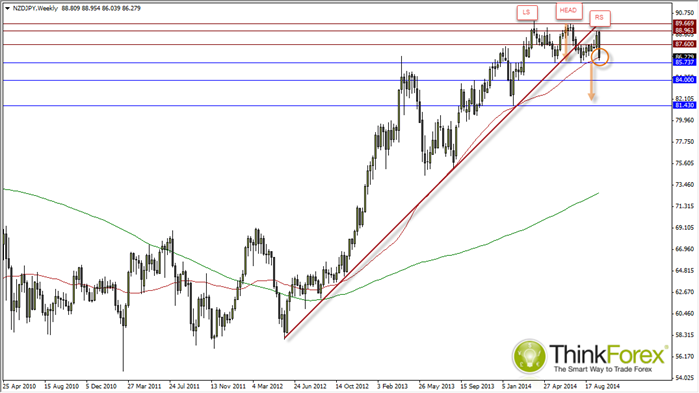

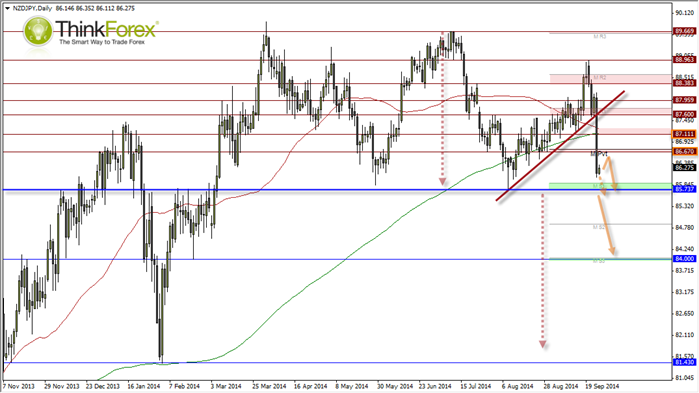

A follow up post to the previous NZDJPY analysis in light of the recent (and rapid) price developments.

SUMMARY:

- Seeking bearish setups on D1 and H4 next week to anticipate bearish break

- A break below 85.70 target 84 and 81.50 over the coming weeks

- Whilst we remain above 85.70, technically, W1 remains within sideways correction

I'll be making the assumption of a bearish engulfing close this week, which leaves the question of how close to the neckline we will close. If anything I would like to see a rebound from current levels which may provide suitable selling opportunities next week, for those seeking to assume a downside break below 85.70.

At time of writing we hover around the 50 week MA, so it is possible to see profit taking around these levels as we finish the week off.

A more conservative approach is to wait for confirmation of a H&S below 85.70 before seeking bearish setups below the neckline.

Assuming we do see a rebound from the lows then obvious levels to consider bearish setups are around 86.70 and 87.10 (where the 50 and 200 day MA meet). However something to keep in mind with the Kiwi Dollar is that when it sells off, it tends not too much around. So unless we see particularly poor data from Japan next week combined with a need to turn bullish on kiwi Dollars again, my bias remains for shallow pullbacks going into next week.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.