EUR/TRY 4H Chart: Channel Up

Comment: The Euro is well-positioned to keep advancing. From below EUR/TRY is underpinned by 3.35, where the lower boundary of the pattern coincides with the weekly S1 and Sep 22 low. Additional supports are the 200-period SMA and Aug 31 low at 3.31 and 3.25 respectively. The main resistance is at 3.48, represented by this month’s high and monthly R1. A close above this serious obstacle will confirm pair’s long-term bullish intentions, but there is likely to be a selloff from 3.5336, where we have the upper boundary of the channel. Still, even despite the bullish technical indicators, the sentiment in the SWFX market is distinctly bearish: 69% of open positions are short.

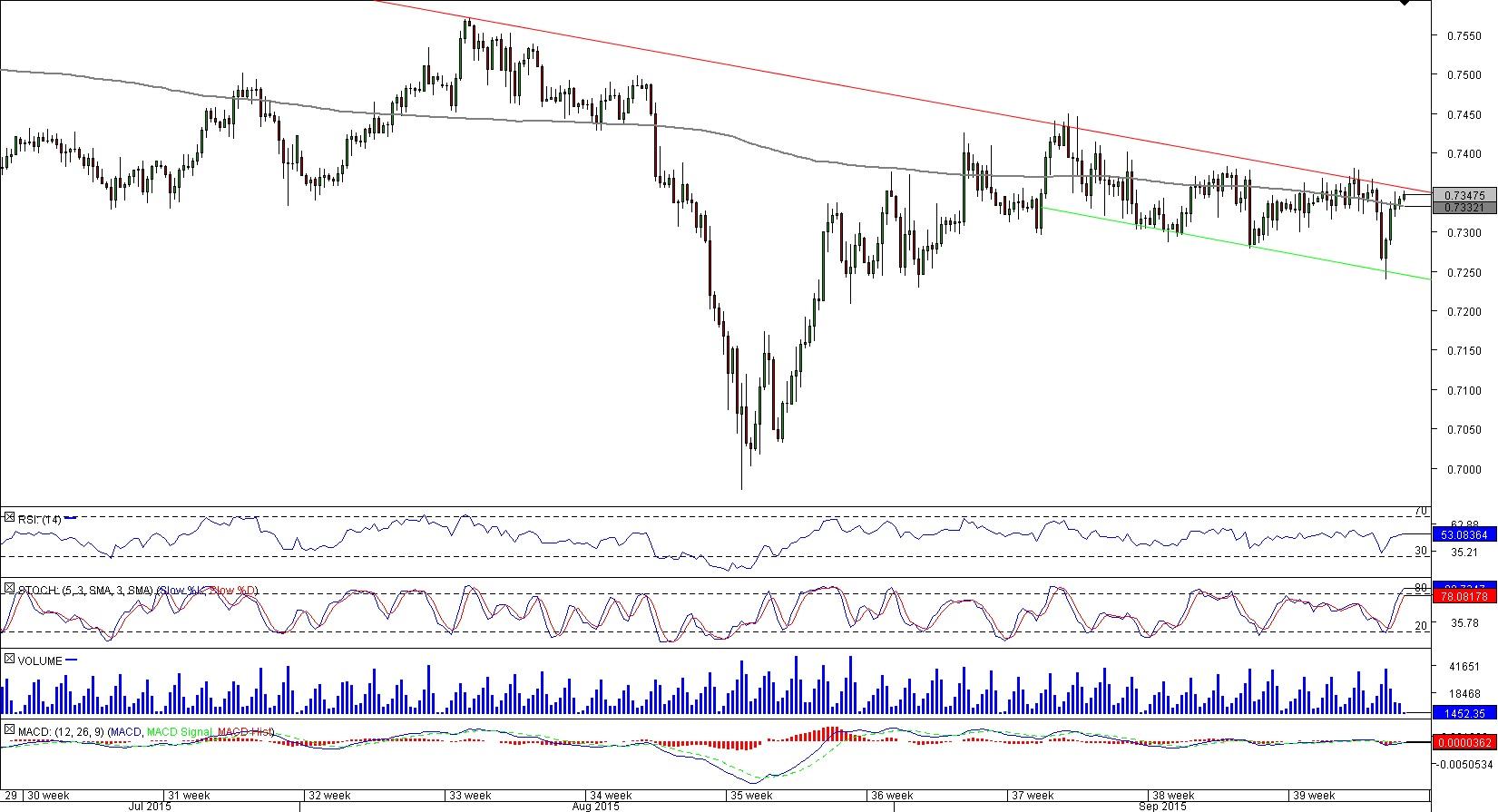

CAD/CHF 4H Chart: Channel Down

Comment: We hold a negative bias with respect to CAD/CHF. The currency pair continues to trade under the falling resistance line, and recently it has entered a bearish channel. Accordingly, we expect the current rally to be rejected by 0.7350, which should be followed by a decline to 0.7240, where the support line coincides with the Sep 24 low and weekly S2. Additional reason to be bearish the Canadian Dollar is the technical studies, a majority of which is pointing south. A breach of 0.7350 however, will invalidate the negative outlook, and the rate will be expected to test September high at 0.7450. Meanwhile, the SWFX market participants are equally divided between the bulls and bears.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD stays depressed near 1.0650, awaits US data and Fed verdict

EUR/USD holds lower ground near 1.0650 amid a softer risk tone and broad US Dollar strength on Wednesday. With European markets closed for Labor Day, the pair awaits the US employment data and the Fed policy announcements for the next directional move.

GBP/USD keeps losses below 1.2500 ahead of US data, Fed

GBP/USD holds lower ground below 1.2500 early Wednesday. The stronger US Dollar supports the downtick of the pair amid the cautious mood ahead of the top-tier US employment data and the all-important Fed policy announcements.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

ADP Employment Change Preview: US private sector expected to add 179K new jobs in April

The ADP report is expected to show the US private sector added 179K jobs in April. A tight labour market and sticky inflation support the Fed’s tight stance. The US Dollar seems to have entered a consolidative phase.