Gold breaking trend channel...

...the downside move in Gold does feel like it has been coming but has been hard to judge. Yesterday's break out of its trend channel and close below recent swing low 1225.70 has now set a bearish tone. Next target to the downside is the band 1190.43-1182.5 where a bounce should materialise. The lows indicated by arrows at 1211.20 and 1201.63 should not be seen as support but rather as targets to scale shorts or even pyramid shorts for the more aggressive trader. The bearish sentiment will not diminish until a close above 1225.70 occurs.

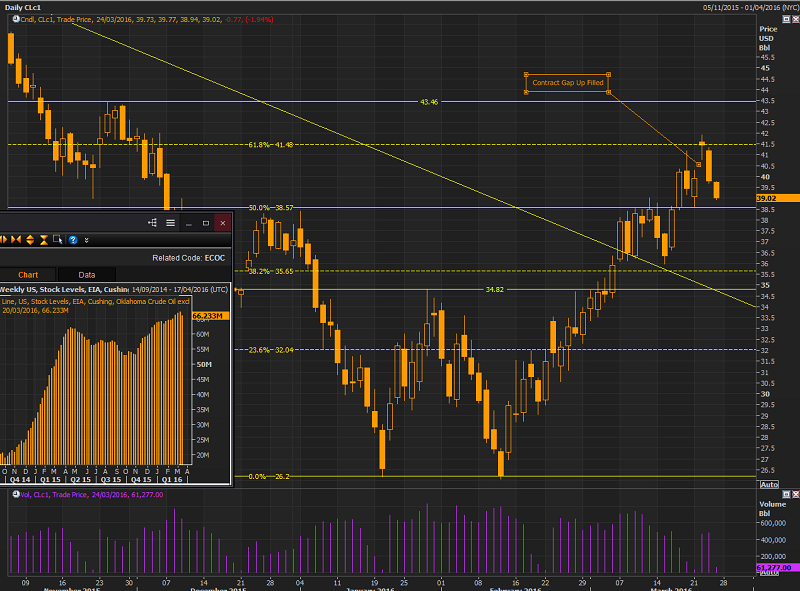

WTI drop since contract roll

The WTI complex is now in contango meaning that further out contracts are priced higher than the front month, this is why when it rolled to May contract early this week we got a gap up. We are seeing a pull back, first area of support to be tested is 50% and highs at 38.57-51. Any push lower will still be seen as a buying opportunity right down to 34.82 old high and trend line re-test. The smaller bar chart shows the inventory levels at Cushing where the WTI contract is priced, we are currently at record levels but saw a draw down last week , another this coming Thursday could start a new bullish move.

Silver Failed Inverse Head and A Shoulders

Silver sits at a critical levels for those still looking for upside moves, the attempts to break the inverse Head and Shoulders above 15.816 early this week has failed and now 15.13 provides last support for bulls. A break of this congested level could quickly see 14.57 trade. If 15.13 holds there could be an argument made that a cup and handle formation is now present and a break of 16.136 recent high can take prices above 16.36 up to 17.77.

.

Recommended Content

Editors’ Picks

AUD/USD gains ground on hawkish RBA, Nonfarm Payrolls awaited

The Australian Dollar continues its winning streak for the third successive session on Friday. The hawkish sentiment surrounding the Reserve Bank of Australia bolsters the strength of the Aussie Dollar, consequently, underpinning the AUD/USD pair.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.