The Aussie goes into tonight's 'Nylon' session firmly on the back foot where US GDP gets the final say for the week.

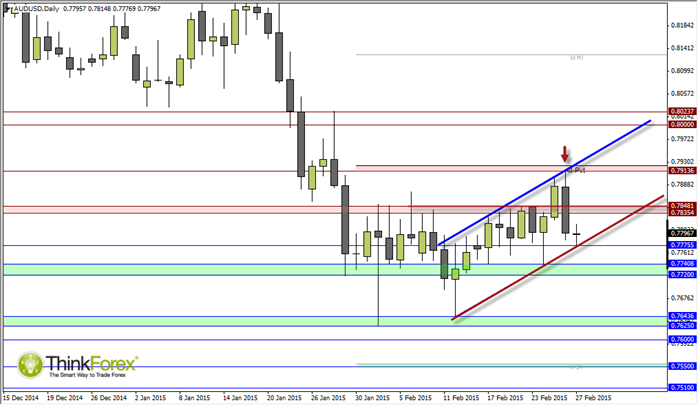

Wednesday's 4-week high required three data sets to break it above 0.748 resistance. The fact it toppled over on the back of US inflation data last night to crash below 0.748 and within the previous range should act as start reminder of who is in control of the Aussie at present.

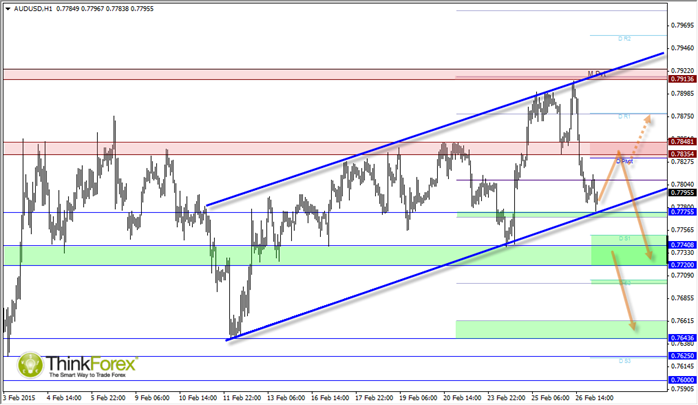

Closing the session with a Bearish Engulfing Candle and below the previous sesison's breakout level, it starts today’s session on the back foot. The intraday price action clings onto a mildly bullish channel but I suspect that if we do see any bullish rallies within it, it will merely serve as a better price for traders to go short on. 0.748 is an obvious level to consider selling into (assuming we get that far) but 0.783 may well suffice as resistance for the 'nylon' session (New York - London).

The focal point for traders will be Q4 GDP from the US which is widely expected to have been revised down to 2.1% from 2.6%. This leaves the Aussie open to further selling if GDP is not as bad as traders feared. If it is lowered to around 2.1% then we could see an upside move towards 0.783 but I doubt we will close back above here this week.

Next week could really stir the pot for Aussie crosses. The focus will shift to RBA's rate decision on Tuesday where the market remains equally divided over whether they'll cut rates or not. (So not much different to last month really...) Thursday provides a decent data dump domestically with GDP, Retail Sales and Trade balance all released simultaneously. Overseas we have Chinese final PMI along with US Trade balance and Nonfarm employment data. So we have a plethora of data to get things moving but at this stage the downside appears more prominent for the Aussie in my humble opinion.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.