Global Market

Global sentiment was dealt a blow this week as soft economic data from China renewed the concerns about its slowing pace of growth. Following a slight decline in global equities, escalating expectations that further monetary policy from China may be impending has translated to Asian equities venturing into green territory. With the looming China Q3 GDP report taking the spotlight, Friday’s trading session may conclude with some built up anxiety as market participants ponder on the possible outcomes over the weekend. If the world’s second largest economy fails to achieve its 7% Q3 GDP targets then global sentiment may be dealt a frightening blow once again. This may translate to a strong decline in Asian equities in the new trading week, regardless of the expectations of further monetary policy from China.

Dollar weakness remains the main driver in the global currency markets. As long as the diminishing expectations of a US interest rate hike in 2015 remains the main concern, more downside pressure in the USD may be expected. If CPI for China on Monday falls short of the 7% target, this may trickle back down to the USD exposing it to further losses. The Dollar Index remains technically bearish on the daily timeframe and additional USD vulnerability may open a path within this index to the next relevant support at 93.30.

The potential decline in economic momentum in the UK, combined with the fact that the BoE will likely push back the interest rate increase deep into 2016 has left the GBP exposed. The GBP remains in a state of sensitivity and if the upside momentum slows down next week, a riskoff environment that may be renewed from a China CPI which fails to meet expectations may open the GBP to additional downside pressures.

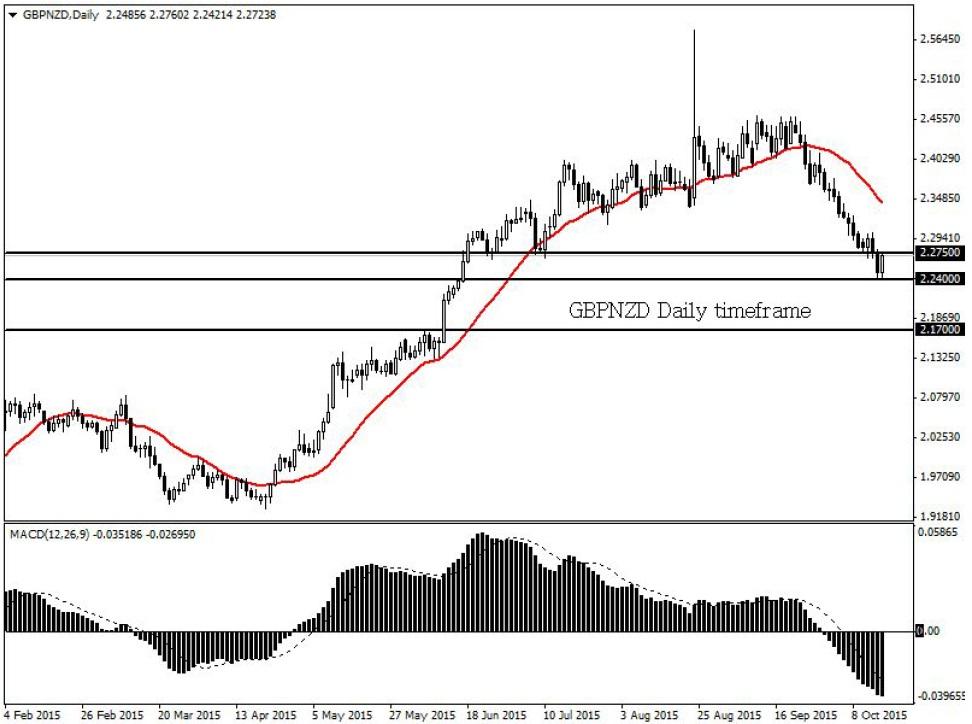

GBPNZD

The GBPNZD is technically bearish on the daily timeframe. Prices are trading below the daily 20 SMA and the MACD has crossed to the downside. The previous support at 2.2750 should act as a dynamic resistance. A breach below the 2.2400 level may open a path to the next relevant support at 2.1700.

SILVER

Silver is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. As long as prices can keep above the 15.55 support, there may be an incline to the next relevant resistance at 16.60.

Dollar Index

The Dollar Index is technically bearish on the daily timeframe. A breakdown below the 94.00 support may open a path to the next relevant support at 93.30.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The data from the US showed that weekly Jobless Claims held steady at 208,000, helping the USD hold its ground and limiting the pair's upside.

GBP/USD fluctuates above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside after Unit Labor Costs and weekly Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.