US Dollar Weekly Forecast: DXY rallies after NFP, focus turns to inflation numbers

- The USD Index (DXY) ended the week with acceptable gains.

- A Fed’s rate cut in September remains on the table.

- US Nonfarm Payrolls came in hotter than expected in May.

- The Fed is largely anticipated to keep rates unchanged next week.

Occasional bearish moves look contained around 104.00

The late and data-driven sudden bounce in the Greenback propelled the US Dollar Index (DXY) back to the upper-104.00s as the week drew to a close, rapidly leaving behind earlier weakness that dragged the index to two-month lows near 104.00, where some decent contention appears to have emerged so far.

Attention remains on upcoming key data

The Dollar traded mostly on the back foot throughout the week until Friday’s Nonfarm Payrolls surprised everybody and motivated the Greenback to return to positive territory on the weekly chart.

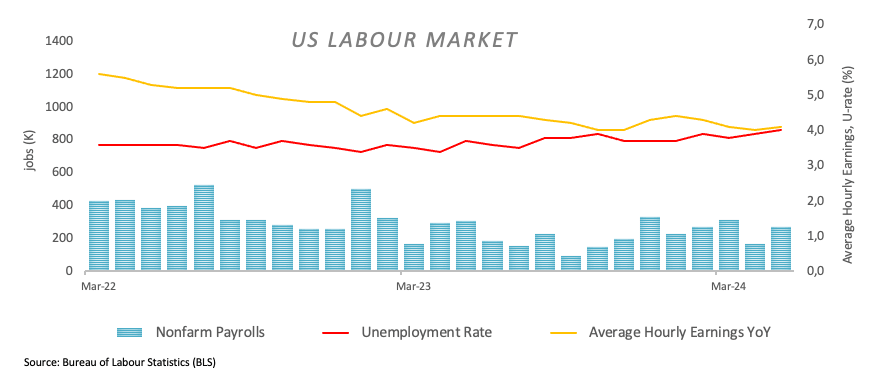

Earlier in the week, softer-than-expected prints from the US labour market (ADP report, JOLTs and weekly claims) signaled further cooling and, therefore, sparked fresh speculation that the Federal Reserve (Fed) might cut rates sooner than anticipated (September?), leaving a second rate reduction at some point by year-end.

The above was also reinforced by the Fed’s “blackout” period, leaving investors with nothing but data to assess the potential moves by the Fed in the latter part of the year.

So far, the CME Group’s FedWatch Tool now indicates around 50% chance of lower rates by September. There are also expectations of nearly 20 bps of easing at the November 7 gathering, and about 40 bps in December, according to money markets.

Fedspeak kept favouring the tighter-for-longer narrative

While there were no speeches nor comments from Fed policymakers this week, it is worth recalling their latest prudent (hawkish?) messages: Minneapolis Federal Reserve Bank President Neel Kashkari suggested waiting for significant inflation progress before considering rate cuts, and even raising rates if inflation does not further decrease. New York Fed President John Williams also argued that there is no immediate need for rate cuts, allowing for more data collection before policy changes. Chicago Fed President Austan Goolsbee noted that further inflation improvement could lead to higher unemployment, while Dallas Fed President Lorie Logan believes inflation is on track to meet the Fed's 2% target.

US yields and the Dollar’s performance

The USD's performance aligned with that of US yields across various timeframes these past sessions. That said, both yields and the Greenback faced a marked corrective decline in the first half of the week, just to be sharply reversed on Friday after US Nonfarm Payrolls crushed consensus in May (+272K jobs).

G10 central banks: Rate cuts and inflation

Among G10 central banks, the European Central Bank (ECB) reduced its rates by 25 bps at its meeting on June 6, although it poured cold water over the likelihood of subsequent cuts during the summer, particularly after revising up its forecasts for inflation. The Bank of England (BoE) is expected to reduce rates in the last quarter, with money markets seeing around 28 bps of easing in November, while the Reserve Bank of Australia (RBA) is likely to begin easing towards the end of the year.

Upcoming key events

Next week’s key events include a “Super Wednesday”, with the release of May’s US inflation figures tracked by the Consumer Price Index (CPI) and the Fed’s interest rate decision, along with the updated “dot plot” and the always-relevant press conference by Chief Jerome Powell.

Techs on the USD Index

The USD Index (DXY) appears to be consolidating between 104.00 and 105.00, no news around that.

Should the index break above the weekly high of 105.74 (May 9), it might attempt to reach the 2024 peak of 106.51 (April 16). Surpassing this level could lead to the November high of 107.11 (November 1) and the 2023 top of 107.34 (October 3).

Conversely, renewed selling pressure might push the DXY back to the June low of 103.99 (June 4). Further declines could test the weekly low of 103.88 (April 9) and the March bottom of 102.35 (March 8). A deeper retracement could target the December low of 100.61 (December 28), the psychological barrier at 100.00, and the 2023 low of 99.57 (July 14).

Overall, the bullish bias is expected to persist as long as the DXY remains above the key 200-day SMA at 104.43.

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Last release: Wed May 01, 2024 18:00

Frequency: Irregular

Actual: 5.5%

Consensus: 5.5%

Previous: 5.5%

Source: Federal Reserve

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.75% | 0.51% | 0.64% | 0.61% | 1.17% | 1.38% | 0.75% | |

| EUR | -0.75% | -0.22% | -0.12% | -0.14% | 0.41% | 0.69% | -0.00% | |

| GBP | -0.51% | 0.22% | 0.10% | 0.08% | 0.65% | 0.91% | 0.22% | |

| JPY | -0.64% | 0.12% | -0.10% | -0.03% | 0.53% | 0.75% | 0.13% | |

| CAD | -0.61% | 0.14% | -0.08% | 0.03% | 0.56% | 0.84% | 0.14% | |

| AUD | -1.17% | -0.41% | -0.65% | -0.53% | -0.56% | 0.26% | -0.43% | |

| NZD | -1.38% | -0.69% | -0.91% | -0.75% | -0.84% | -0.26% | -0.68% | |

| CHF | -0.75% | 0.00% | -0.22% | -0.13% | -0.14% | 0.43% | 0.68% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.