Global Markets

Reoccurring concerns over the global economy and the most recent developments in emerging market weakness has been a key factor in encouraging the Organization for Economic Cooperation and Development (OECD) to downwardly revise 2015 global forecasts to 2.9%. This has contributed to downward pressures on global markets, to which the recent weak economic data from China has weighed further on market sentiment. Sentiment towards the global economy has received another jab following the weak data from China over the past two days, including another astonishing decline in China imports at 19% and a weaker than expected inflation reading. Falling inflation provides further scope for the People’s Bank of China (PBoC) to unleash further monetary stimulus and expectations remain high that the PBoC will ease policy further.

Lower commodity prices have dragged down inflation prospects in China, while its own economic slowdown has weighed heavily on the commodity markets due to the economy not importing anywhere near as heavily as it has done in the past. Overall, the recent string of soft economic data will continue to reinforce anxieties market participants have about the China economy, which will impact on those economies that have become reliant on trade from China.

The anxieties over slowing growth in China have had an impact on Asian equities today, with most major Asian markets venturing back into red territory. Both European and American equities are also suffering losses, which aside from China can also be correlated to a sense of nervousness around whether the Federal Reserve will raise US interest rates next month. If the recent weakness in the emerging markets continues to escalate into wider fears over the global economy and the China concerns remain elevated, equity markets can remain under pressure.

Whilst an air of anxiety lingers around the equity markets, this has not encouraged any gains in Gold. The metal has been sold off heavily on the renewed optimism that the Federal Reserve could begin raising US interest rates next month and unless this changes, Gold is looking vulnerable to further pressure. Gold declined over eight consecutive days last week and now that prices have fallen below 1100.00 support and its appeal to investors is waning, there may be potential for a further decline towards the 1080 level.

USDCAD

The bolstered prospects of a December US rate hike has instilled USD bulls with upwards momentum. The USDCAD is technically bullish on the daily timeframe, and as long as prices can keep above the 1.3050 support, there may be an incline to the 1.3450 level.

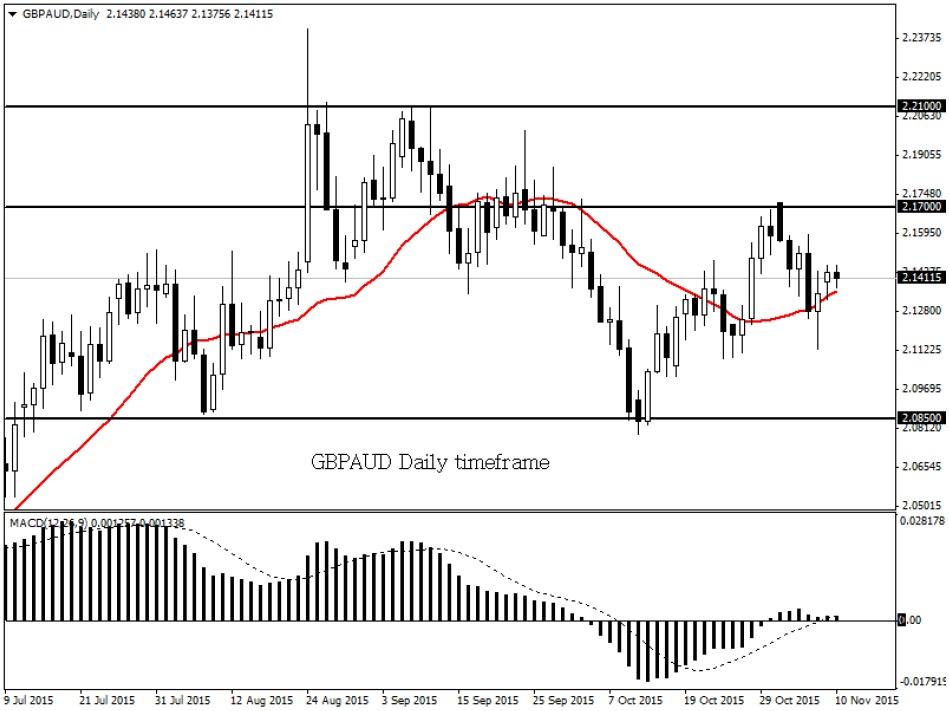

GBPAUD

The Sterling has been left weakened following the BoE’s dovish tone on the UK economy. The GBPAUD is currently in a tug of war because both the GBP and AUD are somewhat weak. Technically this pair slowly turns technically bullish. A breakout above 2.1700 may open a path to 2.2100.

EURAUD

The EURAUD is technically bearish on the daily timeframe. A breakdown below the 1.5150 support may open a path for a decline back down to the 1.4750 level. Prices are trading below the daily 20 SMA and the MACD had crossed to the downside.

EURJPY

The increasing expectations that the ECB may further QE in the future may enforce downwards pressures on the EUR. The EURJPY is technically bearish on the daily timeframe and the next relevant support is based at 130.50.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.