US Dollar Forecast: Short-term bias looks at Inauguration Day

- US Dollar Index puts an end to six weekly advances in a row.

- Donald Trump will take office on January 20.

- Investors believe that the Fed might cut rates just once this year.

Greenback's rally hits a roadblock

The US Dollar’s multi-week rally finally lost steam this week. After reaching new cycle highs above the 110.00 mark, the US Dollar Index (DXY) reversed course, weighed down by a notable pullback in US yields across the board.

US data and rate cut bets pressure Greenback

The Dollar's decline began after disappointing US inflation data for December, as shown by the Consumer Price Index (CPI). The retreat accelerated further with softer than expected weekly labor market figures and lackluster Retail Sales data for December. These developments reignited hopes that the Federal Reserve (Fed) might maintain its rate-cutting stance for the rest of the year.

What are Fed officials saying?

Fed officials appeared cautiously optimistic about the inflation outlook and its implications for monetary policy:

Richmond Fed President Thomas Barkin highlighted that December's inflation data aligns with the trend of inflation gradually moving closer to the Fed's target.

New York Fed President John Williams reiterated that future policy decisions will hinge on economic data, given the uncertainty tied to potential policy shifts.

Fed Governor Chris Waller suggested that inflation might ease sufficiently to justify faster than expected rate cuts.

Chicago Fed President Austan Goolsbee expressed growing confidence in a stabilising labour market.

Despite this optimism, markets assign a 97% probability that the Fed will keep rates unchanged at its January meeting, according to the CME Group’s FedWatch Tool.

What About Trump?

The so-called “Trump trade” has been a significant factor behind the Greenback's rally since October. Investors have been recalibrating expectations for a potential Donald Trump victory in the November 5 presidential election.

If Trump returns to the White House, his economic agenda is expected to focus on corporate deregulation, relaxed fiscal policies, and boosting domestic manufacturing. Tariffs on imports would likely feature prominently to protect American industries and reduce reliance on foreign goods.

On immigration, Trump’s platform remains centred on strict enforcement, including enhanced border security, tighter asylum policies, and possibly completing the southern border wall.

In foreign policy, Trump is expected to prioritise US self-interest, favouring reduced military involvement abroad, pressuring NATO allies to increase defence spending, and taking a hardline stance on China, both economically and diplomatically.

Yields decline alongside the Dollar

The Greenback's sharp decline echoed in US Treasury yields this week. Yields pulled back from recent highs across various maturities, reflecting the broad selling momentum in the Dollar.

Upcoming key events

The Inauguration Day on January 20 will be the salient event of the week, while the release of advanced PMIs toward the end of the week could also spice things up in the FX world in the context of the Fed’s blackout period ahead of the January 28-29 gathering.

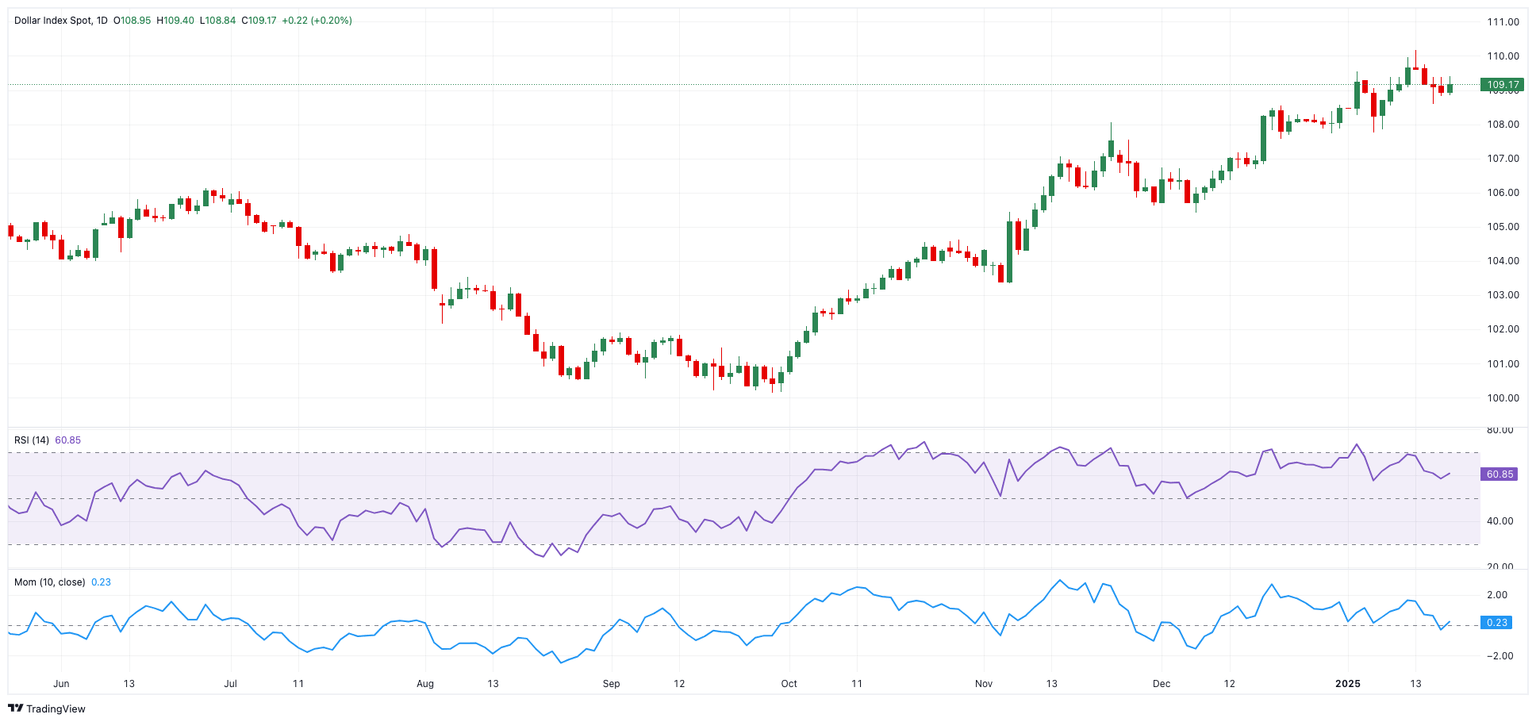

Techs on the US Dollar Index

Following the recent top at 110.17 (January 13), the DXY is expected to meet the next hurdle of relevance at the 2022 peak of 114.77 (September 28).

On the downside, the DXY is expected to meet initial contention at the 2025 bottom of 107.75 (January 6), prior to the interim 55-day Simple Moving Average (SMA) at 107.02 and the December 2024 low of 105.42 (December 6), which anticipates the critical 200-day SMA of 104.67.

Meanwhile, the US Dollar’s constructive stance should remain unchanged while above the latter SMA.

DXY daily chart

US Dollar PRICE Today

The table below shows the percentage change of US Dollar (USD) against listed major currencies today. US Dollar was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.17% | 0.47% | 0.67% | 0.27% | 0.08% | 0.27% | 0.42% | |

| EUR | -0.17% | 0.30% | 0.51% | 0.09% | -0.10% | 0.10% | 0.25% | |

| GBP | -0.47% | -0.30% | 0.21% | -0.20% | -0.39% | -0.20% | -0.04% | |

| JPY | -0.67% | -0.51% | -0.21% | -0.39% | -0.59% | -0.40% | -0.25% | |

| CAD | -0.27% | -0.09% | 0.20% | 0.39% | -0.21% | -0.00% | 0.15% | |

| AUD | -0.08% | 0.10% | 0.39% | 0.59% | 0.21% | 0.19% | 0.34% | |

| NZD | -0.27% | -0.10% | 0.20% | 0.40% | 0.00% | -0.19% | 0.16% | |

| CHF | -0.42% | -0.25% | 0.04% | 0.25% | -0.15% | -0.34% | -0.16% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.