EUR/GBP 1H Chart: Channel Down

Comment: Since mid-March, the single European currency has been gradually losing value versus the British Pound and on Jun 26 the pair entered one of the several bearish patterns it formed throughout its slide. The formation represents a 237-bar long channel down pattern with average quality but high magnitude.

Now the currency couple is headed towards the upper limit of the pattern since it got a strong bullish impetus after a drop to a two-year low of 0.7915 early July. However, the SWFX numbers warn the upside is likely to end soon – more than 71% of all orders are placed to sell the pair.

CAD/JPY 1H Chart: Channel Down

Comment: A one-week long retreat of CAD/JPY started at a seven-month high of 96.23 reached in the very beginning of July.

Recently, the currency pair has touched a three-week low of 94.30 that lies slightly below the lower boundary of the corridor. However, at the moment, the instrument is trading within the pattern’s trend-line, albeit it is still sitting very close to the lower limit of the formation. In the hours to come, the pair is likely to increase the distance from the pattern’s support line as almost two-thirds of traders on the SWFX are bullish on the instrument. Meanwhile, technical data belies traders’ view by sending a clear ‘sell’ signal for the medium-term.

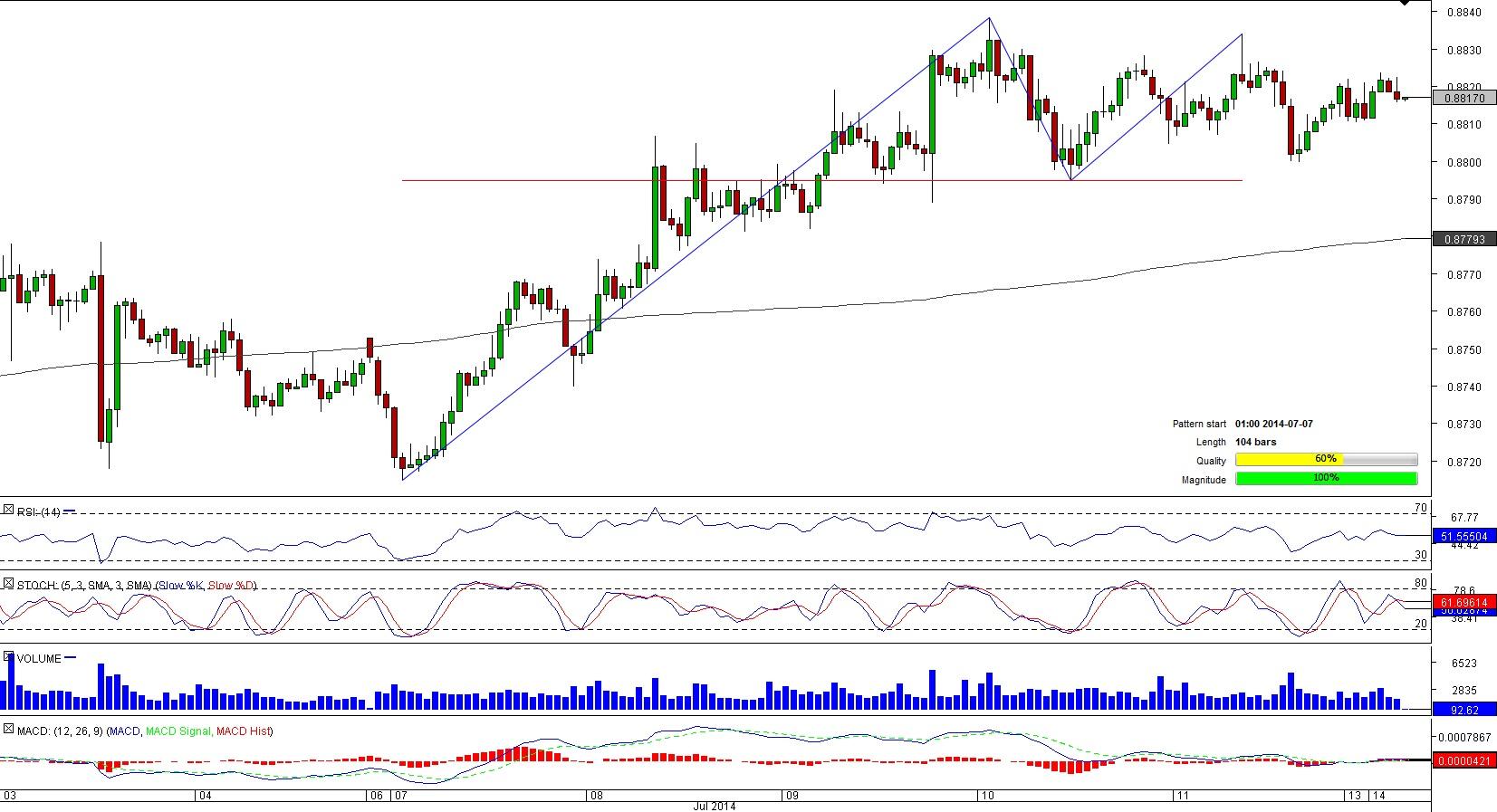

NZD/USD 1H Chart: Double Top

Comment: Having peaked near a three-year high of 0.8838 for two times, the New Zealand Dollar embarked upon depreciation against its U.S. counterpart. Although the decline was expected since the pair is trading inside a 104-bar long double bottom pattern, the pair’s following moves were surprising. NZD/USD jumped above the short-term SMA at 0.8815 a few hours earlier and now is not showing any willingness to retreat from the current level. At the same time, market players believe the pair will make the pattern to work out – over 60% of SWFX players hold short positions, meaning that the pair may reverse its trend to near the neck-line at 0.8794.

EUR/USD 1H Chart: Triangle

Comment: The most traded currency pair has been narrowing down its trading range since early July, being locked inside a symmetric triangle pattern.

Currently, the pair seems to be on the verge of a breakout, considering that the apex of the 104-bar long formation will be attained later in the day. Taking into account the fact the pair is now vacillating only a few pips below the upper limit as well as moderately bullish SWFX sentiment – around 58% of traders on the SWFX bet on appreciation of the pair, the direction of the looming breakout may be bullish. However, technical indicators contradict to the SWFX data—the signals are bearish for short-to-long term.

This overview can be used only for informational purposes. Dukascopy SA is not responsible for any losses arising from any investment based on any recommendation, forecast or other information herein contained.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.