Crude

Commodity markets have so far largely ignored talks about Greek debt and oil has been no exception. Yesterday, the oil price fell only slightly despite the fact it was another session of waiting in vain on an agreement between Greece and the creditors. Oil market has rather been watching signs of possible agreement on Iranian nuclear programme. The talks are to be held next week and in case the final deal was reached a relatively sharp decline in oil prices would be likely. Although a deadline for negotiations is set to 30th June, the talks could easily be extended if there was a solid chance for a deal to be reached (recall the talks that led to the framework agreement).

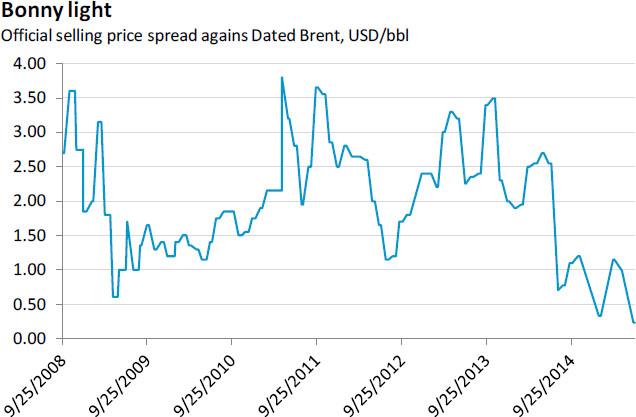

Recently, though, signs that oil market is more than well supplied have been mounting. Namely, Nigerian OSP differentials against Dated Brent (for example for Bonny light) are seen at the lowest level in ten years (see the chart below) as news that tankers full of Nigerian oil cannot find buyers hit the market. Moreover, Reuters said yesterday that North Sea Forties differentials hit the lowest level since the financial crisis.

If we take into account a surprising increase in gasoline inventories in the US last week (the US used to be important buyers of West African crude oil), this suggests that risks for oil prices continue to be skewed to the downside.

Chart of the day:

Nigerian OSP differentials against Dated Brent are seen at the lowest level in ten years…

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD gains ground on hawkish RBA, Nonfarm Payrolls awaited

The Australian Dollar continues its winning streak for the third successive session on Friday. The hawkish sentiment surrounding the Reserve Bank of Australia bolsters the strength of the Aussie Dollar, consequently, underpinning the AUD/USD pair.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.