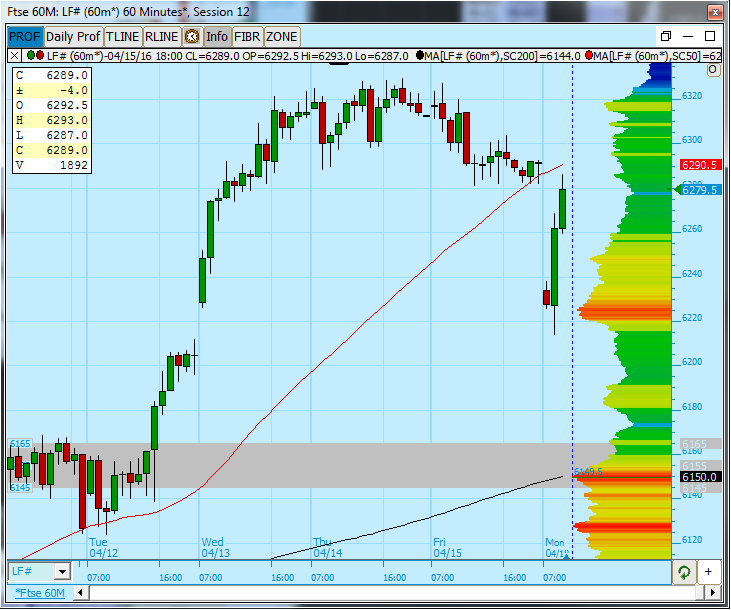

FTSE - Mind The Gap

FTSE opened weak this morning due to the overnight sell off in Oil which put pressure on all equity markets. On the cash open it was sitting just above Volume support in the 6220-5 region and was instantly sold. Most (myself included) would have been expecting and playing for a gap close from Tuesday at 6204 or 6212.5 depending on whether you used the day’s high or days close. It got so close but twice failed to fill it which of course leads to a lot of shorts in the hole. As you can see the move after was pretty straight line into Friday's gap where it has so far stalled. When a market gets so close to important levels but can't tag them it often leads to a violet move in the opposite direction as traders will be holding on looking for that level to trade. Keep this in mind in the future. Going forward I would only want to hold longs if we can hold above 6290.

Stoxx at key area

The Stoxx got to a key area last week before falling back slightly and of course today's gap has seen it lower still. So far though it has made a decent recovery but as we all know it's where the market closes that matters. I think going forward things are pretty simple; if we can get back above and stay above last week’s highs then the immediate term outlook is bullish, failure to hold above here and shorts seem the better play. Initial targets on shorts would be 2905-25 which was decent support throughout March.

Spoo weekly all about the trend lines baby

Hard to make a bear case for the Spoo on a weekly scenario at the moment (other than the obvious 'it's come too far too quickly' arguments). However the down trend from the all-time highs marks a key line in the sand for me. Any close back below here marks a false break in my book and we should then start to roll over finally. That's still a big 'if' at the moment but something to keep an eye on. 2026-34 still marks very key support below which will need to see a close below if we are to have a much more protracted pull back.

.

Recommended Content

Editors’ Picks

AUD/USD trades with mild positive bias near 0.6700, RBA Meeting Minutes eyed

The AUD/USD trades with a mild positive bias near 0.6695 during the early Asian session on Monday. The weaker US Dollar provides some support to the pair. The Fed’s Bostic, Barr, Waller, Jefferson, and Mester are set to speak on Monday.

EUR/USD: Could FOMC Minutes provide fresh clues?

The EUR/USD pair advanced for a fourth consecutive week, comfortably trading around 1.0860 ahead of the close. Progress had been shallow, as the pair is up roughly 250 pips from the year low of 1.0600 posted mid-April.

Gold looks to extend uptrend once it confirms $2,400 as support

Gold price continued to push higher last week and rose above $2,400 on Friday, gaining nearly 2% for the week. Investors will continue to scrutinize comments from Fed officials this week and look for fresh hints on the timing of the policy pivot in the minutes of the April 30-May 1 meeting.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.