Global Markets

A bluntly spoken ECB Governor Nowotny took the opportunity to put a conclusion on the recent Euro rally by explicitly stating that the ECB was clearly missing their inflation target in Thursday’s trading session. Market participants understood this comment as a signal that more stimulus measures from the ECB will be coming in the near future, and as a result the EUR experienced a hefty selloff against the USD and across most of its counterparts. If Friday’s CPI release for Europe fails to meet expectations, this may simply compliment ECB Governor Nowotny’s comments and provide a final compelling case for the ECB to provide additional stimulus measures in the near future.

The ongoing weak sentiment towards the Dollar has refused to have a positive impact on WTI which has suffered four successive days of declines this week. The latest inventory report showed another huge stockpile and will further the continual concerns regarding oversupply. On top of this, weak data from both the US and China has fueled concerns over global growth, with this further pressuring the price of WTI. This commodity remains technically bearish on the daily timeframe and with the central theme of oversupply remaining unchanged, any additional fears about a reduction in demand for oil should send prices back to the magnetic $44.00 support.

NZDUSD

The NZDUSD is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. Prices have hit the 0.6850 resistance this trading week. The next relevant resistance is based at 0.7000.

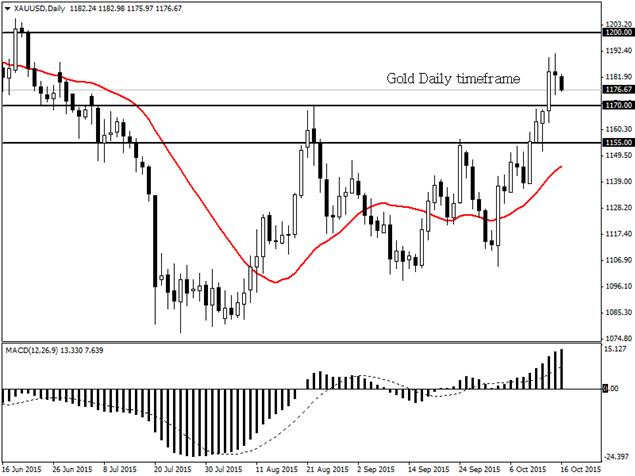

GOLD

Dollar weakness has instilled bullish momentum within Gold. This commodity is technically bullish on the daily timeframe. Previous resistance at 1170.0 may become dynamic support which should send prices to the next relevant resistance at 1200.0.

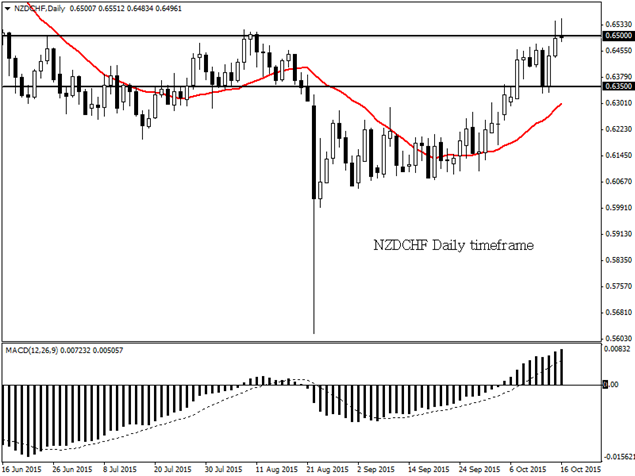

NZDCHF

The NZDCHF is technically bullish on the daily timeframe. Prices are trading above the daily 20 SMA and the MACD has crossed to the upside. A breach above the 0.6500 resistance may open a path to the next relevant resistance at 0.6700. A move back below 0.6350 suggests bullish weakness.

USDZAR

The USDZAR is technically bearish on the daily timeframe. As long as prices can keep below the 13.250 resistance there may be an additional decline to the next relevant support at 12.600.

Disclaimer:This written/visual material is comprised of personal opinions and ideas. The content should not be construed as containing any type of investment advice and/or a solicitation for any transactions. It does not imply an obligation to purchase investment services, nor does it guarantee or predict future performance. FXTM, its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness of any information or data made available and assume no liability for any loss arising from any investment based on the same.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 90% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The data from the US showed that weekly Jobless Claims held steady at 208,000, helping the USD hold its ground and limiting the pair's upside.

GBP/USD fluctuates above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside after Unit Labor Costs and weekly Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.