At 76 pages, this is longer than the usual RBA statement, with the main ficus being on downgrades.

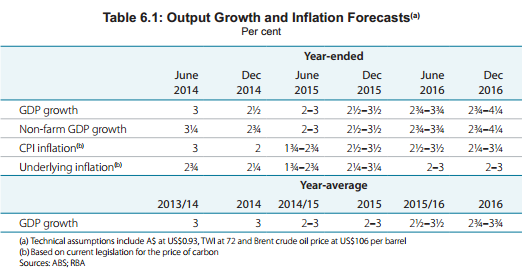

RBA Trimmed growth an inflation forecasts:

- Cuts end-2015 GDP forecast To 2.5%-3.5% Vs 2.75%-3.75%

- Cuts end-2014 CPI forecast To 2% Vs 2.75%

- Raises end-2015 CPI forecast To 2.5%-3.5% Vs 2.25%-3.25%

- Cuts end-2014 Core CPI forecast To 2.25% Vs 2.5%

- Cuts mid-2015 Core CPI forecast To 1.75%-2.75% Vs 2.25%-3.25%

RBA:

- Monetary Policy Settings Appropriate

- 12-year high unemployment comes at a time when the sample set has been rotated

- Unemployment not expected to decline consistently

- Iron ore & coal: At current prices, there is a sizeable amount of coal and iron ore production that is unprofitable. The outlook for prices will depend on what proportion of these mines is shut down.

Home Loans down -0.2% m/m

Australia Jun Value Of Investment Housing Finance -0.3% Vs May

Australia Jun Housing Finance +0.2% Vs May; Forecast +0.6%

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

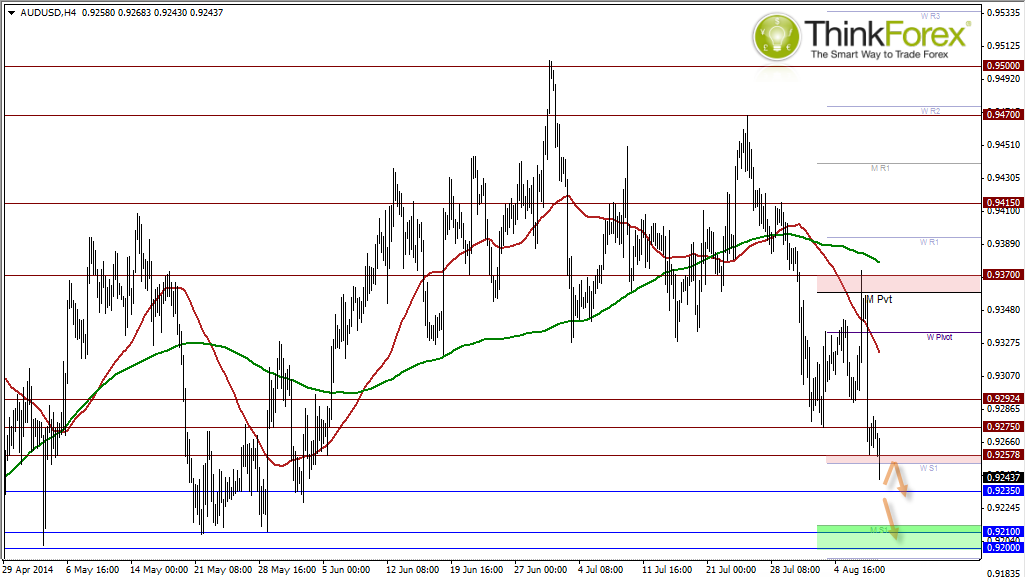

AUD/USD weakens further as US Treasury yields boost US Dollar

The Australian Dollar extended its losses against the US Dollar for the second straight day, as higher US Treasury bond yields underpinned the Greenback. On Wednesday, the AUD/USD lost 0.26% as market participants turned risk-averse. As the Asian session begins, the pair trades around 0.6577.

EUR/USD stuck near midrange ahead of thin Thursday session

EUR/USD is reverting to the near-term mean, stuck near 1.0750 and stuck firmly in the week’s opening trading range. Markets will be on the lookout for speeches from ECB policymakers, but officials are broadly expected to avoid rocking the boat amidst holiday-constrained market flows.

Gold price drops amid higher US yields awaiting next week's US inflation

Gold remained at familiar levels on Wednesday, trading near $2,312 amid rising US Treasury yields and a strong US dollar. Traders await unemployment claims on Thursday, followed by Friday's University of Michigan Consumer Sentiment survey.

President Biden threatens crypto with possible veto of Bitcoin custody among trusted custodians

Joe Biden could veto legislation that would allow regulated financial institutions to custody Bitcoin and crypto. Biden administration’s stance would disrupt US SEC’s work to protect crypto market investors and efforts to safeguard broader financial system.

Navigating the future of precious metals

In a recent episode of the Vancouver Resource Investment Conference podcast, hosted by Jesse Day, guests Stefan Gleason and JP Cortez shared their expert analysis on the dynamics of the gold and silver markets and discussed legislative efforts to promote these metals as sound money in the United States.