EUR/TRY 1H Chart: Channel Up

Comment: The near-term outlook for EUR/TRY is positive, as the pair is currently trading near the lower trend-line of the bullish channel. Accordingly, we expect a rally from 3.2815 up to 3.3150 during the next few days. However, the longer-term recovery of the European currency is doubtful. The upside is limited by several tough resistances, including the weekly PP, 200-hour SMA and four-week down-trend, meaning the price should stay beneath 3.32 Turkish liras. At the same time, the daily technical indicators are mostly giving ‘sell’ signals, and the sentiment among the SWFX market participants is strongly negative, being that 71% of open positions are short.

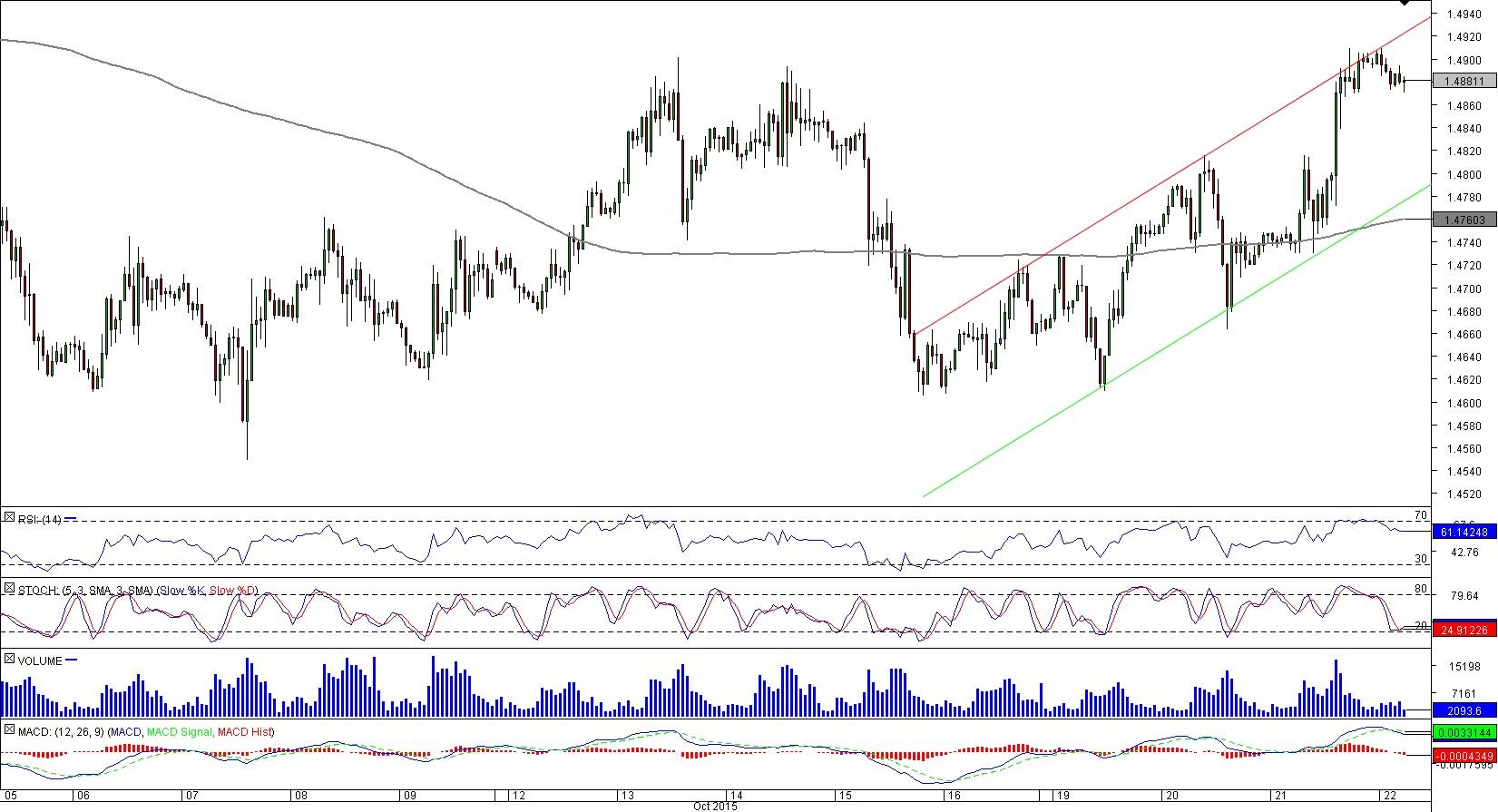

EUR/CAD 1H Chart: Channel Up

Comment: The bias towards EUR/CAD is bullish. The currency pair has recently broken through the long-term moving average, and a majority of the technical studies is pointing north. However, we would like to see a close above the last week’s high to confirm the bullish outlook. The next target would then be the weekly R2 at 1.5020, followed by the weekly R3 and Sep high at 1.5150. On the other hand, violation of 1.4770 will imply a sell-off. First, down to the weekly PP at 1.4725, then to a solid support level at 1.46, represented by the Oct 15 low. As for the distribution between the bulls and bears, it is strongly skewed in favour of the latter, who take up 71% of the market.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.