Financials: June Bonds are currently 3 higher at 164’17, 10 Yr. Notes 1 higher at 130’13.5 and 5 Yr. Notes 0.5 higher at 121’05.7. June 2017 Eurodollars are unchanged at 99.08. Estimates for today’s Unemployment Report are in the 200,000 range for new non-farm payrolls. I will be a seller in June 2017 Eurodollars on a rally to the 99.10 level.

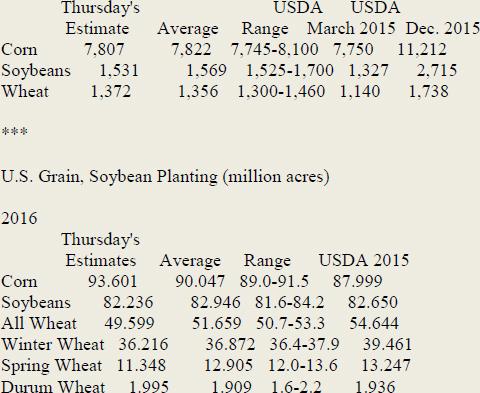

Grains: Yesterday’s Grain Report showed the following:

Thu Mar 31 12:05:08 2016 EDT

Following are key numbers from the USDA's March 1 Quarterly Grain, Soybean Stockpiles and 2016 U.S. Grain, Soybean Prospective Planting reports Thursday and how the government's estimates compared to analysts' forecasts in a Wall Street Journal survey.

U.S. Stockpiles on March 1, 2016 (million bushels)

As expected more Corn acreage and less Soy acreage. I will be a buyer in Beans on a set back to the 893’0 level and a buyer in Corn (May) below 343’0. Currently: May Corn 2’2 lower at 349’2, Beans 2’4 higher at 913’2 and Wheat 3’0 lower at 470’4.

Cattle: Yesterday Live and Feeder Cattle closed sharply higher with FC posting limit up gains and possibly making a key reversal. We have covered all back spreads in Live Cattle. I will be looking to the buy side of the market on breaks next week.

Silver: May Silver is currently 10 cents lower at 15.36 and June Gold 4.00 lower at 1230.00. We remain long. Take profits in Gold above 1265.00.

S&P's: June S&P’s are currently 8.50 lower at 2043.00. We were stopped out of recent short positions. Treat as a trading market between 2024.00 and 2060.00. today’s Jobs number could move the market sharply in either direction. Most global mkts. Are sharply lower this morning.

Currencies: As of this writing the June Euro is currently 31 higher 1.1440, the Yen 34 higher at 0.8938 and the Pound 73 lower at 1.4300. Normally I would be a seller in the Euro above 1.1400 but I am going to error on the side of caution at the moment and stand aside.

Futures and options trading involves substantial risk of loss and may not be suitable for everyone. The valuation of futures and options may fluctuate and as a result, clients may lose more than their original investment. In no event should the content of this website be construed as an express or implied promise, guarantee, or implication by or from The Price Futures Group, Inc. that you will profit or that losses can or will be limited whatsoever. Past performance is not indicative of future results. Information provided on this website is intended solely for informative purpose and is obtained from sources believed to be reliable. No guarantee of any kind is implied or possible where projections of future conditions are attempted.

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.