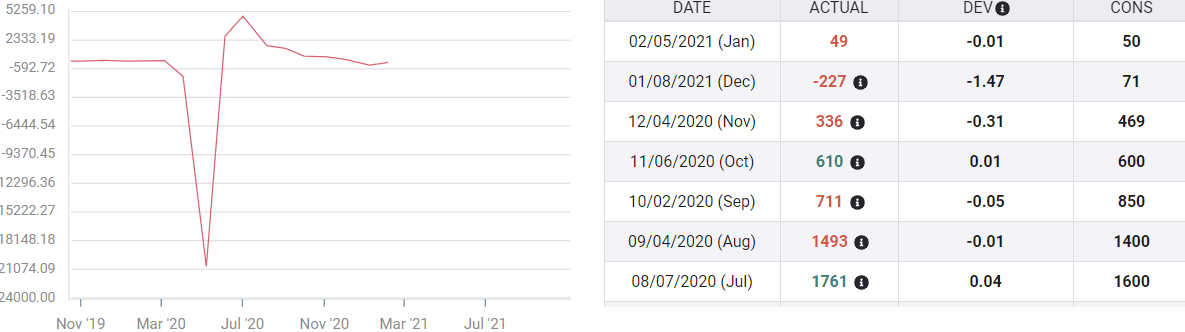

Nonfarm Payrolls are forecast to add only 180,000 jobs in February. Though hiring was completed before the opening announcements, the fast improving pandemic situation that led to the policy changes had to have been evident to employers. Hiring was likely stronger than the current estimate last month.

Nonfarm Payrolls

The impact on jobless claims should be equally swift and positive. Businesses that are on the edge of failing now have every reason to wait out the remaining weeks until they can reopen.

Conclusion

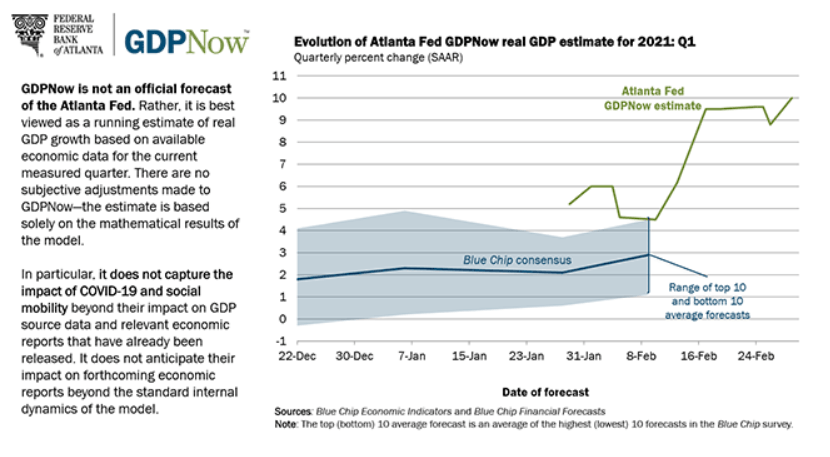

The economy is widely expected to see an explosive recovery as the pandemic, consumer and business pictures rapidly improve. The promised stimulus bill in Congress combined with the psychological relief from the end of the pandemic is a powerful emotional and financial package.

The Atlanta Fed GDPNow model's current estimate for the first quarter is 10% annualized growth.

Credit, equity, commodity and currency markets have paused for the last two weeks, waiting for US data to catch up to their speculative positions.

When the statistics begin to reflect that reality expect the advances to resume.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.