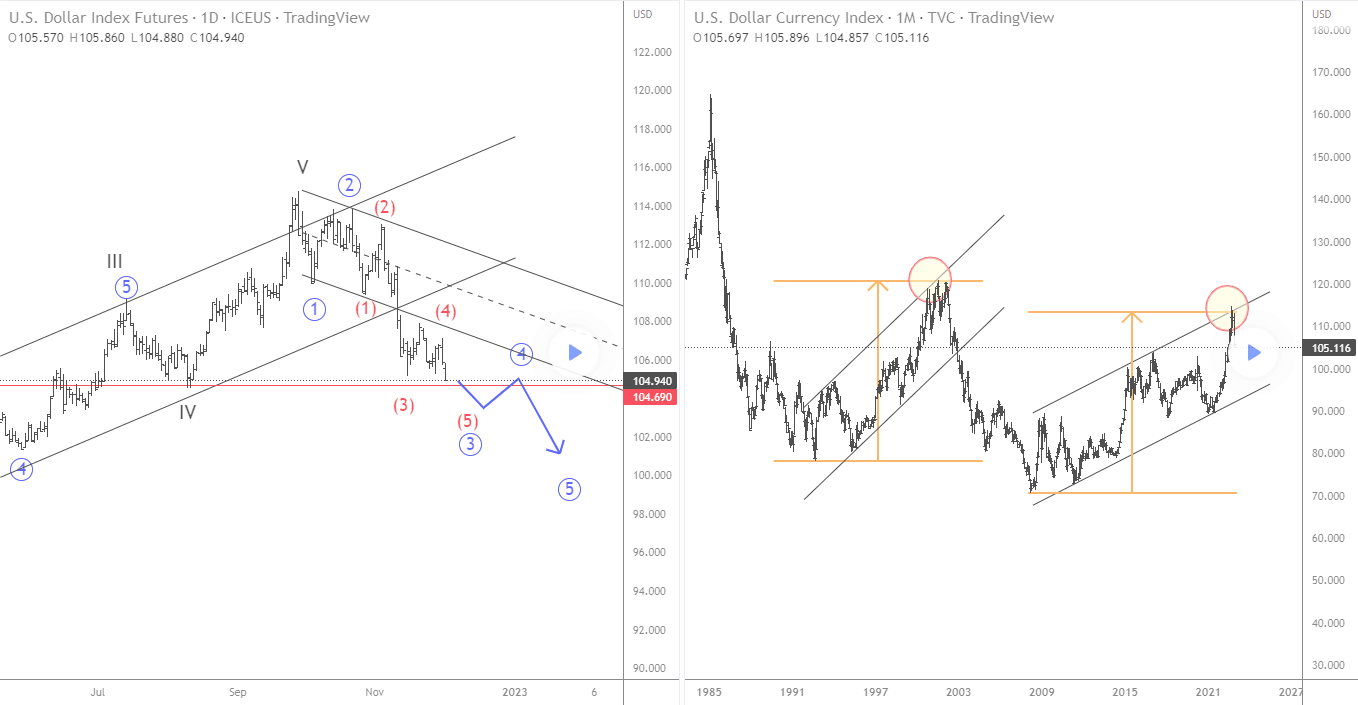

Elliott Wave: The USD outlook

PCE was out yesterday, showed that the Inflation is stable. Also, on Wednesday speculators wanted to see if Powell will stay hawkish or be even more aggressive; he was the complete opposite, despite still good jobs data in last few months (it's below 4%). From this we can assume that even if jobs data will stay fine today, Powell will stick to his plan, because he did not mention that next decision will depend on jobs. He said 100K is the line for creation/destruction of jobs. But if suddenly jobs will get worse, then this will be another confirmation for slowing down the hiking pace, which is not impossible, considering that economy is slowing down. But of course it really depends how big would be the potential NFP miss, below 100k would likely cause a shock on stocks which eventually can lead to DXY rally later, but only for a correction IMO.

There will be pullbacks of course. Here is the Elliott wave count I am looking at; potential impulse from a monthly channel top.

I will turn back bullish if I see strong bounce back to 109.

BLACK FRIDAY Monthly 50% Off Lifetime Crypto, FX and major Global Markets. Apply here.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.