With tightening monetary policy, an ongoing global growth slowdown, and relatively elevated valuations, the path of least resistance continues to be lower for the equity market. Rising nominal and real interest rates continue to pressure valuation multiples, particularly for large cap growth stocks. The market looks like it has room to “catch down” to where real rates are currently, and there is a strong chance real rates continue to rise based on the Fed’s framework.

Defensive sectors like health care, utilities, and consumer staples continue to show relative market strength. Also, the energy sector has been a standout given the nature of the current economic and geopolitical problems in the world. In the initial market drawdown from the beginning of the year to the mid-June lows, energy was the only sector that was up and health care, consumer staples, and utilities were down the least. The same has been true in the recent decline from the mid-August interim high.

Some valuation models and historical analogs that I cross reference suggests the market might be about 15-20% overvalued currently. Chances are that the forward P/E multiple is understating valuations. I suspect that market expectations for 2023 earnings are lower than what has been published by the analyst community. In other words, there’s a difference between what’s projected by analysts and what’s actually priced into markets.

On equity markets internationally, the China CSI 300 Index has not shown any follow-through to the upside after its May-June rebound and looks likely to retest its lows. The Chinese market was the first to peak (in Feb 2021) and may be the first to trough. If it makes new lows, it will become an 18-month long bear market for the benchmark Chinese index.

As noted earlier in the year, the TINA effect has been greatly reduced as interest rates have risen. There are arguably some reasonably attractive alternatives to stocks, at least over the near term. For example, a 2-year TIPS note yields 1.3% in real terms, i.e., after inflation. That’s in the 88th percentile over the past twenty years.

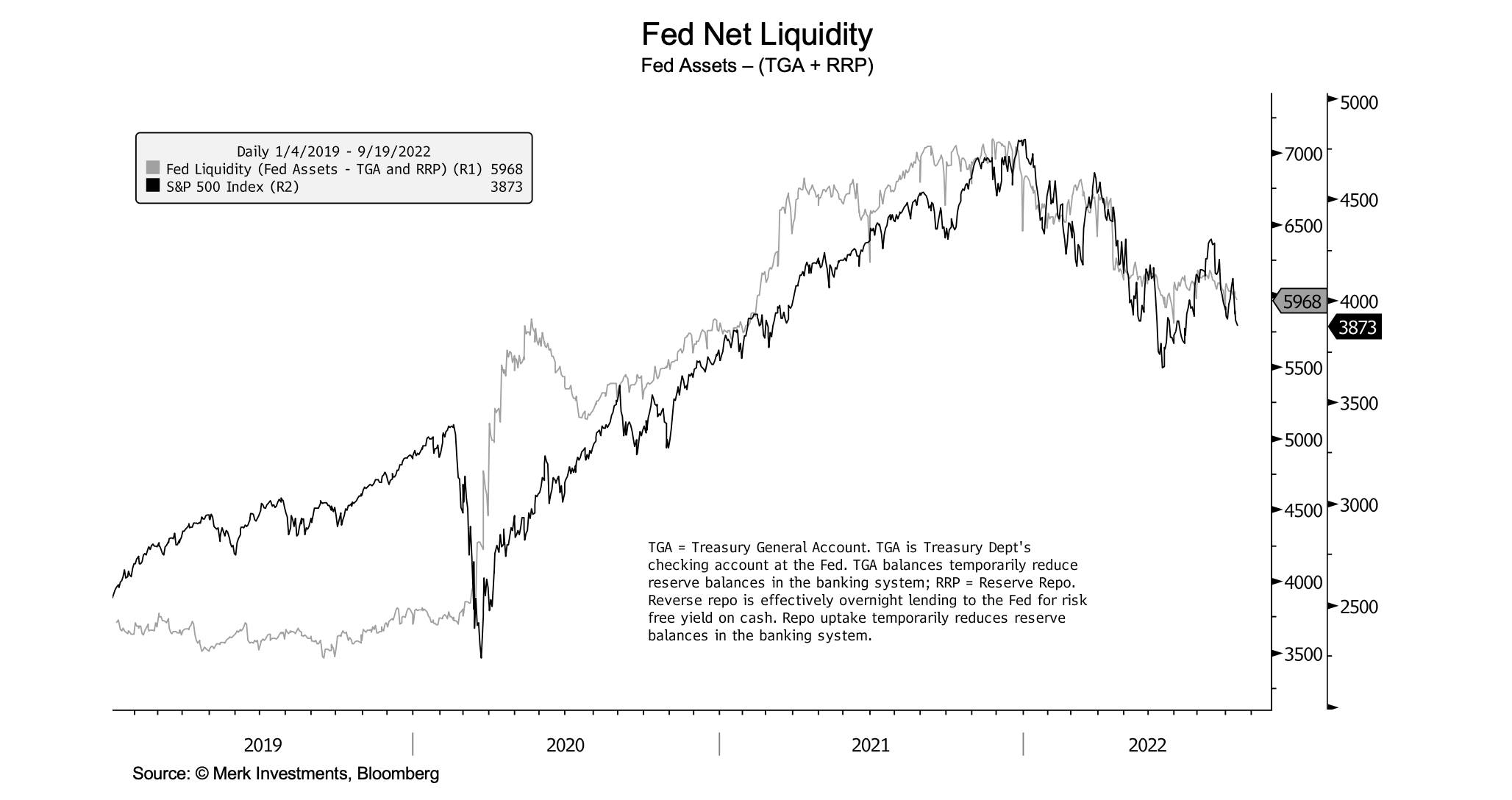

Also, the Fed continues to drain liquidity via quantitative tightening. Net liquidity had improved from late June to mid-August due to idiosyncratic factors but is now a headwind again for the market and is likely to remain so until further notice.

The silver lining of a hawkish Fed and an ongoing global growth slowdown is that inflation expectations continue to decline. As previously commented, I think the market is more concerned with inflation than growth. While, in my assessment, a recession isn’t fully priced into the market and represents a downside risk, it’s likely the lesser of the two evils to the extent they are mutually exclusive. In general, I continue to view the current drawdown as a cyclical bear market in an ongoing secular bull market.

As always, the outlook remains data dependent and everyone needs to put probability and reward-to-risk assessments in the context of their strategy, process, and time horizon.

The Merk Hard Currency Fund is a no-load mutual fund that invests in a basket of hard currencies from countries with strong monetary policies assembled to protect against the depreciation of the U.S. dollar relative to other currencies. The Fund may serve as a valuable diversification component as it seeks to protect against a decline in the dollar while potentially mitigating stock market, credit and interest riskswith the ease of investing in a mutual fund. The Fund may be appropriate for you if you are pursuing a long-term goal with a hard currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Fund and to download a prospectus, please visit www.merkfund.com. Investors should consider the investment objectives, risks and charges and expenses of the Merk Hard Currency Fund carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Fund's website at www.merkfund.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest. The Fund primarily invests in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Fund owns and the price of the Funds shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Fund is subject to interest rate risk which is the risk that debt securities in the Funds portfolio will decline in value because of increases in market interest rates. As a non-diversified fund, the Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. The Fund may also invest in derivative securities which can be volatile and involve various types and degrees of risk. For a more complete discussion of these and other Fund risks please refer to the Funds prospectus. The views in this article were those of Axel Merk as of the newsletter's publication date and may not reflect his views at any time thereafter. These views and opinions should not be construed as investment advice nor considered as an offer to sell or a solicitation of an offer to buy shares of any securities mentioned herein. Mr. Merk is the founder and president of Merk Investments LLC and is the portfolio manager for the Merk Hard Currency Fund. Foreside Fund Services, LLC, distributor.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.