US Dollar Weekly Forecast: Investors now look at the US economy and Trump

- The US Dollar Index clinches its seventh weekly gain in a row.

- Trump secured the House of Representatives, reaching a ‘Red Sweep’.

- The US Dollar’s gains were largely propped up by the ‘Trump trade’.

The US Dollar (USD) has been on a strong run for yet another week, continuing its impressive streak and now marking seven consecutive weeks of gains. The Greenback even broke past the key 107.00 barrier when measured by the US Dollar Index (DXY), hitting a new YTD top and putting further distance from the recently broken 200-day Simple Moving Average (SMA) at 103.90.

The Greenback’s rally began in early October, fueled by solid economic data from the US and, more recently, a boost from the so-called “Trump trade”. This was combined with the more prudent approach from the Federal Reserve (Fed) when it came to evaluate the next move on interest rates.

Trump’s policies now come to the fore

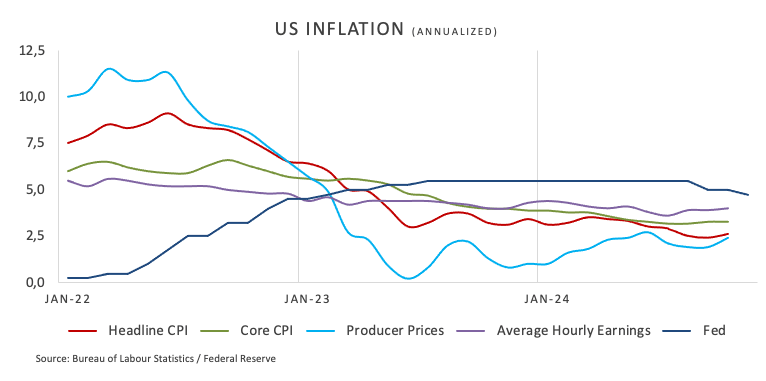

Following the widely anticipated quarter-point interest rate reduction by the Fed last week, October’s inflation figures tracked by the Consumer Price Index (CPI) might have not moved the dial regarding the Fed’s easing plans for the next couple of months as investors continue to price in another 25-basis-point rate cut at the December 18 gathering.

However, Trump’s “Red Sweep” might.

It is vox populi President-elect Trump’s favourite policy to implement tariffs on Chinese and European imports, ranging from 10% to 60%, and even 100% for Chinese electric vehicles coming south of the Rio Grande.

In addition, fiscal policy under the Trump administration is expected to become more “accommodative”, while deregulatory measures in the corporate universe are also well on the table.

All the above points to the most likely return of inflationary pressure in the US economy sooner rather than later, which carries the potential to derail the Fed’s intentions to ease its monetary policy further, or even considering the likelihood of rate hikes in case of need.

The Fed’s cautious message: Another excuse for the Dollar’s rally

In his latest comments at an event in Dallas, Chair Jerome Powell argued that the strong economic growth, resilient job market, and persistent inflation above the 2% target mean the Fed can afford to be patient with interest rate cuts. He also emphasised that the pace of cuts is not predetermined and that current economic conditions do not indicate urgency for rate reductions. Powell also mentioned that the Fed has time to adjust its policy approach if needed, especially considering the return of Donald Trump as president.

Aligning behind his remarks, Dallas Fed President Lorie Logan advised caution on future rate cuts, stressing the importance of not reigniting inflation. She pointed to potential risks such as increased business investment post-election and strong consumer spending. Logan also observed that while the labor market seems to be cooling, the current 4.1% Unemployment Rate indicates there has been no major weakening so far.

And finally: US fundamentals do rock

With the Fed now shifting its focus from inflation to take a closer look at the job market, the overall health of the US economy is becoming a major factor in shaping future policy decisions.

In October, the Nonfarm Payrolls report showed a modest increase of just 12K jobs, while the Unemployment Rate held steady at 4.1%. Although the ADP report came in better than expected, weekly jobless claims have been suggesting the labour market is still strong, even if it’s cooling down very slowly.

Recent GDP figures have also been surprisingly positive, easing concerns about an imminent recession. Right now, neither a soft nor a hard landing looks likely.

Compared to other G10 economies, the US is standing out, which could help keep the US Dollar relatively strong over the medium to long term.

Rate hikes and cuts: A global snapshot

The Eurozone, Japan, Switzerland, and the UK are all facing deflationary pressure and increasingly unpredictable economic activity.

In response, the European Central Bank (ECB) lowered interest rates by 25 basis points on October 17 but gave little indication about its next moves, leaving it all to its “data dependent” stance.

Similarly, the Swiss National Bank (SNB) trimmed its rates by 25 basis points on September 26.

The Bank of England (BoE) also reduced its policy rate by 25 basis points to 4.75% earlier in the month. However, the BoE remains cautious, as it expects the new budget to boost both growth and inflation, making it unlikely to lower rates aggressively. Nonetheless, the central bank anticipates inflation to stabilize by the end of 2025.

Meanwhile, the Reserve Bank of Australia (RBA) decided to keep rates unchanged at its November 5 meeting, maintaining its usual cautious stance. Markets are now expecting a possible rate cut by May 2025.

In Japan, the Bank of Japan (BoJ) stuck with its accommodative policy during the October 31 meeting. Markets are only anticipating a modest 45-basis-point tightening in the next 12 months.

What’s up next week?

Key US inflation figures are already out of the way, although market participants are expected to closely follow other measures of the real economy, such as the advanced S&P Global Manufacturing and Services PMIs and the usual weekly report on Initial Jobless Claims.

In addition, the release of the Philadelphia Fed Manufacturing Index and the final Michigan Consumer Sentiment print should also maintain the focus on the health of the US economy.

Techs on the US Dollar Index

The US Dollar Index (DXY) is steadily climbing, with the next key target being the recent high just above the 107.00 barrier on November 14, followed by the November 2023 top of 107.11 (November 1), and the 2023 peak of 107.34 (October 3).

On the flip side, if the DXY starts to pull back, the first support level is the critical 200-day SMA at 103.90, which precedes the November low of 103.37 (November 5). Below that, the 100-day and 55-day SMAs sit at 103.10 and 102.82, respectively. A deeper drop could bring the index closer to the 2024 bottom of 100.15 (September 27).

Meanwhile, the Relative Strength Index (RSI) remains in the oversbought zone just above the 70 yardstick, which could be a harbinger of a potential short-term corrective move. Meanwhile, the Average Directional Index (ADX) has regained impetus and advanced past 45, labelling the current uptrend in the index as quite strong.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the British Pound.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.25% | 0.26% | -1.40% | 0.12% | -0.21% | -0.34% | -0.50% | |

| EUR | 0.25% | 0.51% | -1.17% | 0.38% | 0.04% | -0.11% | -0.25% | |

| GBP | -0.26% | -0.51% | -1.69% | -0.12% | -0.46% | -0.62% | -0.75% | |

| JPY | 1.40% | 1.17% | 1.69% | 1.60% | 1.24% | 1.08% | 0.94% | |

| CAD | -0.12% | -0.38% | 0.12% | -1.60% | -0.35% | -0.48% | -0.63% | |

| AUD | 0.21% | -0.04% | 0.46% | -1.24% | 0.35% | -0.14% | -0.30% | |

| NZD | 0.34% | 0.11% | 0.62% | -1.08% | 0.48% | 0.14% | -0.15% | |

| CHF | 0.50% | 0.25% | 0.75% | -0.94% | 0.63% | 0.30% | 0.15% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.