Global Market

Market participants have been left bewildered as, despite a GDP growth of 6.9% in Q3, the People’s Bank of China (PBoC) has abruptly cut interest rates for the sixth time since November 2014. The Chinese government’s aggressive use of monetary policy to jumpstart the Chinese economy has had an adverse effect, with fears renewed about the pace of growth. With economic weakness in China likely to draginto Q4, China Premier Li Keqiang has already stepped forward and educated participants that the 7% growth goal was never set in stone. The Chinese five year plan, which is currently being formulated by China’s top leadership, may play down growth targets for 2016-2020,since despite the vigorous efforts of the government the Chinese economy has failed to pick up.

The Euro has continued to decline across the global currency markets as a result of the European Central Bank’s (ECB) dovish stance towards the Eurozone. Sentiment remains bearish for the Euro as fears escalate of an economic slowdown in Europe following the deflationary CPI reading of -0.1% in September. Mario Draghi’s repeated statement about the ECB implementing additional stimulus measures if needed, as a tool to promote economic growth within Europe, has resulted in market participants increasing bets on further QE in the near future. As downwards pressures mount on thesingle currency, the EURUSD which is already technically bearish may be open to a steeper decline once prices breach past the psychological 1.1000 support.

A risk-off environment has punished the value of the Sterling for an extended period of time. The fears of a slowdown in economic momentum in the UK economy combined with a deflationary CPI release of -0.1% in October has opened the GBPUSD to further declines. Despite the bullish momentum gained in the Sterling last week Tuesday as a result of a hawkish BoE McCafferty highlighting the risks of delaying a rate rise in the UK, the GBPUSD remains technically bearish. If Tuesday’s latest GDP report for the UK economy fails to meet expectations and prints below 0.6%, not only will this provideadditional signs of a slowing economic momentum in the UK economy, but it will also offer a strong reason as to why expectations for a UK interest rate hike will be pushed back into 2016.

EURUSD

The EURUSD is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. A breakdown below the 1.1000 support may open a path to the next relevant support at 1.0850.

GBPUSD

The GBPUSD is technically bearish on the daily timeframe. A breach below the 1.5300 support may open a path to the next relevant support at 1.5100.

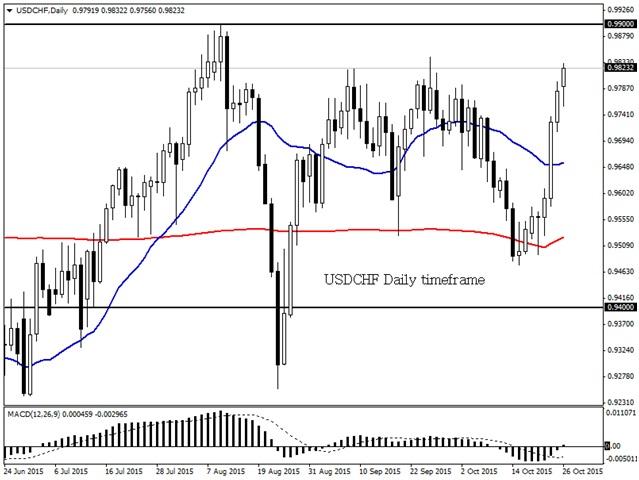

USDCHF

The USDCHF is technically bullish on the daily timeframe. Prices have breached above the 20 and 200 daily SMA. The next relevant resistance is based at 0.9900.

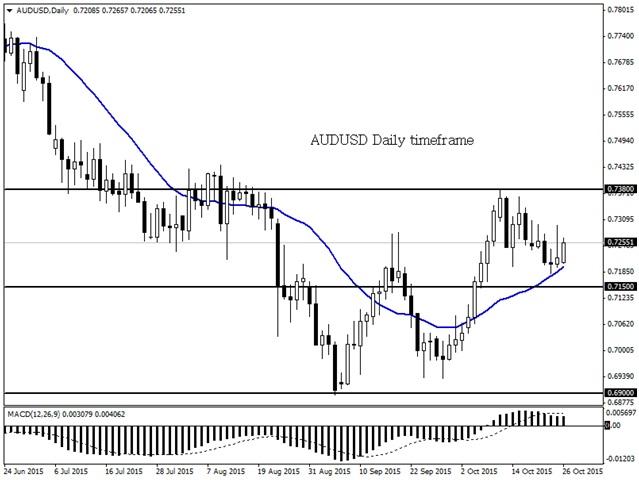

AUDUSD

The AUDUSD is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. As long as prices can keep above 0.7150, there may be an incline to the next relevant resistance at 0.7380.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.