Interested in more FX key technical levels? Take a look at Swissquote's daily technical outlook.

EUR/USD

Rejection from the 1.1340 high yesterday see a long upper wick weighing though setback below the 1.1300 level see the downside limited to 1.1280 low so far. Break will see retest of 1.1256 support then the 1.1217 low. Below the latter will trigger further decline to 1.1144. [PL]

USD/CHF

Break of the .9733 support triggers deeper pullback from the .9797 high to the .9700 level to retrace recent strong up-leg from the .9585 low last week. Nearby see strong support at the .9688 recent high which must hold to keep overall focus on the upside. Failure will trigger deeper pullback. [PL]

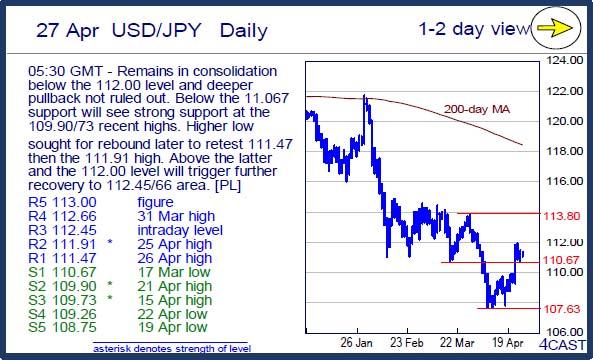

USD/JPY

Remains in consolidation below the 112.00 level and deeper pullback not ruled out. Below the 11.067 support will see strong support at the 109.90/73 recent highs. Higher low sought for rebound later to retest 111.47 then the 111.91 high. Above the latter and the 112.00 level will trigger further recovery to 112.45/66 area. [PL]

EUR/CHF

Bounce from the 1.0964 low see pressure returning to the 1.1000 level. Above this will see scope for retest of the 1.1016/23 highs and where clearance will shift focus to the 1.1061 resistance. Would take setback to break the 1.0964 low to see room for deeper setback to the 1.0930/00 area. [PL]

GBP/USD

Tight intraday trading providing little change to this morning's view with the upmove from 1.4090 low still in play and push above 1.4640 hurdle will trigger extension to 1.4668 then 1.4786. Only dip below 1.4460 support to turn current upmove around. [W.T]

EUR/GBP

Downside stays in focus to reach .7735 low and below this will target the .7700 level next. Lower will target .7684 which marks 38.2% retrace of the Nov 2015/Apr up-leg. However, divergence building on intraday tools caution bounce with resistance starting at .7812 and lift over this needed to trigger stronger recovery. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.