Today's FX, gold, oil, and stock market outlook

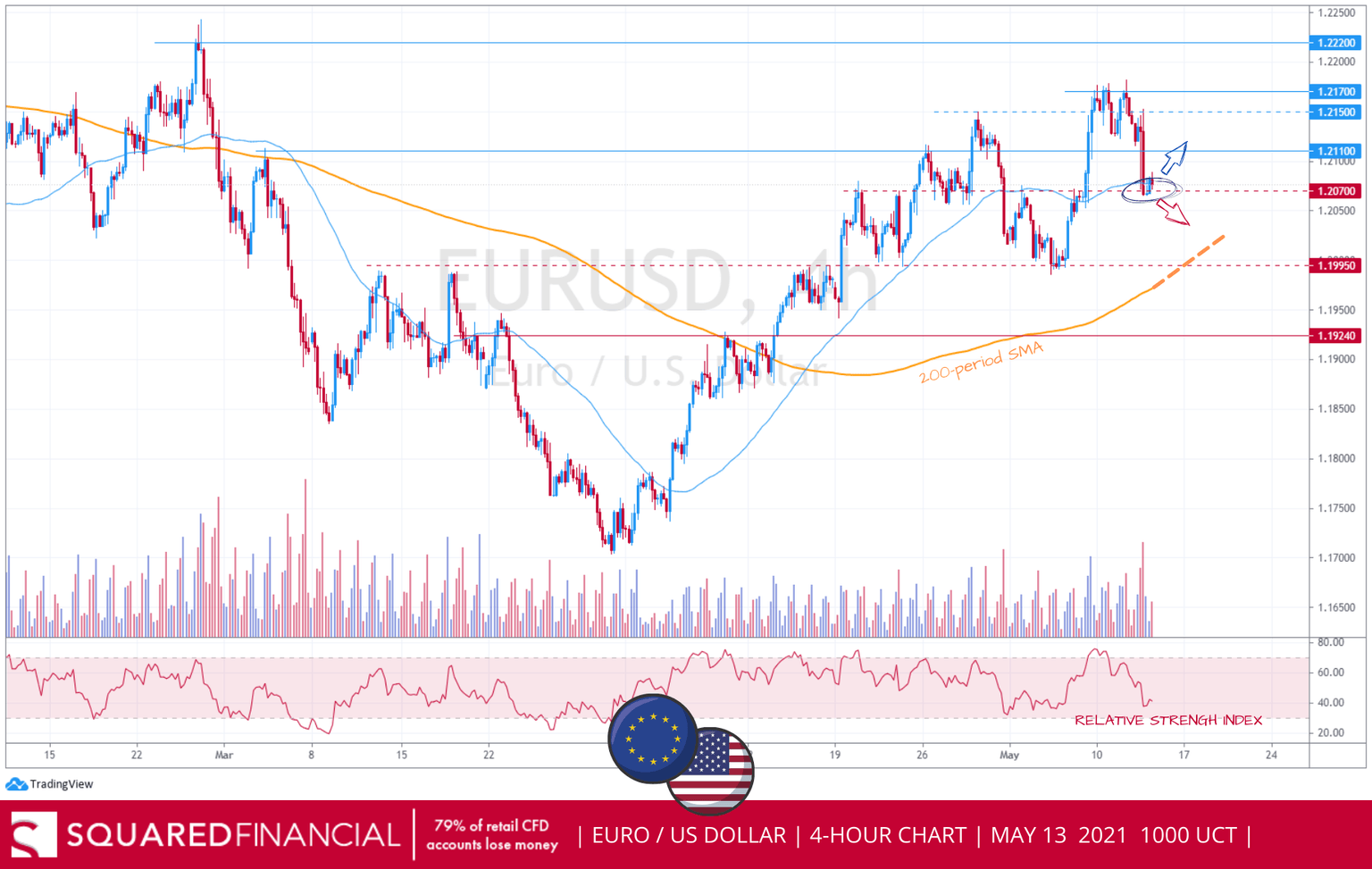

EUR/USD

US Core CPI jumped 3% yesterday in its biggest increase since January 1996, pushing the 10-year US bond yield and the US Dollar higher. The EURUSD currency pair tumbled below 1.21 with a break of the 1.2070 support level to trigger additional selling pressure with the 200-period SMA as nearest support, ahead of wholesale inflation and jobless claims due to be released out of the US this afternoon.

GBP/USD

The jump in US headline CPI yesterday was the catalyst for a big drop of the British Pound against the US Dollar on the back of a rise in US Treasury yields. The GBPUSD is now within striking distance of the 50-period moving average highlighting a possible test trade. Technically speaking, failure to break the 1.4050 support level will indicate the presence of buyers ahead of US jobless claims and US PPI due later today.

USD/JPY

The US Dollar did not pull back against the Japanese Yen as expected, instead, USDJPY rallied driven by an upbeat CPI report that showed an increase by the most in nearly 12 years as a reopening economy pushed demand and prices higher. USDJPY jumped rapidly over ¥109 and is now seen challenging the resistance area at ¥109.70 / 80 ahead of wholesale inflation and jobless claims, both due out of the US later this afternoon.

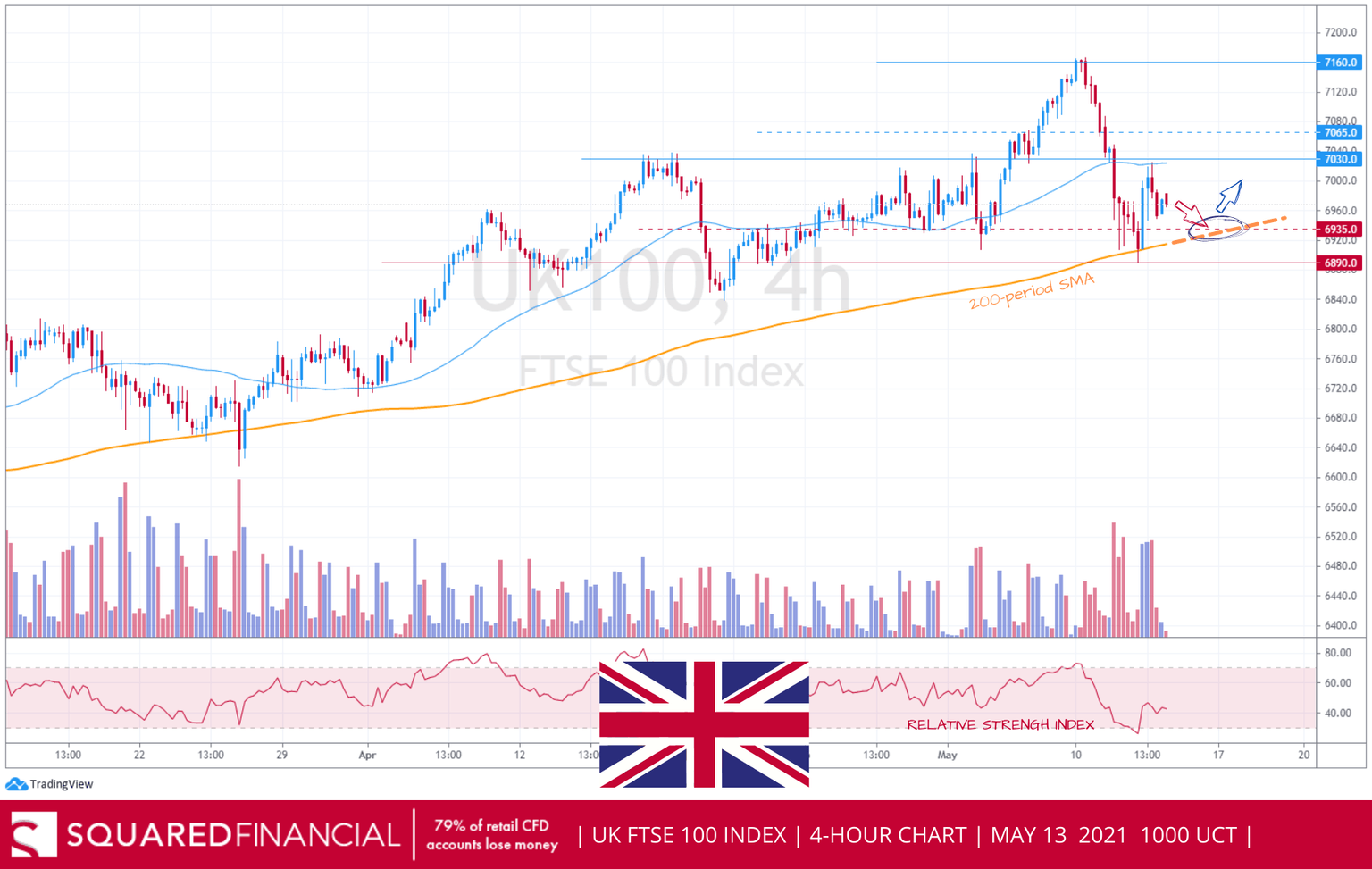

FTSE 100

The FTSE 100 index closed around 50 points higher yesterday, however as a result of US and Asian markets’ selling-off overnight following a report that showed US inflation in April hit its highest level since 2008, we can expect to see stocks in London open lower this morning ahead of another inflationary test due out of the US later this afternoon, as US producer prices are due to be released, with the 200-period moving average and the 6890 level to act as support for the Footsie.

Dow Jones

The relentless selling pressure following US CPI data yesterday drove the Dow Jones Industrials to its worst day since January, as investors are now concerned over whether interest rate hikes from the Fed could happen sooner than later. Technically, the Dow is now on a downtrend after the index dropped below both the 34000 and the 200-period SMA. However, if the market pulls back higher later in the session as PPI data and jobless claims are released, preventing a follow through day below the 200-period SMA, this will be seen as a bullish signal that will attract dip-buyers.

DAX 30

The annual rise in the US consumer price index for April came in at 4.2%, beating forecasts of 3.6%, and causing global equity markets including German shares to slump, as DAX futures now retest the crucial 200-period moving average. US producer price index and US jobless claims are both due later this afternoon and may provide a catalyst for equity markets to reverse the recent sell-off. However, technically speaking, a break below the 15000-support will trigger an acceleration to the downside as it will be seen as a bearish follow-through day.

Gold

5-day winning streak on Gold got interrupted, ending yesterday’s session in the red after a US CPI print surprised to the upside, lifting US10Y yields to one-month highs and pushing the greenback higher. Focus returns to the labor market today, with Initial Jobless Claims consensus at 490K, with any weakness in labor market conditions to refresh buying interest in the safe haven. An hourly close above $1820 resistance level is needed to favor further upside with $1840 as closest resistance target.

US oil

WTI Crude hit our resistance target at $66.60 only to end the day in the red, weighed down by EIA inventory data that registered a smaller than expected drawdown of -0.427Mb vs. expectations of -2.25Mb, along with surging covid-19 cases in India, the world’s third largest importer. Technically, an hourly close below $65 support level (coinciding with 200-period SMA) will confirm bearish momentum with $64.40 as next closest support target.

Author

Rony Nehme

SquaredFinancial

Rony has over twenty years of experience in financial planning and professional proprietary trading in the equity and currency markets.