The greenback is losing positions on the background of profit taking by traders after its recent appreciation. Other events that put the USD under pressure were comments by European politicians regarding monetary tightening in the UK and cutting of the asset purchasing program in the Eurozone in 2018. The possibility of a quarter percent interest rate hike in the UK, to bring the rate to 0.50% in November, is just shy of 50% after a hawkish statement by the Bank of England. At the same time, inflation in the Eurozone, according to ECB’s officials is likely to approach the target level of 2.0% and plans to cut quantitative easing in the euro area are likely to be announced at the end of October after the ECB meeting.

The US dollar also took a hit today from weak retail sales that fell 0.2% in August against forecasted growth of 0.1%. The Empire State manufacturing index in September, which declined to 24.4 against the forecasted fall to 18.2, could not change traders’ mood. By the end of the trading session today we may see the typical fixing of positions ahead of the weekend.

The New Zealand dollar demonstrates positive dynamics that was caused by a number of factors, including the growth of Business NZ manufacturing index to 57.9 in August against 55.5 in July and the growth of new loans amount in China to 1090 billion against the expected increase to only 933 billion in August. Keep in mind that China is the key trade partner for New Zealand.

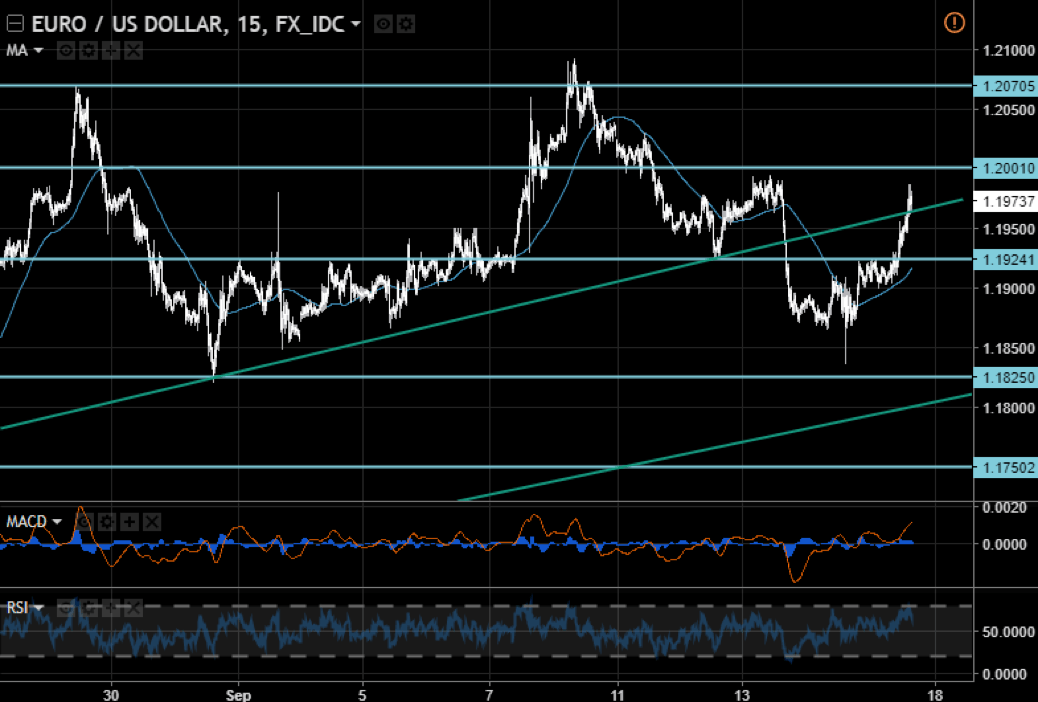

EUR/USD

The EUR/USD accelerated the upward dynamics after it was able to overcome resistance at 1.1925. Now the price is close to 1.2000 and its breaking may open the way for continued increases up to 1.2070 and 1.2200. The RSI on the15-minute chart is in the overbought zone that may be judged as a reason for a descending correction soon.

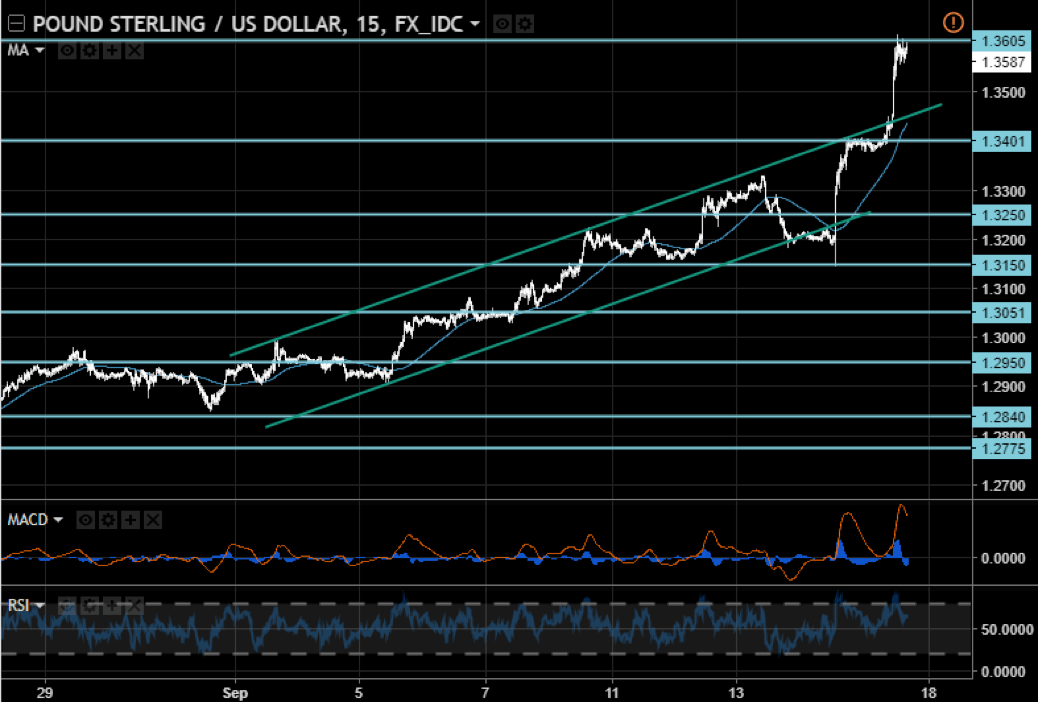

GBP/USD

The GBP/USD is soaring after it left the limits of the rising channel. Currently the quotes are consolidating under the important 1.3600 mark, and breaking through that may become a trigger for a continued increase to 1.3800. In case of a rollback, quotes may return to SMA100 on the 15-minute chart or the support lines at 1.3500 and 1.3400.

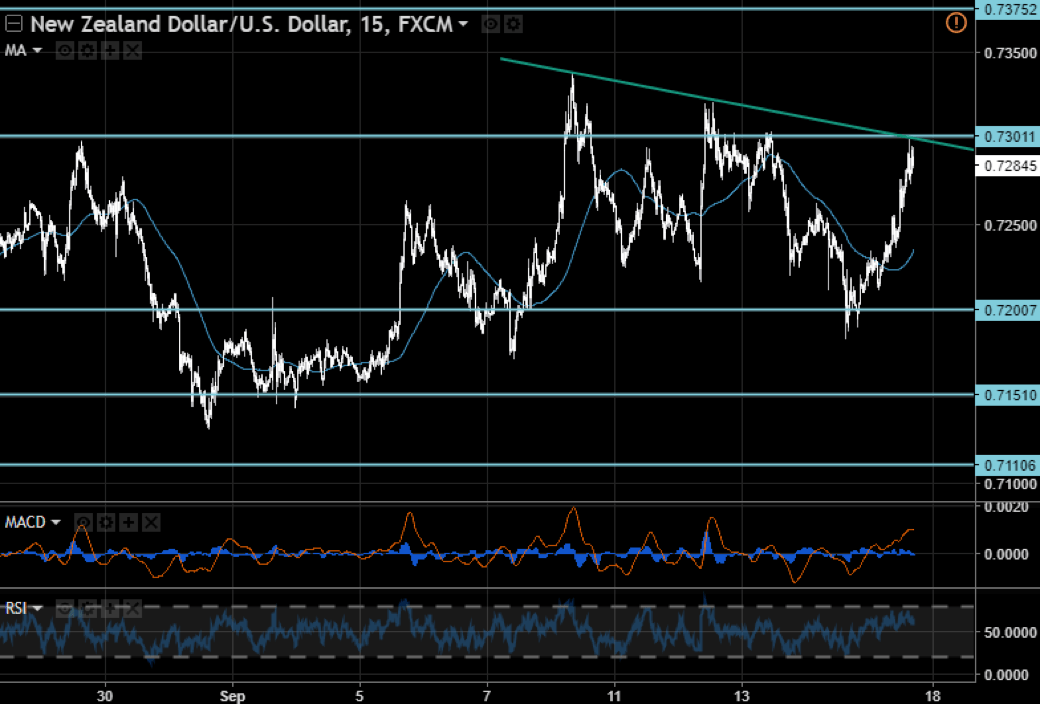

NZD/USD

Within the rising impulse, the quotes of NZD/USD reached the inclined resistance line and horizontal obstacle at 0.7300. Approaching this level, and the RSI on the 15-minute chart being near the overbought area, increases the chances of a pullback of NZD/USD happening soon with the first goals at 0.7250 and 0.7200.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.