Breakdown of the Cliff Deal

Following months of discussions and political wrangling, the Fiscal Cliff deal included most of what had already hit the newswires.

Taxes on Top Earners – Income taxes are to be raised for top earners, effectively cancelling the Bush era tax cuts for individuals making $400,000 or more, and families earning over $450,000. The measure will raise the top tax rate to 39.6% from 35%. The hardest hit will be the top 1% of income earners in the US.

Capital Gains and Dividends Tax – Capital gains and dividend taxes on investments will increase, rising to 20% from 15%. This measures will include carried interest income used by most private equity managers.

Estate Tax - Taxes on estates will now experience a top tax rate of 40%. However, the rate isn’t expected to kick in on any estate worth less than $5 million.

Unemployment Benefits Extension – Under the current measure, unemployment benefits will be extended for one year along with tax credits for low income families.

Payroll Tax Expiration – A casualty of the Fiscal Cliff deal, the payroll tax holiday enacted two years ago will expire at the beginning of 2013. Although it only represents a 2% increase in payroll taxes, it is likely to effect up to 77% of taxpayers and their paychecks. The rate will increase to 6.2% on all income up to $114,000.

What Now?

With the bill set to be signed into law by US President Barack Obama, focus has now shifted to the impending debt ceiling debate – likely to begin in mid-February. The concern remains over the fact that Democratic leaders will need to make further concessions on spending to Republicans in order to allow an extension of the $16.4 trillion ceiling.

An inability to do so would plunge the government into a plausible shutdown. This will likely include cutbacks in entitlement spending and other programs in order to equalize Republican concessions for the Fiscal Cliff deal.

Outlook

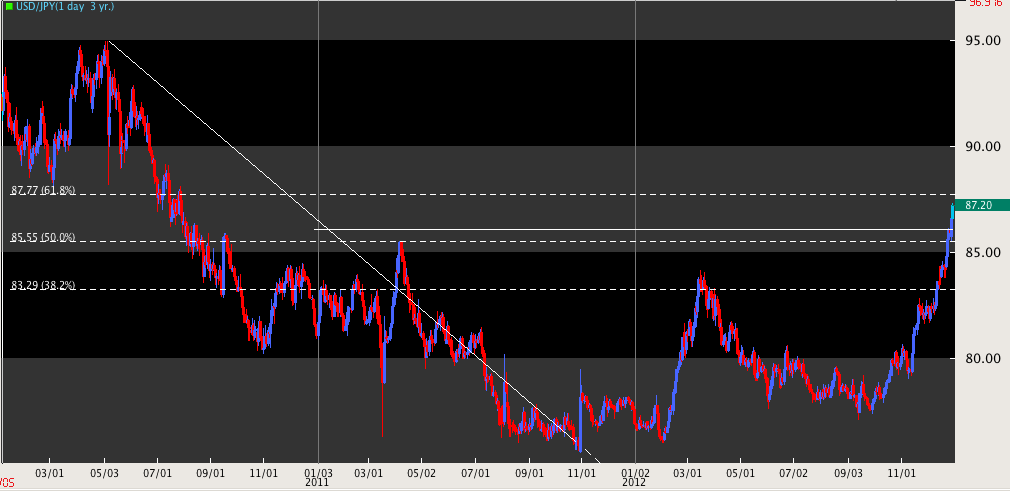

For now, however, it seems that sentiment has calmed in the face of a Fiscal deal – and is likely to power markets and risk tolerance higher temporarily. In particular, the notion is expected to push USDJPY higher through till medium term resistance targets at 88.38. Currently, the major pair advancing on the level on a break higher above 86.00 on Monday.

Source: FXTrek Intellicharts

Source: FXTrek Intellicharts

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.