We have a quiet day ahead in the UK, US and Canada. Following the release of the European Central Bank stress test results yesterday, we will have the numbers for ECB covered bond purchases today (14:30GMT).

UP

EUR performed strongly overnight, strengthening against most of its major peers after the ECB stress tests showed that the largest Eurozone banks were sufficiently capitalised, with no German, Spanish or French banks causing concern, The stress tests identified a total capital shortfall of EUR25bn across the banks reviewed at the end of 2013, but all but EUR6.35bn capital shortfall has been remedied by the banks.

It is expected that we will see some strength in the Brazilian real when markets reopen this morning following there-election of president Dilma Rousseff, securing 51 percent of the vote. But while Dilma has made noises about increasing her support for pro-market measures, her first term was market by heavy-handed state responses to weak growth and inflation concerns.

DOWN

While most indices performed well overnight, Chinese and hong Kong equity markets declined. The Hang Seng dropped 0.87 percent overnight, while Shanghai dropped 1.07 percent.

DAY AHEAD

Today sees a quiet session in the UK, US and Canada, with only Europe releasing any data of note.

The ECB will release covered bond purchase numbers at 14:30 GMT.

German IFO numbers are expected to see a decline in the November expectations number, with the consensus pointing to a decline from 99.3 to 98.9, while the business climate survey is expected to see a decline from 110.5 to 110.0.

UK POLITICS

With less than 200 days to go until the UK general election, odds on the Betfair exchange of the election resulting in no overall majority have decreased to 51 percent. William Hill has the odds of no overall majority at 8/11, with the odds of a Labour majority at 9/4, aConservative majority at 7/2 and the odds of a return of theConservative-Liberal Democrat coalition at 3/1.

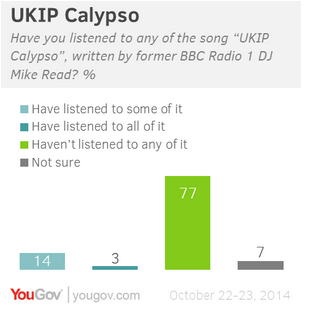

A YouGov poll showed that the Ukip Calypso song is unlikely to make it to number one in the UK music charts. According to a poll carried out, 14 percent of British people heard some part of the song,while only 3% say they listened to the whole thing. 7 percent of Ukip supporters say they listened to the whole song.

Of those who heard at least some of the song, most people (57 percent) say they did not enjoy what they heard, however a significant minority (43 percent) did.

CHART OF THE DAY

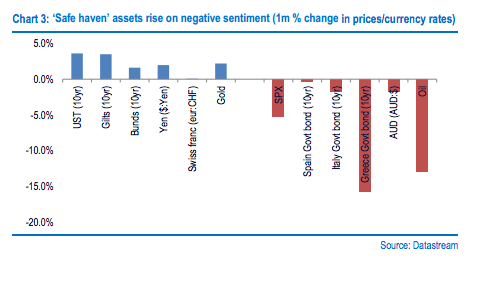

In their Global Economic View, Investec chief economist Philip Shaw highlights gains in “safe haven†assets.

“Growth concerns have helped the risk on/risk off split re-emerge, a theme we have become accustomed to in recent crisis years. Safe haven assets, Treasuries and gilts have rallied as expected with the wave of risk aversion, with 10y yields dropping below 2% on 15 Oct for the first time since May 2013. Meanwhile Euro area growth concerns, fears of a snap election in Greece and its aim to go it alone in exiting its bailout, have reinvigorated nervousness in peripheral Eurozone fixed income markets. As such spreads over Bunds have also widened in Spain, Portugal and Italy. Similarly investors have sought the traditional safe haven currencies, such as the Yen and Swiss Franc and sold risk currencies.â€Â

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.