US Dollar Weekly Forecast: DXY approaches 105.00 with US PCE inflation in the spotlight

- The USD Index (DXY) bounced off multi-week lows near 104.00.

- Fed’s rate cut bets in September lost momentum

- Fed speakers lean towards a cautious note regarding rate cuts.

A week of recovery for the Greenback

Following the recent drop to five-week lows, the US Dollar (USD) managed to stage quite a marked comeback in the past five days. That said, the USD Index (DXY) reclaimed the area beyond the 105.00 barrier in tandem with the equally firm bounce in US yields and hawkish FOMC Minutes.

Focus remains on inflation and Fedspeak

The performance of the Greenback was predominantly influenced by the publication of the FOMC Minutes of the May 1 meeting, in which the Federal Reserve (Fed) maintained its Fed Fund Target Range unchanged at 5.25%-5.50%, as broadly anticipated.

In fact, despite expressing disappointment over recent inflation readings, Fed officials at their last policy meeting conveyed confidence that price pressures would gradually ease. According to the Minutes, members added that, for now, the policy response will "involve maintaining" the central bank's benchmark rate at its current level. However, the Minutes also indicated discussions about the possibility of additional rate hikes.

Despite the fact that hikes seem to be a “long shot” for the time being, they have started to emerge on the horizon. And, if Fed policymakers are considering them, so should investors.

All in all, the CME Group’s FedWatch Tool now sees lower rates in September at around 50% in the wake of the hawkish tilt from the FOMC Minutes, a firmer-than-expected advanced PMIs and another solid reading from the weekly Initial Jobless Claims.

Additionally, only 14 bps of easing are priced in at the September 18 gathering vs. around 35 bps in December.

Prudent Fedspeak needs more conviction

While markets appear in contrast to what Fed officials suggest or recommend, a cautious message still remained well in place throughout the week. On this, Atlanta Fed President Raphael Bostic and Federal Reserve Vice Chairman Phillip Jefferson expressed cautious optimism about the return of inflation to the 2% target. They emphasized the need for caution before approving the first rate cut to avoid triggering pent-up spending, which could cause inflation volatility. In addition, Federal Reserve Governor Christopher Waller tempered speculation about further interest rate hikes, stating that the latest inflation data is "reassuring" and the current policy rate is appropriate, while the President of the Federal Reserve of Boston, Susan Collins, and the President of the Cleveland Fed, Loretta Mester, expect inflation to continue declining.

US yields regained the smile and the uptrend

The weekly performance of the Dollar coincided with a renewed upward trend in US yields across various timeframes, all in tandem with the renewed macroeconomic backdrop, which saw rate-cut bets at the September meeting lose further shine. The short end of the US yield curve approached once again the key 5.0% barrier, the highest level in the last three weeks.

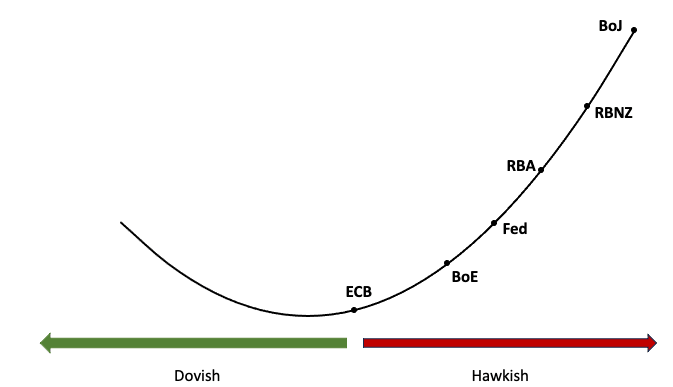

G10 Central Banks: Anticipated rate cuts and inflation dynamics

Considering the broader interest rate trends among G10 central banks and inflation developments, the European Central Bank (ECB) is expected to cut rates during the summer. A rate reduction by the Bank of England (BoE) now seems likely in the last quarter, while the Federal Reserve and the Reserve Bank of Australia (RBA) are likely to start easing at some point by year-end.

Upcoming key events

Next week, the key events will include the release of US inflation figures gauged by the Personal Consumption Expenditures (PCE), while further Fedspeak will remain at the centre of the debate.

Technical analysis of USD Index (DXY)

A further rebound could prompt the USD Index (DXY) to leave behind its weekly high of 105.11 (May 23) to then challenge the 2024 peak at 106.51 (April 16). A breakout of this level might lead to the November high at 107.11 (November 1) and the 2023 top at 107.34 (October 3).

On the other hand, the resurgence of selling pressure could lead the USD Index (DXY) to revisit the May low of 104.08 (May 16), supported by the proximity of the interim 100-day SMA. Further declines could see the index approach the weekly low of 103.88 (April 9) and the March bottom at 102.35 (March 8). A deeper retracement might test the December low at 100.61 (December 28), followed by the psychological barrier at 100.00 and the 2023 bottom at 99.57 (July 14).

From a broader perspective, the prevailing bullish bias is expected to persist as long as DXY remains above the 200-day SMA at 104.39.

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.35% | -0.36% | -0.02% | -0.52% | -0.37% | -0.36% | -0.03% | |

| EUR | 0.35% | 0.00% | 0.32% | -0.19% | -0.03% | -0.02% | 0.33% | |

| GBP | 0.36% | -0.01% | 0.32% | -0.19% | -0.02% | -0.03% | 0.29% | |

| JPY | 0.02% | -0.32% | -0.32% | -0.47% | -0.35% | -0.34% | -0.03% | |

| CAD | 0.52% | 0.19% | 0.19% | 0.47% | 0.13% | 0.15% | 0.47% | |

| AUD | 0.37% | 0.03% | 0.02% | 0.35% | -0.13% | -0.00% | 0.33% | |

| NZD | 0.36% | 0.02% | 0.03% | 0.34% | -0.15% | 0.00% | 0.32% | |

| CHF | 0.03% | -0.33% | -0.29% | 0.03% | -0.47% | -0.33% | -0.32% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.