Outlook

Today is PMI day, although the cement on the outlook for central banks is starting to dry, so perhaps without the usual effect on traders. And only one Fed speaker today (Atlanta Fed Bostic). We also get the usual Thursday unemployment report, ho hum. This PMI is the S&P version and expected to slip to 51 from 51.3 in April. The market prefers the ISM version, due later (manufacturing on June 1 and services on the 3rd).

Some analysts like to parse every word and punctuation mark in the Fed minutes and make a big deal out of an added (or deleted) word. Reuters writes the Fed minutes say this: "… various participants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate." The modifier “various” is not usually used in the minutes and unlike the usual words (some, many, and most) conceals how many people we are talking about. We’d say “some” and “many” are equally ambiguous.

We are not sure focusing on “various” useful. It’s a bad use of time if we really believe the Fed is data-dependent. It should be obvious that if we got a series of higher inflation numbers, the Fed would have to consider a hike. Kindly remember that word IF. Somebody saying, “Golly, we may have to hike” is just plain speculative. Besides, the meeting took place before we got the somewhat better April inflation data, taking out some of the sting of the Q1 data. A hawkish tilt given Q1 should not be a surprise.

If we want to know a professional interpretation, look to the 10-year. The high early in the day was 4.460%. By the close, it had dipped to 4.424%. Even the more sensitive 2-year started out early at 4.873% (from 4.880% at the previous close) and ended around 4.882%, or very little more than the previous close. In other words, those in the know, or rather those who think they know, were not impressed by the idea of a hike. It’s just an idea, not a forecast and not, so far, based on data.

Somewhat more impressive is that the Goldman Sachs CEO opining we won’t get any cuts this year. He points out that while the rate of inflation may be falling, prices are higher than two years ago and staying that way, starting to hit the average consumer, as seen in consumer company sales. It was only April that the Goldman economists had predicted two cuts this year. Separately, another top official said “the house doesn’t have a view” on cuts.

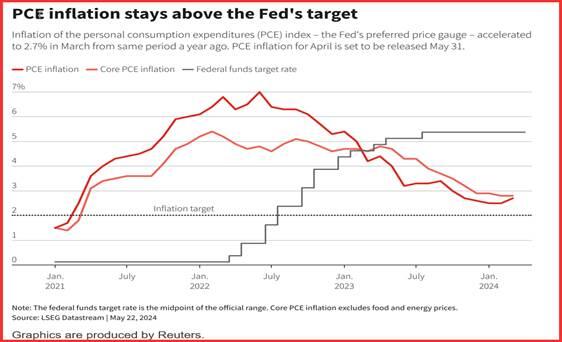

We hate to point it out, but we get the next inflation numbers on May 31, a week from tomorrow and after the long US weekend—and it’s the right data set for talking about the Fed, the PCE version. See the chart from Reuters. If we were to get another tick up, traders could well overreact and push the first cut out into the coming year, or firm up the idea of a hike. On the other hand, a nice drop would restore the idea of a Sept cut, taking it away from November. A Nov cut is, to our mind, out of the question, for all the reasons listed below.

Forecast

We expected to see dollar short-covering going into the Memorial Day weekend, but so far got only three days’ worth. Tomorrow may be a short day so that traders can make it a 3½-day or 4-day holiday, leaving a rallyette to today or not at all. The resilience of the euro is remarkable. All the same, we continue to expect a dip to about 1.0780, where the 20-day and 200-day moving averages converge near the cloud top. We are not calling it a tipping point, but everyone knows those levels. If met, a further drop to 1.0750 is likely. Be aware that this scenario could have more than a dollop of wishful thinking.

Reasons for the Fed to Cut Rates

Avoid embarrassment from getting inflation wrong twice

Normalize the yield curve

Head off any recessionary tendencies

Help housing via mortgage rates

Help banks rollover commercial property loans

Help the stock market

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD stays in positive territory above 1.0850 after US data

EUR/USD clings to modest daily gains above 1.0850 in the second half of the day on Friday. The improving risk mood makes it difficult for the US Dollar to hold its ground after PCE inflation data, helping the pair edge higher ahead of the weekend.

GBP/USD stabilizes above 1.2850 as risk mood improves

GBP/USD maintains recovery momentum and fluctuates above 1.2850 in the American session on Friday. The positive shift seen in risk mood doesn't allow the US Dollar to preserve its strength and supports the pair.

Gold rebounds above $2,380 as US yields stretch lower

Following a quiet European session, Gold gathers bullish momentum and trades decisively higher on the day above $2,380. The benchmark 10-year US Treasury bond yield loses more than 1% on the day after US PCE inflation data, fuelling XAU/USD's upside.

Avalanche price sets for a rally following retest of key support level

Avalanche (AVAX) price bounced off the $26.34 support level to trade at $27.95 as of Friday. Growing on-chain development activity indicates a potential bullish move in the coming days.

The election, Trump's Dollar policy, and the future of the Yen

After an assassination attempt on former President Donald Trump and drop out of President Biden, Kamala Harris has been endorsed as the Democratic candidate to compete against Trump in the upcoming November US presidential election.