The Bank of Japan is the main counterparty in the Fed’s FRRP facility

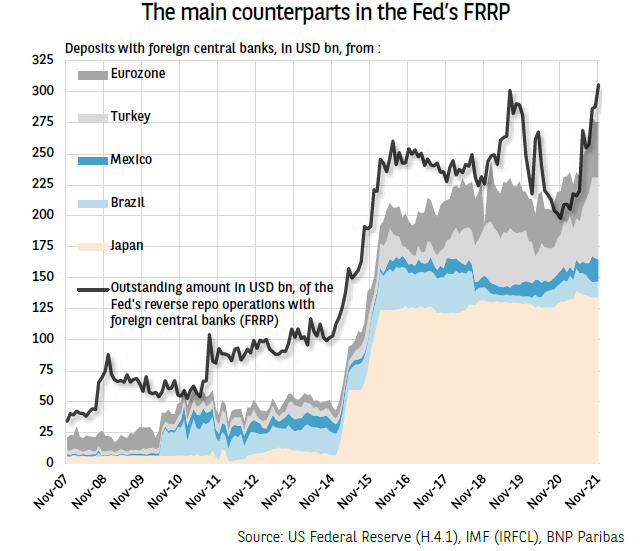

Since November 2020, there has been a significant increase in repurchase agreements1 by the US Federal Reserve (the Fed) with foreign central banks as part of the Foreign Repo Pool (FRRP). Two statistical series can be used to identify the Fed’s main counterparts.

The structure of official foreign reserves2 indicates the amount of deposits (in the broad sense of the term, including repurchase agreements) made by each economy with “foreign central banks, the Bank of International Settlements, and the International Monetary Fund”. Given the weight of the USD, EUR, JPY and GBP in global foreign reserves, the Fed, the European Central Bank (ECB), the Bank of Japan (BoJ) and the Bank of England are probably the main beneficiaries.

The US Department of the Treasury3 also reports the value of US financial institutions’ liabilities (excluding certificates of deposit and shortterm debt securities) to MFIs of each foreign country, presented as a whole (commercial and central banks). Yet these statistics are not granular enough to identify the claims of each foreign central bank alone with the US financial sector (at the aggregate level, these claims are mainly comprised of repurchase agreements with the Fed since 2008). For the period 2014-16, the very comparable trajectory of Japanese deposits with foreign central banks, the US financial sector’ liabilities to Japanese MFIs, and the outstanding amount of the Foreign Repo Pool (FRRP) nonetheless suggests that the BoJ largely contributed to the growing importance of the FRRP facility. More recently, however, the Central Bank of the Republic of Turkey, and to a lesser extent, the ECB seem to be more interested in the FRRP.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.