The Australian Dollar (AUD) inched higher against the U.S. Dollar (USD) on Friday (October 15, 2021), increasing the price of the AUDUSD pair to more than 0.7400, ahead of the release of the U.S. Retail Sales data.

Technical analysis

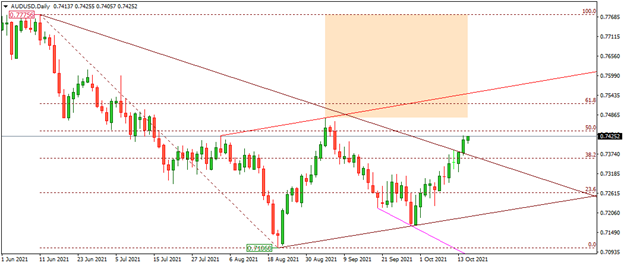

As of this writing, the AUDUSD pair strengthens around 0.7425. Should the price increase further, the pair might find some resistance near the listed price levels.

Short-Term resistance

0.7440 – the major horizontal resistance.

0.7518 – the 61.8% Fib level resistance.

0.7547- the upper trendline arm.

Daily Chart Source- MetaTrader4

On the downside, the price of the pair might find some support near the listed price levels.

Short-Term support

0.7371 – the trendline support.

0.7262 – the Fibonacci retracement (23.6%).

0.7226 – the low of October 06, 2021.

US Retail Sales news

The U.S. Census Bureau is scheduled to release U.S. Retail Sales data Today (October 15, 2021). As per the average economists forecast the U.S. retail sales registered a reading of -0.2% in September, compared to 0.7%, in the month before.

The U.S. Retail Sales data reflects the total retail sales receipts over a given period. The change in the percentage of monthly sales indicates an increase or decrease in retail sales volume.

Not to mention, U.S. Retail Sales data is a major economic indicator since it helps economists forecast consumer spending patterns in the coming days. Generally speaking, a high reading strengthens the U.S. Dollar and suggest a bearish trend for the AUDUSD pair and vice versa.

Conclusion

Considering the price movements of the pair over the past few days, it may be a better option in the short term if the AUDUSD pair was bought at around 0.7400. Due to the volatile nature of the market, however, prices may change and lead to different outcomes.

Trading foreign exchange, indices and commodities, on margin, carries a high level of risk and may not be suitable for all individuals. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange or other markets you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some, or all, of your initial investment. Therefore you should not invest money that you cannot afford to lose. Past performance is not a guarantee of future results. No guarantee is being made that any individual will be able to replicate our past performance results.

Recommended Content

Editors’ Picks

USD/JPY off lows, stays pressured near 142.50 ahead of BoJ policy decision

USD/JPY has bounced off lows but remains pressured near 142.50 in the Asian session on Friday. Markets turn risk-averse and flock to the safety in the Japanese Yen while the Fed-BoJ policy divergence and hot Japan's CPI data also support the Yen ahead of the BoJ policy verdict.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

XRP eyes gains as Ripple gears up for stablecoin launch, Grayscale XRP Trust notes rising NAV

Ripple (XRP) gained 2.3% since the start of the week. The altcoin’s gains are likely powered by key market movers that include Ripple USD (RUSD) stablecoin, Grayscale XRP Trust performance and the demand for the altcoin among institutional investors.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.